As an analyst with over a decade of experience in financial markets, I have seen countless rallies and corrections, bull runs and bear markets. The current state of Bitcoin is particularly intriguing, given the short-term holder (STH) dynamics at play.

Upcoming Bitcoin resistance points may pose a challenge for potential future price surges, and here are the precise levels where these resistances exist.

Bitcoin Short-Term Holders Have Their Cost Basis At These Levels Ahead

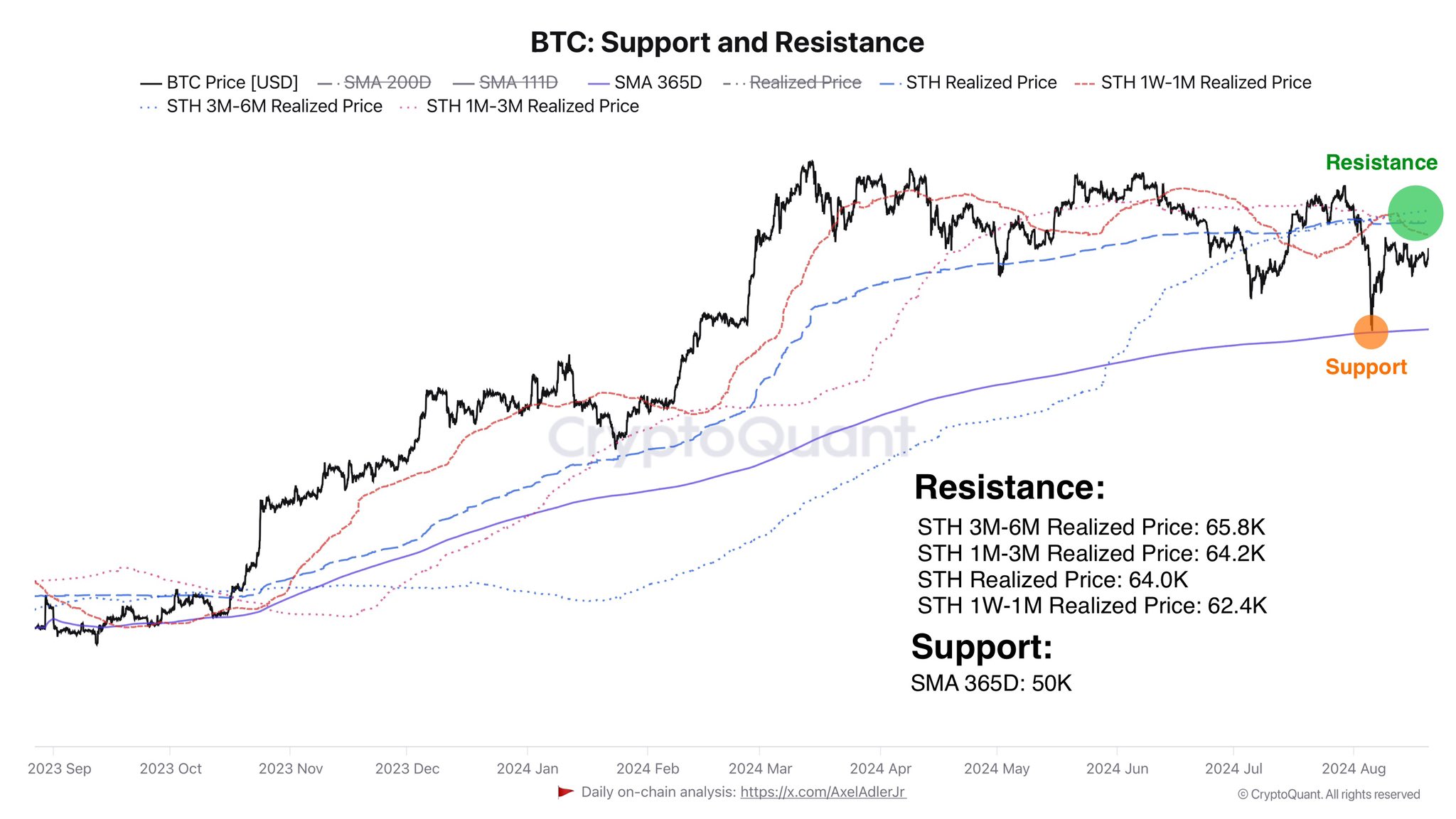

According to a recent post by Axel Adler Jr on X, short-term Bitcoin holders at present are finding their initial purchase prices ranging from approximately $62,000 to $65,000. The significant factor in this context is the “Realized Price,” which serves as an on-chain indicator that monitors the typical buy-in price across the Bitcoin network.

As a crypto investor, when I see that this specific indicator surpasses the current price of the cryptocurrency, it indicates that the average investor in the market is currently underwater – or, to put it simply, they’re losing money right now. Conversely, if the indicator falls below the value of Bitcoin (BTC), it signals a strong profitability on the network, suggesting that we’re witnessing more profits than losses at the moment.

For our ongoing discussion, we’re focusing solely on the Realized Price associated with a particular group, known as Short-Term Holders (STHs). These are individuals who have recently acquired their coins within the last six months.

Members of this Bitcoin group tend to react impulsively, often selling quickly when significant market shifts take place, be it the start of an uptrend or downtrend.

Over the course of the last year, I’ve been keeping an eye on the Realized Price trends for the STH group and some of its subsets, as illustrated in this chart provided by the analyst. It’s fascinating to see how these prices have evolved over time!

From the graph you see, the current Realized Price for Bitcoin’s STH (Short-Term Holder) is approximately $64,000, indicating that these investors have suffered a net loss. A closer look at the breakdown per cohort segment shows that those who bought between 3 to 6 months ago are experiencing the deepest losses since their initial cost basis stands at $65,800.

1-to-3-month investors and the overall cohort’s average are quite similar, with an average value of approximately $64,200 each. On the other hand, the latest buyers (within 1 week to 1 month) have the advantage as they bought their tokens at an average price of around $62,400 per unit.

For investors, their ‘cost basis’ holds significant value, and for Strategic Token Holders (STHs), it’s particularly noteworthy as they may respond sensitively to price retests of this level. So, if the price approaches one of these sensitive points, it’s probable that STHs will show some response.

Since the STHs are experiencing losses at present, they might eagerly anticipate the next retest. This eagerness stems from the possibility of selling at that point, thereby recovering their initial investment. Consequently, Bitcoin might encounter some resistance as it approaches those Realized Price thresholds.

BTC Price

As a crypto investor, I’ve noticed that the value of my Bitcoin holdings briefly surpassed $61,000, but it seems there’s been a significant dip in its price since then. Now, I find myself looking at a figure closer to $59,000.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-08-21 12:40