As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent rebound of Bitcoin (BTC) after reaching its new all-time high (ATH) has me feeling optimistic. The resilience displayed during the downturn, despite significant liquidations, is a testament to the maturity and stability of the market.

It seems that Bitcoin (BTC) is bouncing back following its recent dip, having hit a record high of $99,645 on November 22. Although liquidations surpassed half a billion dollars during the decline, there were no signs of the widespread sell-offs typical in past market situations.

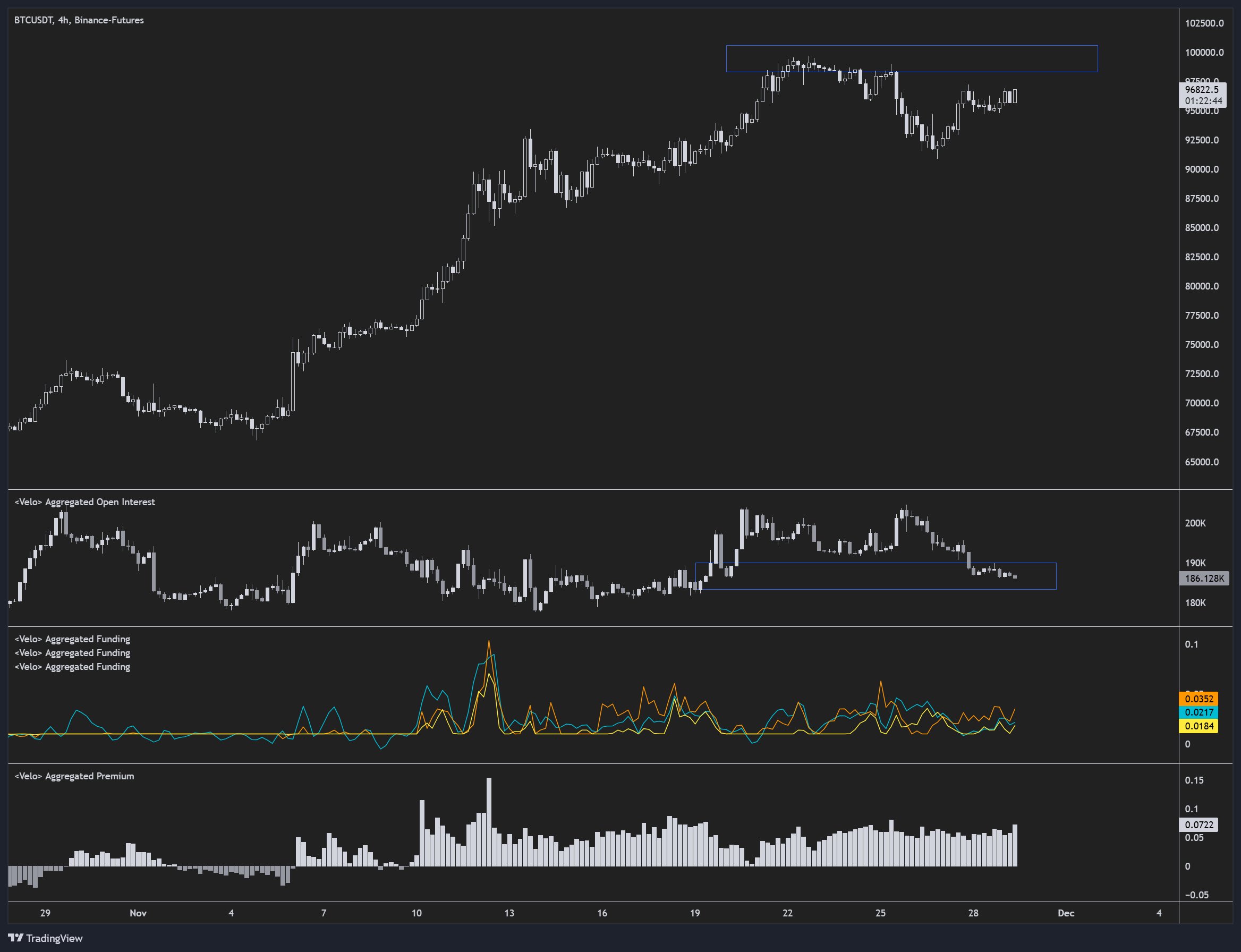

Bitcoin Open Interest Resets: Is $100,000 Next?

It appears that Bitcoin, the leading cryptocurrency, is gearing up for another try at reaching the significant price point of $100,000. As per crypto expert Byzantine General’s analysis, the recent drop in BTC prices has brought open interest back to levels similar to when the asset initially hit $90,000.

As a researcher, I’ve noticed Bitcoin holding steady around $90,875, which could indicate the commencement of a new consolidation period. Prior to the next surge, Byzantine General suggests that BTC is positioned to surpass its current highs and may even attempt to break through the 100k mark. This insight highlights the potential for further growth in Bitcoin’s price trajectory.

In the last effort, a significant amount of passive supply was absorbed. Therefore, it’s quite likely that we’ll witness the 100k mark approaching soon.

Jelle, a well-known crypto trader, mirrored similar sentiments as those held by the Byzantine General, stating that Bitcoin’s value reaching $100,000 could soon become a reality. Jelle provided this chart to support his claim, which shows Bitcoin seemingly breaking free from a descending trendline. Furthermore, it appears to be forming an inverted head-and-shoulders pattern, usually a sign of optimistic market movement.

According to Daan Crypto Trades, Bitcoin might soon hit the $100,000 milestone. Previous reports suggest that Bitcoin’s current trend resembles its price movement in 2023, which could potentially drive the asset’s value up to $200,000 by mid-2025.

Healthy Corrections Essential To Fuel Long-Term Growth

On November 6, Bitcoin was hovering slightly above $69,000. Then, it soared beyond its previous all-time high and reached its current price of $97,150 – that’s a remarkable increase of 40.8% in less than a month. But this swift surge might indicate a potential overextension.

Adjusting slightly below $90,000 could’ve provided the push Bitcoin needed for a stronger, prolonged price surge in the future. Additionally, this dip allows individual investors, who have been absent from the recent market surge, an opportunity to join and potentially boost the demand for Bitcoin.

As a crypto investor, I’ve noticed that the recent dip in prices has caused a softening of the Bitcoin Fear & Greed Index, moving it away from ‘extreme greed’ towards more balanced ‘moderate’ levels. This shift creates a healthier environment for a gradual and sustainable uptrend across the cryptocurrency market.

Regarding future projections, Dan Morehead – founder and head partner at Pantera Capital – has put forth a striking prediction that Bitcoin could potentially reach an astounding price of $740,000 by the year 2028. At present, the value of one Bitcoin stands at approximately $97,150, representing a modest increase of 1.4% over the past day.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Brody Jenner Denies Getting Money From Kardashian Family

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Capcom Spotlight livestream announced for next week

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

2024-11-30 12:04