As a researcher with a background in cryptocurrency analysis, I find Axel Adler’s predictions intriguing. Based on his analysis of the Short-Term Holder Spent Output Profit Ratio (STH SOPR) and Open Interest (OI), it seems that we are in the midst of a 300-day bull run for Bitcoin.

After taking a break for two months at its record peak, Bitcoin (BTC) is poised to deliver another powerful punch, as per the assessment of cryptocurrency analyst Axel Adler. He anticipates a prolonged bull market lasting 300 days, driven by substantial profits among short-term investors and a resilient market with significant vigor left.

Profitable Punches And Room For More

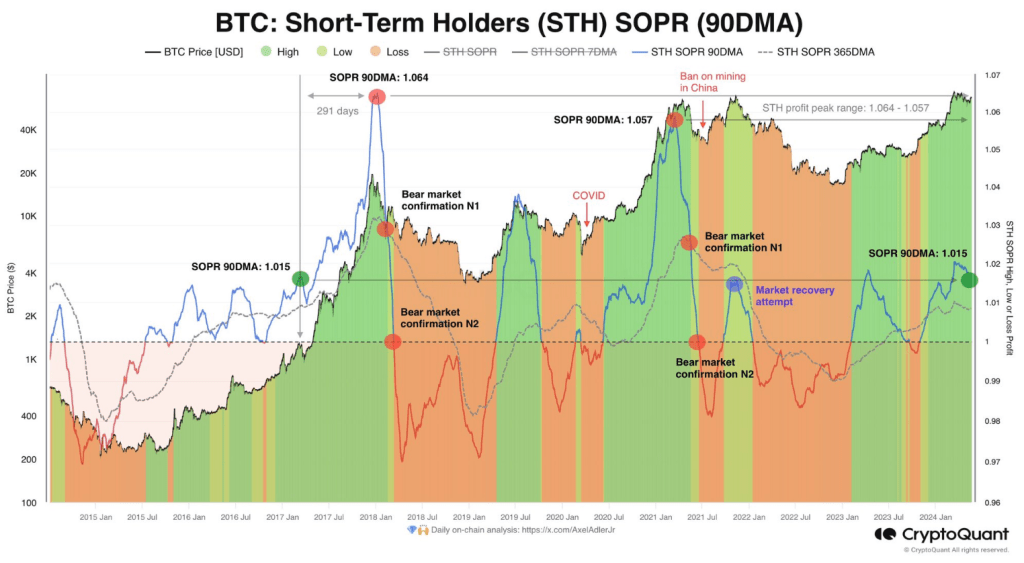

As an analyst, I’d interpret Adler’s assertion this way: I’m drawing a challenge with the figures on Short-Term Holder Spent Output Profit Ratio (STH SOPR) that Adler has presented. This particular metric sheds light on whether short-term holders are currently realizing profits from their transactions.

At present, the average of the past 90 days for STH’s SOPR is 1.015, signifying that short-term holders have made a profit but not yet reached the intense selling points experienced during previous market rallies (approximately 1.06). This implies there may be additional opportunities for traders to cash out their profits before the bullish trend starts to lose momentum.

The bull market is currently thriving with no signs of slowing down, and based on current trends, it may continue for around 300 more days, give or take. However, unexpected catastrophic events, such as Black Swans, could potentially disrupt this trajectory.

This is based on the P&L analysis of Short-Term Holders with a 90-day moving average.

— Axel Adler Jr (@AxelAdlerJr) May 21, 2024

Open Interest: The Untapped Reserve Of Strength

As a researcher studying market dynamics, I’d like to introduce another powerful tool at the disposal of market participants: Open Interest (OI). This important metric represents the current number of open derivative contracts, including both futures and options, that are actively held by traders in the markets.

I’ve noticed an impressive price surge lately, but the 7-day moving average for open interest (OI) hasn’t shown the significant increase that was present during previous bull markets. This observation, based on my analysis, implies that there is a hidden reserve of strength in the market. In other words, there’s more potential fuel ready to be added to the rally.

Technical Edge: Bulls Have Momentum On Their Side

Technical analysis involves more than just complex ratios and mysterious graphs according to Adler. He highlights several technical indicators that present a bullish outlook. For instance, the Relative Strength Index (RSI), which measures momentum, hasn’t surpassed 70 – a threshold commonly linked with overbought assets.

The current Bitcoin rally indicates that it’s robust and long-lasting. Moreover, the Chaikin Money Flow (CMF) climbing above 0.05 signifies substantial investment capital flowing in and heightened investor interest.

Can The Bulls KO Resistance Levels?

Although bulls currently hold the advantage, there are obstacles yet to be surmounted. Notable resistance levels remain at $79,000, $88,000, and $97,000 – determined via Fibonacci extension analysis. These price thresholds may impede Bitcoin’s upward trajectory.

If the present trend persists, those resistance levels might be broken, leading to a potential revisit of the record-high price of $73,700 and possibly further gains.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-22 16:19