As a seasoned researcher with over two decades of experience in financial markets, I must admit that the cryptocurrency market continues to astound me with its volatility and rapid pace of development. The recent surge of Bitcoin (BTC) above $100,000 for the first time is indeed a remarkable achievement, but it also brings forth concerns about potential corrections in the near future.

For the very first time, Bitcoin (BTC) surpassed $100,000 per coin at the end of the week, marking yet another significant milestone in its history. Yet, it’s important to note that an analyst has issued a cautionary statement to investors, suggesting that past trends might signal a substantial drop for this leading cryptocurrency.

Bitcoin First Weekly Close Above $100,000

Approximately a week back, Bitcoin surpassed the $100,000 mark for the first time, breaking through a significant psychological barrier. Following this impressive achievement, the leading cryptocurrency by market cap experienced its biggest price drop since Donald Trump’s victory in the 2016 US presidential elections.

As a researcher studying Bitcoin’s market dynamics, I observed a striking resemblance in its recent behavior to when it initially breached the $10,000 threshold. In a single candle, Bitcoin dipped approximately 13% and touched the $90,000 level. Since then, it has been oscillating between the $97,000-$101,000 price range, encountering resistance as it attempts to break through the upper boundary of this band.

According to NewsBTC, cryptocurrency expert Jelle anticipates that Bitcoin might mirror its route following the $10,000 milestone, making the recently surpassed level a source of support after a span of three days, similar to what happened in November 2017.

Over the past four days, I’ve observed Bitcoin fluctuating within its new price range. However, on Sunday, it managed to record its initial daily closure surpassing the $100,000 mark, which also signified its first weekly close above this significant threshold. In terms of weekly performance, it mirrored the dramatic leap Bitcoin made when it crossed the $10,000 barrier.

