As an experienced financial analyst, I’ve seen my fair share of market volatility and trends in the cryptocurrency space. The latest developments with Bitcoin have been a source of intrigue for me, given the expectations surrounding the halving event. However, the current consolidation range and increased bearish sentiment on social media are concerning.

Bitcoin‘s story hasn’t significantly changed in the past week, as its price remains trapped within a narrow range. Even after the halving event, which took place a week prior, the lethargy in both Bitcoin and the broader cryptocurrency market persists.

The Bitcoin reward reduction, leading to a substantial decrease in mining income, was predicted to spark another wave of price increases. However, instead, some investors are growing discontented with the lethargic market performance and are advocating for selling Bitcoin.

Bitcoin Sell Calls At Increased Rate: Blockchain Firm

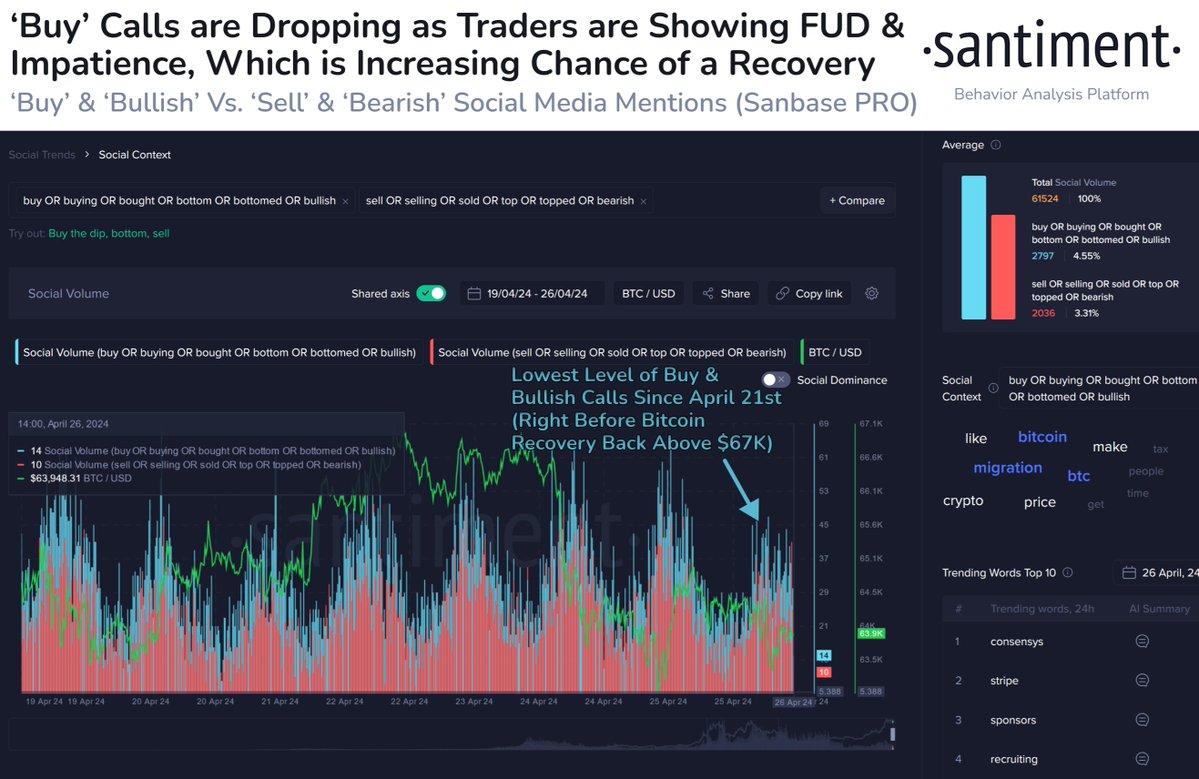

Based on data from Santiment’s latest report, there has been a noticeable uptick in discussions about selling Bitcoin on social media since its recent dip to around $63,000. The key metric here is the “social volume” measure, which records the count of distinct mentions of this topic on various social media outlets.

As a crypto investor, I’ve been closely monitoring the market trends using Santiment’s aggregated data. Over the past week, I noticed a significant increase in “sell” or “bearish” mentions for Bitcoin compared to “buy” or “bullish” ones. The on-chain analytics further highlighted this shift in sentiment, suggesting that bearish calls are currently dominating social media discussions.

Based on Santiment’s analysis, I discovered that the recent drop in Bitcoin’s price to $63,000 led to the lowest number of buy and bullish calls since April 21st, which was right before BTC rebounded above $67,000. The chart above highlights a surge in social volume for terms related to “sell” following the price decline.

As a crypto investor, I’ve noticed that an uptick in bearish sentiments about Bitcoin often indicates heightened fear, uncertainty, and doubt among investors. Yet, experience has taught me that when traders grow frustrated and restless, there’s typically a greater chance of a market recovery.

Almost 90% Of Circulating BTC In Profit – Impact On Price

Based on latest on-chain analysis, approximately 90% of circulating Bitcoin was purchased below its current market value.

As an analyst, I’ve observed a significant increase in Bitcoin’s profitability during the timeframe between October 2023 and March 2024. However, I must caution that such high levels of profitability could indicate an overbought condition. In other words, the price may have risen too quickly and exceeded its intrinsic value. Consequently, a potential correction or pullback could unfold in the near term, resulting in Bitcoin shedding some of its recent price gains.

At present, the value of Bitcoin stands at $63,077, marking a 2% decrease from its price over the previous 24-hour period.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-04-27 12:22