As an experienced analyst, I have closely followed the Bitcoin Runes protocol since its inception on April 20. Initially, I was intrigued by the surge in activity and transaction volumes, driven largely by the excitement surrounding the Bitcoin halving event. The dominance of Runes transactions on the Bitcoin blockchain was truly remarkable, peaking at 81.3% of all transactions on April 23.

As a researcher studying the cryptocurrency landscape, I’ve noticed a notable decrease in transaction volume for the Bitcoin Runes protocol. This protocol, which gained considerable attention within the crypto community upon its launch on April 20 – coinciding with the fourth Bitcoin halving – experienced a remarkable surge in activity at first. However, this heightened level of usage has since dwindled significantly.

Initial Surge and Peak Activity

At its debut, Bitcoin Runes generated significant buzz in the marketplace, primarily due to the anticipation surrounding the Bitcoin halving. On the 20th of April, Runes transactions represented approximately 57.7% of all Bitcoin transactions. This heightened activity led Runes transactions to control a substantial portion of the Bitcoin blockchain, reaching a maximum of 81.3% on the 23rd of April. The extensive engagement fostered by this surge contributed to an unprecedented high in Bitcoin mining revenue, which peaked at $107.7 million.

Yet, its supremacy proved fleeting. By the 2nd of May, the share of Runes transactions had dropped dramatically to 11.1%, representing a substantial decrease compared to its recent high.

Declining Transactions and Fees

At Bitcoin Runes’ debut, the initial buzz resulted in substantial trading activity and high fees. On its first day, approximately 3,344 Runes were engraved, raking in nearly $3 million in transaction costs. However, this surge in demand did not last long. By April 26, a record-breaking 23,061 Runes had been carved, but the trend took a downturn shortly after. By May 21, less than 200 Runes were being engraved each day, and the associated transaction fees had plummeted to a mere fraction of Bitcoin’s total fees – a significant decrease from the 70.1% they represented at launch.

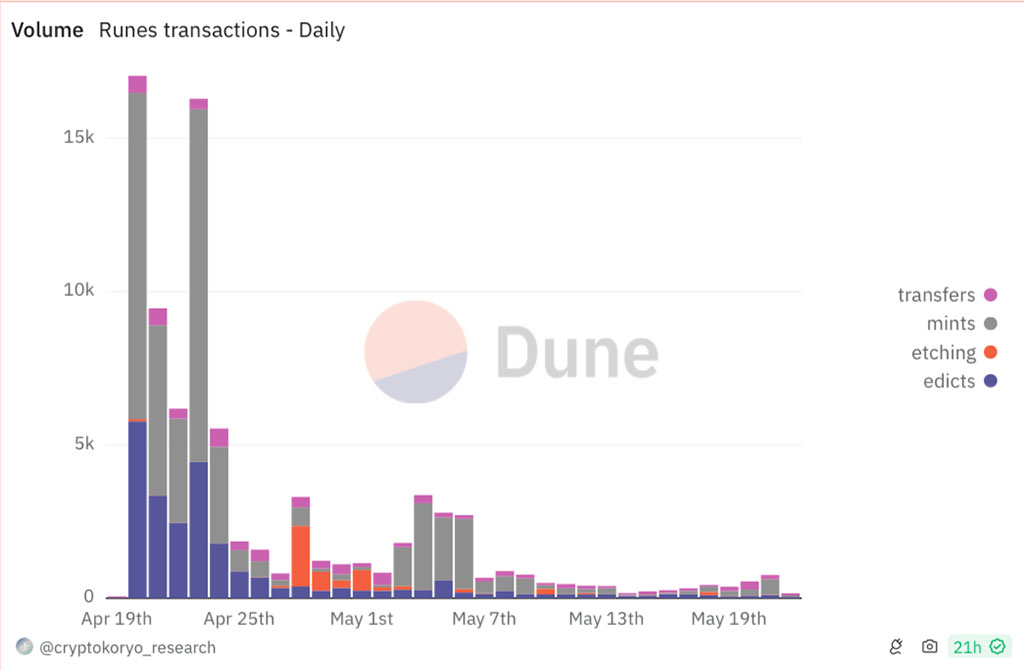

The data provided by Dune Analytics reveals that the number of Runes transactions has been varying significantly. Following an initial surge, there has been a noticeable decrease in Runes transaction activity. As of May 22, Runes accounted for only 12.7% of all Bitcoin transactions, marking a substantial decline from their highest point.

The decrease in Runes’ transaction fees aligns with the broader trend, illustrating the obstacles faced in keeping engagement and excitement high within the crypto market.

Photo: cryptokoryo_research / Dune

Market Dynamics and Future Outlook

The decline in Runes transactions is reflective of a wider pattern noticed within the Bitcoin Decentralized Finance sector, referred to as BTCFi. While there was an initial flurry of activity driven by the buzz surrounding Bitcoin’s halving event, the long-term viability of projects such as Runes is still up for debate.

Multiple elements have led to both the early growth and subsequent decrease. Private investment and positive investor attitudes significantly fueled escalating evaluations and initial excitement. Nevertheless, insufficient long-term demand and market corrections have dampened initial fervor.

As an analyst, I’ve observed that despite their decline, Runes have significantly influenced the Bitcoin market. They’ve generated hefty transaction fees and served as a testing ground for new protocols. With Runes settling into a less dominant role, their impact on the Bitcoin ecosystem is expected to wane, paving the way for a more consistent integration.

As a researcher exploring the cryptocurrency landscape, I’m optimistic about Runes’ future role in the Bitcoin ecosystem. Although their initial buzz has subsided, they’ve demonstrated significant potential for innovation within this sector. For developers and investors alike, Runes present both intriguing opportunities and complex challenges to navigate.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-05-23 14:12