As a seasoned analyst with over two decades of market analysis under my belt, I’ve seen my fair share of market fluctuations and recovery phases. The recent surge in Bitcoin back towards the $57,000 level is a classic case of the market’s resilience and ability to bounce back after a dip.

Over the last 24 hours, Bitcoin has shown signs of improvement, potentially averting a significant drop it was earlier vulnerable to.

Bitcoin Has Recovered Back Towards The $57,000 Level

Over the past few days, Bitcoin experienced a significant dip. However, the beginning of this week has seen it surge forward once more, giving off a positive vibe as if revitalized, with its value now back up to approximately $57,000.

The below chart shows what the coin’s recent performance has looked like.

In the past 24 hours, there’s been a significant 4% increase that has entirely reversed the previous steep drop in the asset’s price. Furthermore, this rise has provided some breathing room for the asset above a critical pricing threshold established by an on-chain analytical model.

BTC Hasn’t Yet Lost This MVRV Pricing Band Support Level

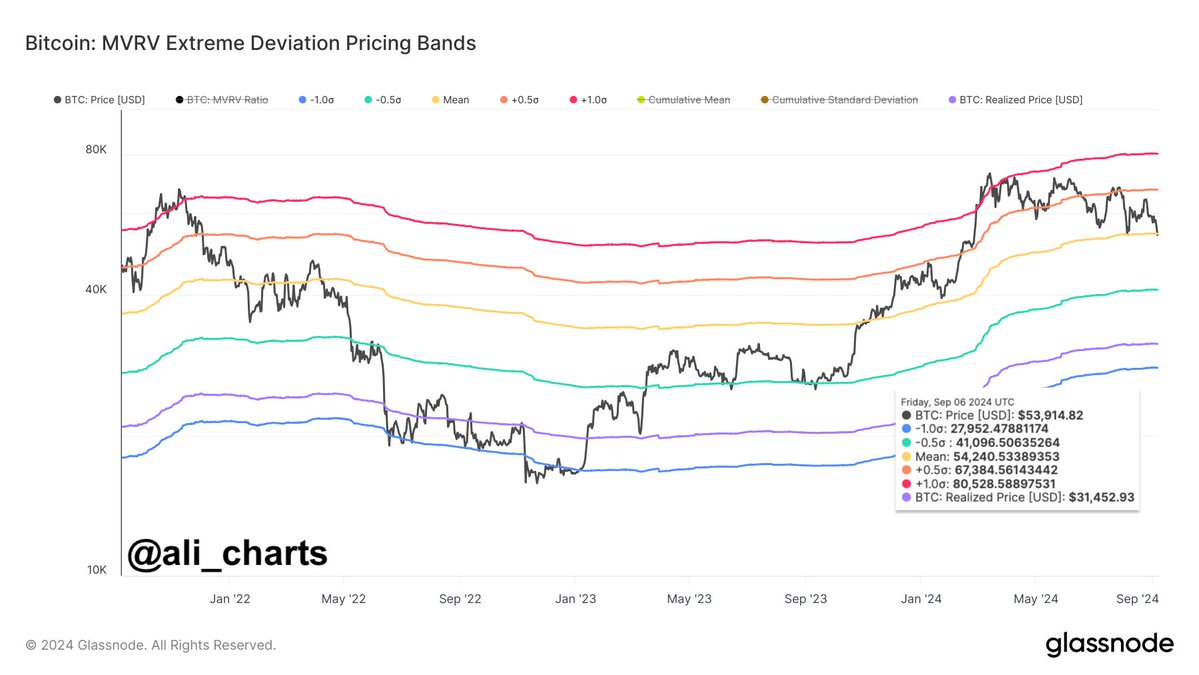

On platform X, analyst Ali Martinez recently talked about Bitcoin (BTC) testing a key support level as per the MVRV Extreme Deviation Pricing Models on the previous day.

The model is designed using the well-known Market Value to Realized Value (MVRV) ratio, which provides an insight into the relationship between the total value of Bitcoin held by investors (or its market capitalization) and the actual amount of money invested in it (referred to as its realized capitalization).

If the ratio is more than 1, it means investors are experiencing a net gain or profit. Conversely, if the ratio falls below the threshold, it suggests that losses have the upper hand in the market.

The MVRV Extreme Deviation Pricing Bands model calculates the average value of this metric, then compares it to the standard deviations (or fluctuations) in relation to the price of the specific cryptocurrency. Yesterday, our analyst provided a chart illustrating this particular model.

Yesterday, Bitcoin was seen testing the $54,200 mark on the graph, a price point that aligns with the MVRV ratio equaling its average historical value.

If Bitcoin (BTC) were to be rejected at its current level and fall below it, an important next level according to the model would be around $41,100. At this price point, the MVRV Ratio of BTC would be approximately 0.5 standard deviations below its average.

Ali observed that Bitcoin might be susceptible to a price adjustment down to this point. However, given its recent rebound within the past day, the imminent danger of such a decrease seems less likely for the cryptocurrency now.

For Bitcoin’s future price movement, the next significant resistance level is approximately $67,400 as indicated by the MVRV pricing band. It might take some time before this level is tested again.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-11 11:46