As a seasoned analyst with years of experience in the cryptocurrency market, I find it fascinating to observe the intricate dance between supply and demand that drives the prices of digital assets like Bitcoin. The recent surge towards the $61,000 level is no exception.

Over the past day, Bitcoin has bounced back and is approaching the $61,000 mark. Here are some potential reasons contributing to this price increase.

Bitcoin Has Made Some Recovery During The Last 24 Hours

Over the past few days, Bitcoin’s performance had been sluggish below the $60,000 mark. However, within the last 24 hours, it has displayed renewed energy, experiencing a rise of over 4% in its value.

The chart below shows how the cryptocurrency’s recent trajectory has looked like.

During the height of the surge, Bitcoin surpassed $61,400, but it later experienced a dip. Despite this decrease, Bitcoin is currently being traded near $60,800, representing a significant enhancement compared to its previous day’s position.

As for what could be behind this surge, perhaps on-chain data can provide some hints.

BTC Has Seen Multiple Positive On-Chain Developments Recently

In the realm of digital currencies, some recent advancements seem promising for Bitcoin. For instance, as reported by the on-chain analytics company Santiment, significant purchases of Bitcoin (BTC) have been made over the past six weeks by investors who own between 100 and 1,000 BTC.

Yesterday when Santiment shared their chart, I noted that Bitcoin investors holding between 100 to 1,000 BTC collectively owned approximately 3.97 million tokens. Interestingly, over the past six weeks, these investors have accumulated an additional 94,700 coins.

As someone who has been actively investing in cryptocurrency for a few years now, I can confidently say that the “sharks” and the “whales” are undeniably influential figures in this market. With their vast holdings of coins, they have the power to significantly impact prices and trends. In my personal experience, it’s essential to keep an eye on their activities and adjust one’s own investment strategies accordingly.

In other words, it’s clear that these major investors continued buying Bitcoin even when its performance was poor previously, indicating a strong belief that the digital currency would recover and bounce back.

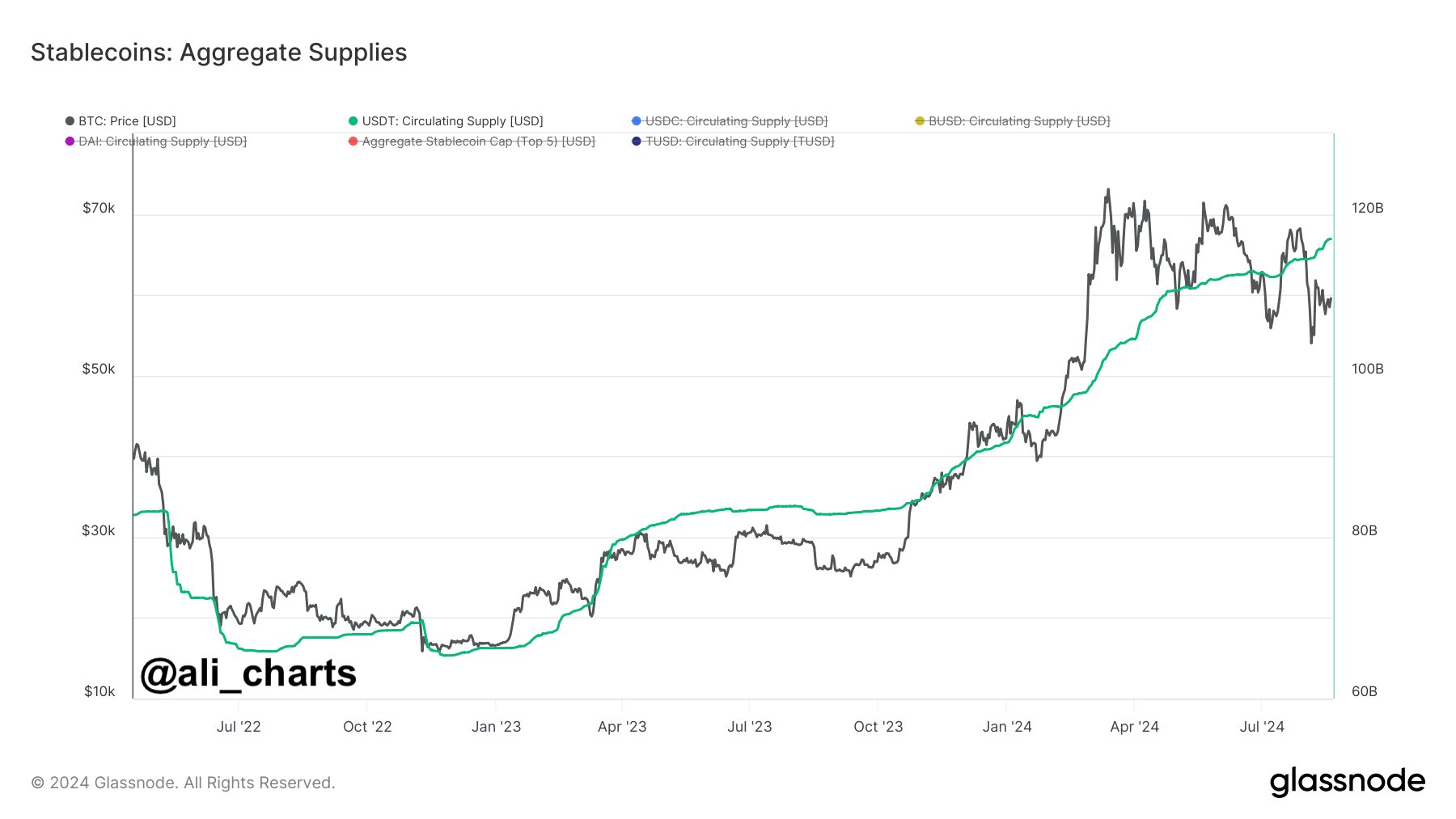

A noteworthy improvement is the upward trajectory observed in the availability of Tether (USDT), a fact highlighted by analyst Ali Martinez in a recent post.

Investors often turn to stablecoins such as Tether when they want to avoid the unpredictable fluctuations typical of cryptocurrencies like Bitcoin. These investors typically have plans to re-enter the volatile market, so the supply of these stablecoins might function as a reserve of funds waiting to be invested in Bitcoin and other volatile coins.

Of course, when investors decide to exchange their stable holdings for these specific assets, we often see an increase in their market value, or a ‘bullish rise’. Given that Tether’s supply has risen significantly lately, it can be thought of as increasing the potential buying power of investors.

It might be due to two scenarios: first, funds moving from Bitcoin and other digital currencies, which could indicate that investors have temporarily sold off their unpredictable assets. However, it’s important to note that these same investors might decide to re-enter the market at a later time. The second scenario involves new capital being injected into the market.

The second scenario suggests that optimism prevails, as it implies new investors are flowing into the market. In truth, elements of both possibilities may have happened; however, with Bitcoin recovering, it’s plausible that the new investments could have contributed more significantly to the price rise.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-08-21 00:41