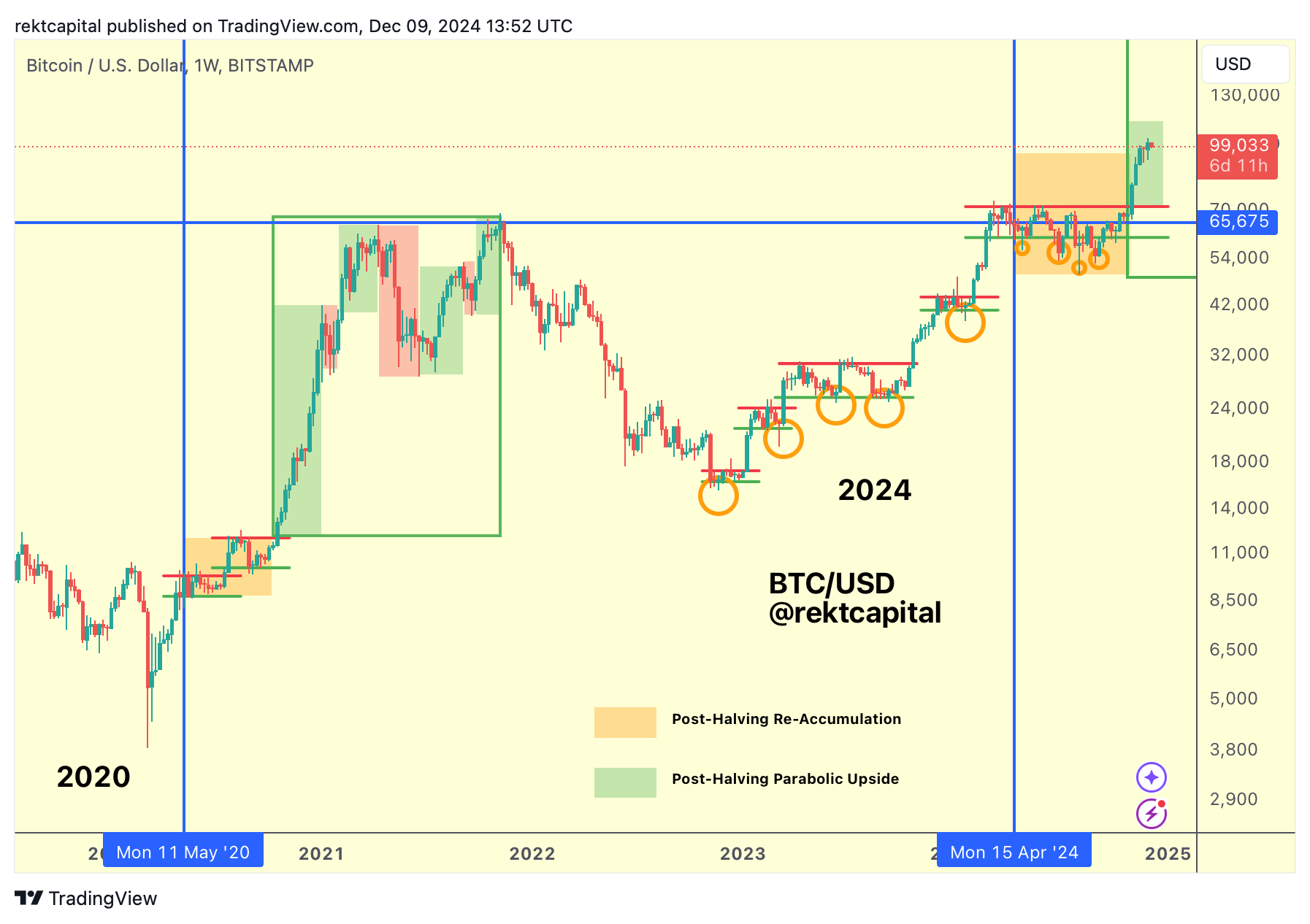

According to crypto analyst Rekt Capital, if Bitcoin’s daily closing price surpasses this specific level, and there was a 2.5% decrease on Monday, it could be considered a repeat of this point. However, this repeat is quite volatile, and for the last two days, it has been trying to transform the “final significant daily resistance” around the $98,000 area from a barrier into support instead.

The analyst stated, “Such a fluctuating retest is indeed expected, particularly in light of the weekly timeframe. He clarified that the $98,000 mark was breached as resistance on the weekly chart following yesterday’s close. This implies that the primary focus this week is to regain this level and potentially establish it as new support.

Will The Next Few Weeks Be ‘Problematic’ For BTC?

Following the significant milestone of surpassing a key threshold, Rekt Capital advised investors to anticipate Bitcoin’s upcoming post-halving “Exponential Growth Phase” during the coming week. Previously, this analyst had stated that Bitcoin typically enters an approximately 300-day parabolic phase following every Halving event.

As an analyst, I’ve observed that traditionally, about a month into Bitcoin’s price discovery mode, a significant pullback takes place. This initial correction in the price during the parabolic phases historically occurs between weeks 6 and 8, typically resulting in a drop of at least 25%.

Rekt Capital notes that we’re now entering the sixth week following Bitcoin’s halving event, highlighting a period during which its value has seen a substantial drop. According to this analysis, there’s a possibility that Bitcoin’s price could experience a steep decline of around 25% to 40% over the coming weeks, similar to what occurred in 2017.

The analyst advises investors to be aware that the recent test of the $98,000 mark is significant. If this level isn’t maintained, it might trigger the initial significant drop or correction in the market.

In the coming three weeks or so, I will become more careful with retest attempts due to the increasing uncertainty. Given Bitcoin’s past trends at this stage of its cycle, it wouldn’t shock me if important support levels are breached.

Nonetheless, he stated that “the Second Price Discovery Uptrend will take place after the Price Discovery Correction,” which could propel BTC to a new ATH.

At the time of writing, Bitcoin is trading at $98,073, a 2% drop in the last 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-12-10 10:17