As a seasoned researcher who has witnessed the cryptocurrency market ebb and flow like the tide for years, I find myself intrigued by this resurgence of retail activity in Bitcoin transactions below $10,000. The shift from risk-averse to risk-on sentiment is reminiscent of a rollercoaster ride, one that I’ve been on since the early days of Bitcoin.

Following a four-month dip in Bitcoin transactions by individual investors, there are indications that retail-level on-chain activities related to Bitcoin are starting to rebound.

Will Bitcoin Benefit From Rising Retail Participation?

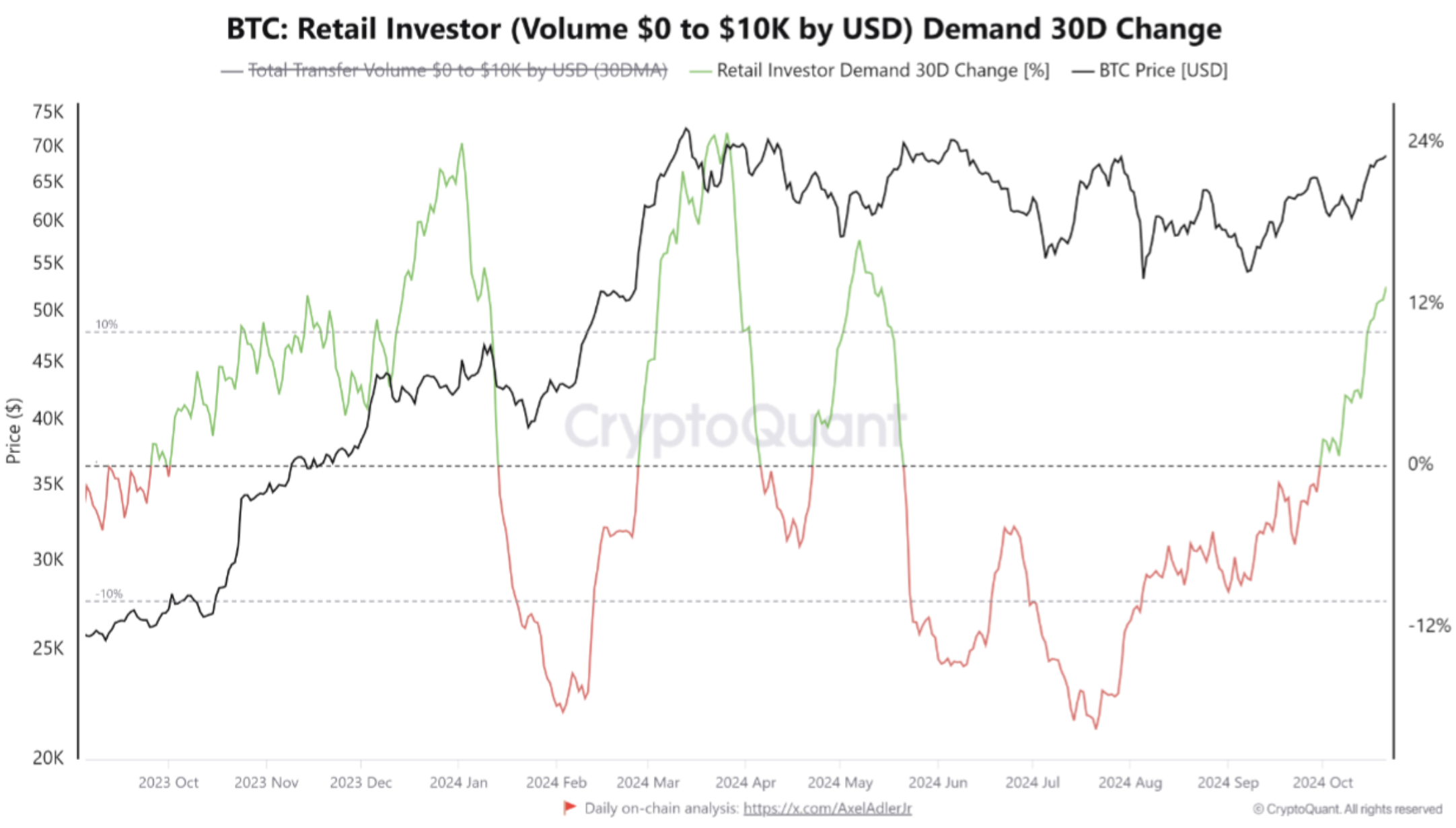

As a crypto investor, I’ve noticed an interesting trend based on a recent analysis by the on-chain analytics platform CryptoQuant. Smaller Bitcoin transactions below $10,000 are increasing, suggesting a shift in market sentiment from cautious to more aggressive, or from risk-averse to risk-on.

Monitoring transactions below the $10,000 threshold offers insights into retail activity levels. In contrast to large-scale institutional trades that are primarily based on financial analysis and long-term perspectives, the behavior of smaller investors is frequently swayed by market sentiment and current events.

According to the study findings, Bitcoin’s retail interest didn’t quickly recover following its record peak in March 2024. Yet, over the last month, retail interest has jumped by 13%, suggesting there may be more expansion in store.

For the same span of time, Bitcoin increased around 7%, climbing from $63,142 on September 22 to $67,346 by October 22. The surge in retail trading activity and price hike hint at a possible increase for Bitcoin in Q4 2024.

After Iran’s recent attacks on Israel, the quick bounce back of Bitcoin and other cryptocurrencies suggests that investors are once again taking on financial risks in the digital currency market, indicating a return to aggressive investment strategies.

It’s important to point out that while retail on-chain transactions decreased significantly over the past four months, institutions have consistently carried out a large number of trades and purchased a substantial amount of coins. In other words, institutional investors have been quite active, even as retail activity has waned.

The surge in the value of Bitcoin is drawing smaller investors back into trading, suggesting that there may be a trend towards reduced caution regarding risk.

Is A Q4 2024 Rally On The Horizon?

As an analyst, I find it reassuring to observe the resurgence of Bitcoin’s on-chain activity among retail investors, indicating a renewed enthusiasm towards the forefront of digital assets. Yet, with the upcoming U.S. presidential elections, it is plausible that we may encounter heightened volatility in Bitcoin’s price in the near future.

As a crypto analyst, I’ve observed that the potential for a significant crypto rally in Q4 2024 could be influenced substantially by the outcome of the upcoming US presidential elections.

According to Bitwise CIO Matt Hougan, if anything other than a Democratic victory occurs, Bitcoin could potentially soar up to $80,000 by the end of 2024.

The measure known as Bitcoin’s dominance, which represents the proportion of the total crypto market held by Bitcoin, has reached an all-time high of 58.9% in this cycle. This is good news for Bitcoin’s future value, but if its dominance continues to grow, it could negatively impact altcoins’ performance. Consequently, the fourth quarter of 2024 might see a new all-time high (ATH) for Bitcoin, but potentially lower returns for alternative coins.

Additionally, it’s important to ponder if the resurgence in global retail interest for digital assets could vary significantly by region rather than being consistent across all countries.

In South Korea, Bitcoin is currently being traded for slightly less than its global value because of a ‘kimchi discount.’ This suggests that domestic investors have a relatively low level of enthusiasm towards cryptocurrencies. As of now, Bitcoin’s price stands at $67,346, representing a 1.4% decrease over the past day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-23 09:40