As a seasoned crypto investor with a keen interest in Bitcoin and its price trends, I find Rekt Capital’s analysis intriguing and thought-provoking. The comparison of Bitcoin’s current price action to historical data from the 2016 bull cycle is fascinating, and it offers valuable insights into what we might expect in the upcoming months.

Renowned cryptocurrency analyst and trader Rekt Capital has shared an intriguing discovery about Bitcoin‘s price pattern in his latest analysis. His insightful prediction indicates that Bitcoin is following the same price trajectory as it did during a previous bull market, which occurred eight years ago.

Similar Historical Price Tendency In Bitcoin

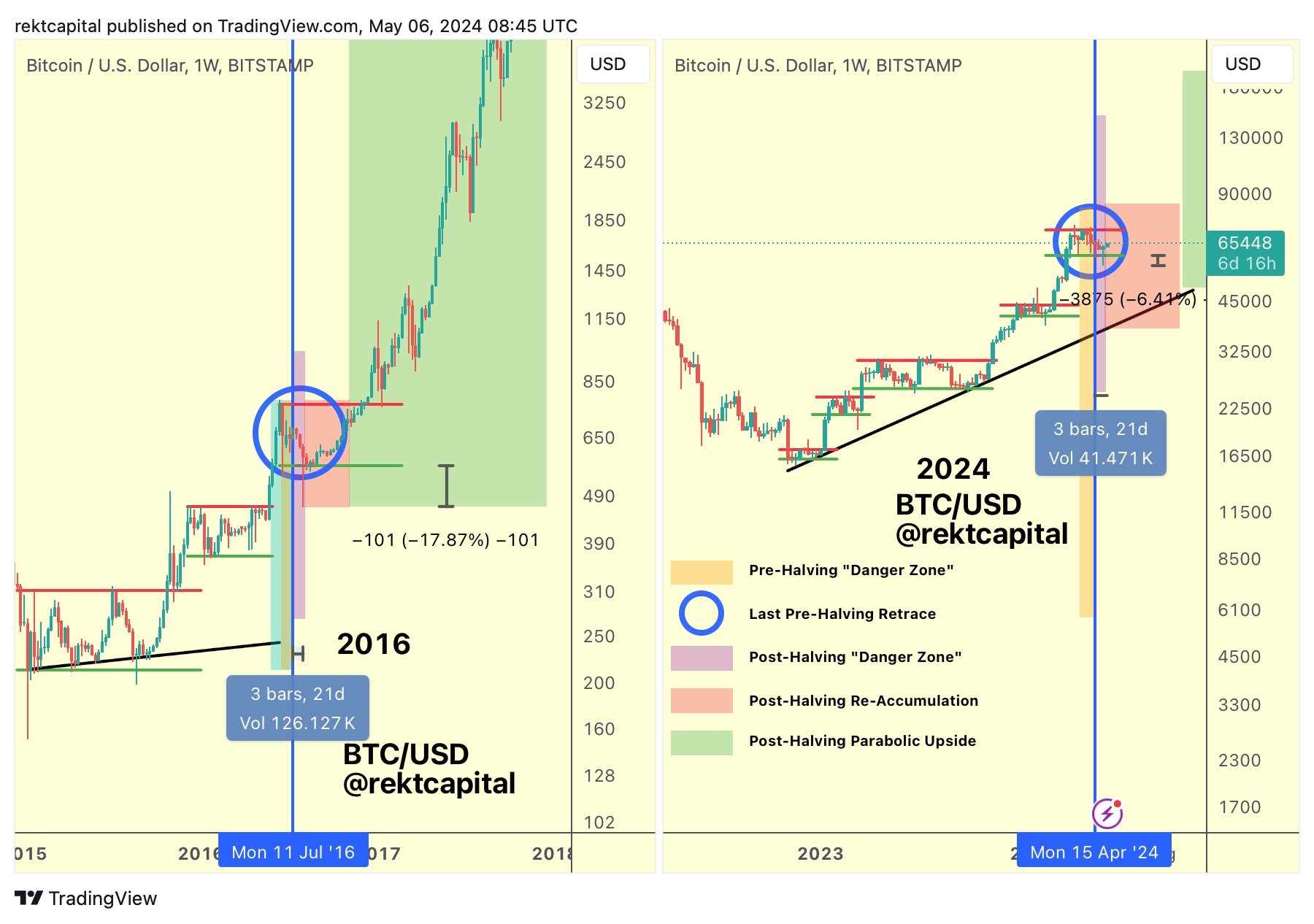

Rekt Capital pointed out the striking similarity between Bitcoin’s current price pattern and one from eight years ago. The magnitude of the 2016 bull market makes it plausible that BTC could experience substantial gains in the upcoming months, as it did following the Bitcoin Halving event in 2016, which resulted in a nearly 3,000% price surge.

As a researcher, I’ve been following the analysis of Rekt Capital with great interest. In his latest insightful post, he identified Bitcoin’s current predicament as being within what he calls the “Post-Halving Danger Zone.” This is an intriguing concept that suggests potential volatility and uncertainty in the digital asset’s price action following a Bitcoin halving event. At present, Bitcoin seems to be navigating through this zone.

Bitcoin has recently dipped below its Re-Accumulation Range Low, following a pattern seen in 2016. In that earlier occurrence, the price drop was approximately 17%. Yet, the deviation in 2024 represents a smaller decrease of around 6%.

In my analysis of Bitcoin’s price history back in 2016, I noted that approximately 21 days after the halving event, there was a prolonged period of roughly -11% price decrease. Subsequently, the cryptocurrency began its upward trajectory.

If we encounter a downturn in the current crypto market cycle around the Re-Accumulation Range Low based on historical trends from 2016, I would keep an eye out for potential price reversals within the next ten days. This shift could occur post the current market downturn.

As a crypto investor, I’ve been closely following the market trends and anticipating the end of the Post-Halving “Danger Zone.” According to Rekt Capital’s analysis, this period may conclude within the next few days, specifically in about four days. However, it’s important to note that historical data from 2016 indicates that there could be some volatile price movements around the $60,600 range low during this transition.

Pre-Halving Danger Zone For BTC

As an analyst, I’ve observed a noteworthy pattern in Bitcoin’s price action prior to every Halving event. Specifically, there has been a distinct “Danger Zone” that has emerged approximately 14 to 28 days before the actual Halving took place. Based on historical data from Rekt Capital, this trend has consistently held true throughout previous market cycles. Therefore, it’s essential for investors and analysts alike to keep a close eye on Bitcoin’s price behavior during this period.

Bitcoin experienced a decline of 18% approximately 30 days prior to its halving in the recent past. In contrast, before the 2016 halving event, Bitcoin had begun to retreat by 28 days. This historical trend indicates that Bitcoin could follow a similar pattern, potentially leading to a risky zone post-halving according to Rekt Capital’s analysis.

As an analyst, I’ve observed that the recent pullback from the new record-high price of Bitcoin has been more prolonged compared to previous corrections. Lasting for several weeks, this downtrend has led me to believe that we might have hit a bottom.

Currently, Bitcoin’s price is on an upward trend, gaining 0.43% to reach $64,126 within the past day. Moreover, its market capitalization and trading volume have experienced growth by 0.50% and 24.43%, respectively, over the last 24 hours.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-06 22:17