As a seasoned crypto investor with a few battle scars from previous market cycles, I’ve learned to always keep an eye on key metrics that can signal potential profit-taking opportunities. The BTC supply in loss indicator is one such metric that has proven valuable in my investment strategy.

As Bitcoin (BTC) hovers near the significant $100,000 mark, some investors might be on the lookout for just the right moment to cash in and leave the market. In this scenario, an analysis by CryptoQuant reveals a crucial Bitcoin metric that could prove useful for planning an exit strategy.

Have Profits In Bitcoin? Keep An Eye On This Indicator

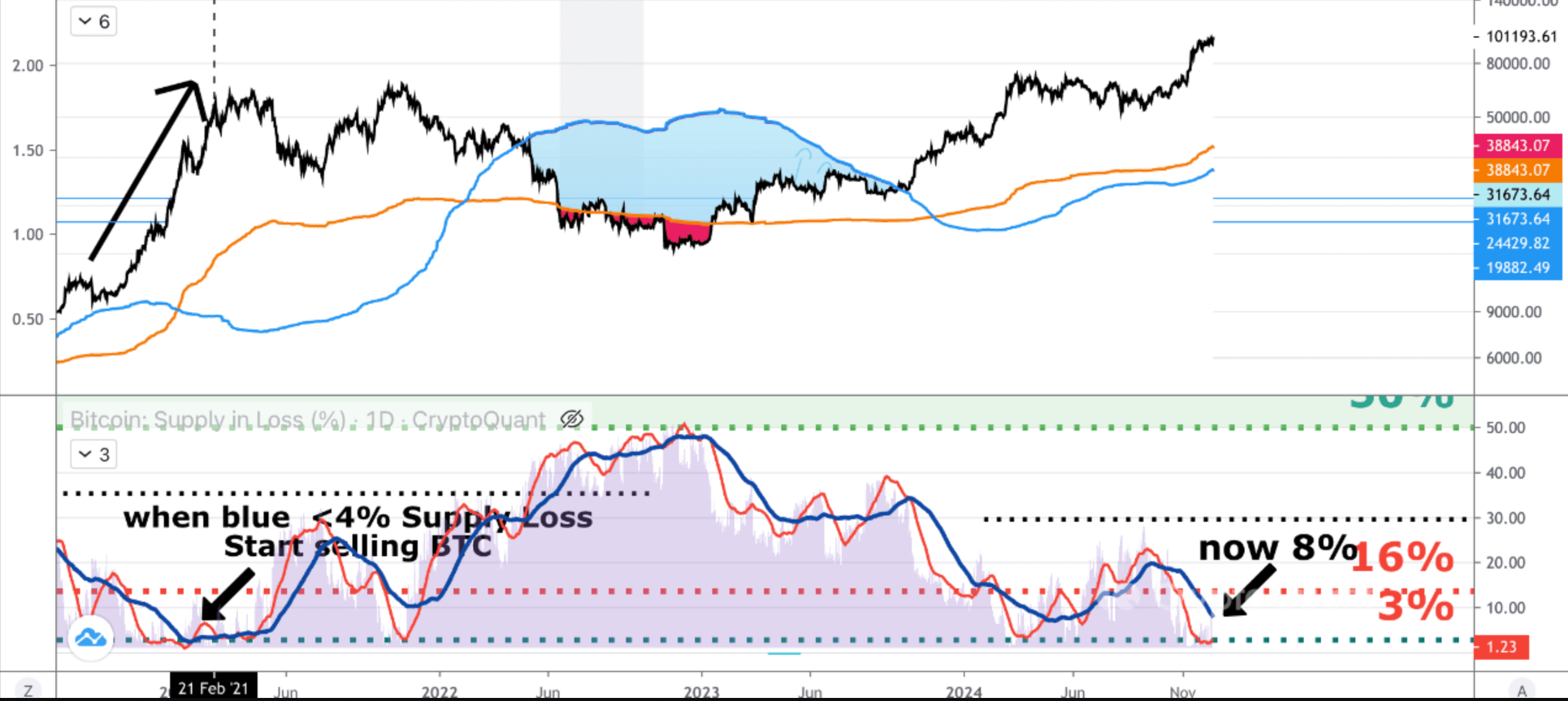

Today, a blog post on Quicktake featured insights from Onchain Edge, a contributor to CryptoQuant, about strategically selling Bitcoin during this ongoing bull market. The analyst underscored the significance of the Bitcoin supply in loss indicator, suggesting that it could serve as a clue for when to begin cashing out to secure gains.

For individuals new to Bitcoin, the term “supply in loss” refers to the proportion of Bitcoins currently being held at a lower price than they were last transferred. When this percentage is small, it often suggests a heightened market excitement and could be a signal to take profits before a potential downturn in the market, known as a bear market correction, begins.

Based on an analysis by CryptoQuant, when the percentage of Bitcoin supply experiencing a loss falls below 4%, it’s often a favorable moment for investors to consider implementing dollar-cost averaging (DCA) with their Bitcoin holdings, and then wait for the upcoming bear market bottoms. At present, the percentage of Bitcoin supply in the red stands at 8.14%.

Investing with DCA (Dollar Cost Averaging) means setting a consistent amount to purchase an asset on a recurring basis, no matter its current price. By doing so, you lessen the effect of market fluctuations and gradually lower your overall cost per unit in the long run. The analyst notes:

If the percentage drops below 4%, it signifies that a significant number of people are currently making profits. This is considered the peak bull run phase. It’s crucial to remember that hanging onto assets (bagholding) during this time, because you thought a bear market wouldn’t return, could lead to unfavorable outcomes. The wise approach is to be cautious when others exhibit greed.

Analysts Confident Of Further Upside In BTC Price

Monitoring Bitcoin’s supply in terms of losses could assist investors in preserving their gains, but some cryptocurrency experts predict that there may be more potential increases ahead before this metric becomes particularly significant.

Based on the analysis by crypto expert Ali Martinez, Bitcoin appears to be shaping a well-known “cup and handle” pattern in its weekly chart. This setup suggests that Bitcoin might soon break free from this bullish structure, potentially reaching heights of up to $275,000.

Likewise, Donald Trump’s election win has sparked renewed enthusiasm within the crypto sector. At a recent Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign manager, Paul Manafort, expressed his belief that investors in Bitcoin could potentially see gains exceeding $100,000 during this current market cycle.

Other predictions continue to be optimistic. Tom Dunleavy, MV Global’s Chief Investment Officer, anticipates Bitcoin (BTC) could soar to $250,000 and Ethereum (ETH) potentially rising to $12,000 during this market phase. Currently, Bitcoin is trading at $100,983, experiencing a slight increase of 0.1% in the last 24 hours.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- All Elemental Progenitors in Warframe

2024-12-14 09:06