As an experienced analyst, I have closely monitored the Bitcoin market and its various indicators for quite some time. The recent trend in the Realized Volatility of Bitcoin, as highlighted in a recent post by CryptoQuant author Axel Adler Jr, has piqued my interest.

As an analyst examining Bitcoin‘s market data, I’ve noticed that the Realized Volatility metric has reached historically low levels. Previous observations have indicated that such a condition could potentially be followed by increased volatility in Bitcoin’s price action. This is due to the fact that low realized volatility may suggest complacency among market participants, leading to potential sudden shifts in sentiment and resulting in higher price swings. However, it’s essential to note that past trends do not guarantee future results, and various other factors can influence Bitcoin’s price behavior.

Bitcoin Realized Volatility Has Decline To Extreme Lows Recently

In a recent post on X, Axel Adler Jr of CryptoQuant explained the current development in the Realized Volatility of Bitcoin. This indicator measures the historical volatility of an asset by considering its price changes over a specific time frame.

As a researcher studying financial markets, I would explain it this way: When the value of this metric is elevated, it signifies that the asset under review underwent significant price swings over the given timeframe. Conversely, a low reading suggests minimal price volatility for the commodity in question.

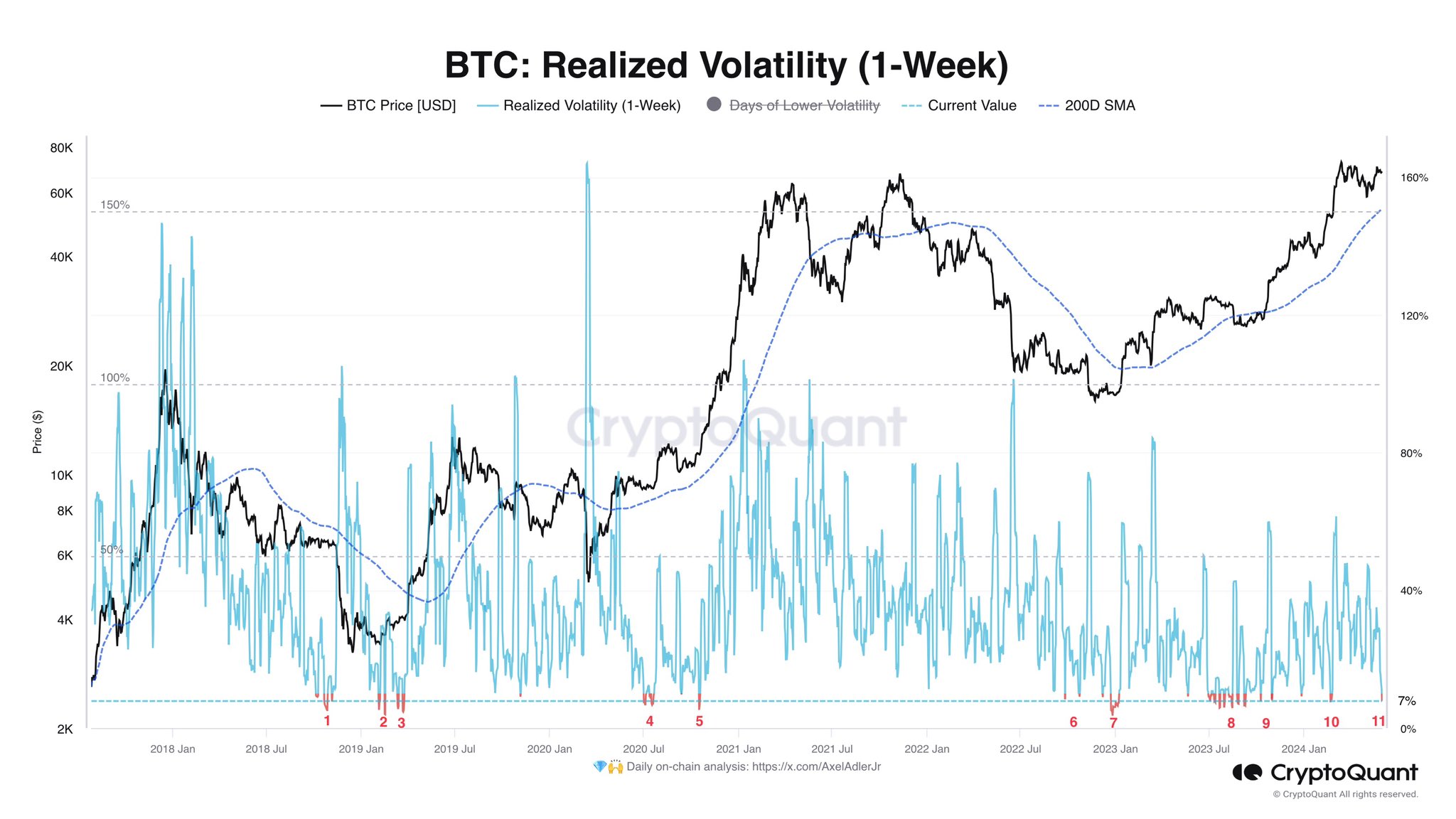

Here’s a chart illustrating the weekly developing trend of Bitcoin’s Realized Volatility over the past few years.

I’ve noticed an intriguing trend in the Bitcoin market lately. The one-week Realized Volatility, as shown on the graph, has dipped to relatively low levels of approximately 7%. In fact, only ten other occasions over the past six years have seen this metric read so low. This degree of tranquility is quite unusual for Bitcoin, which is known for its volatile nature.

The current consolidation of this cryptocurrency is among the most narrow in its past record. As for potential implications, we might look to historical trends for clues.

Examining the graph, it’s clear that prolonged price stability in the asset typically gives way to significant market swings. This most recent occurrence took place just prior to the surge towards a new record high (ATH).

Based on this trend, there’s a likelihood that the recent Bitcoin consolidation may result in another significant price swing for the cryptocurrency. However, it’s essential to keep in mind that historically, increased volatility following low Realized Volatility has led to price swings in either direction. Consequently, the upcoming price shift originating from this narrow range could potentially turn out to be a dramatic drop.

As a crypto investor, I can’t predict with certainty how Bitcoin’s price will evolve moving forward. The lackluster price action we’ve observed in the last week is historically unremarkable, leaving me uncertain about what lies ahead for this digital asset.

As a crypto investor, I’ve noticed that the ongoing developments at the defunct exchange Mt. Gox have led to some misleading on-chain signals. Axel brought up this topic in a recent post.

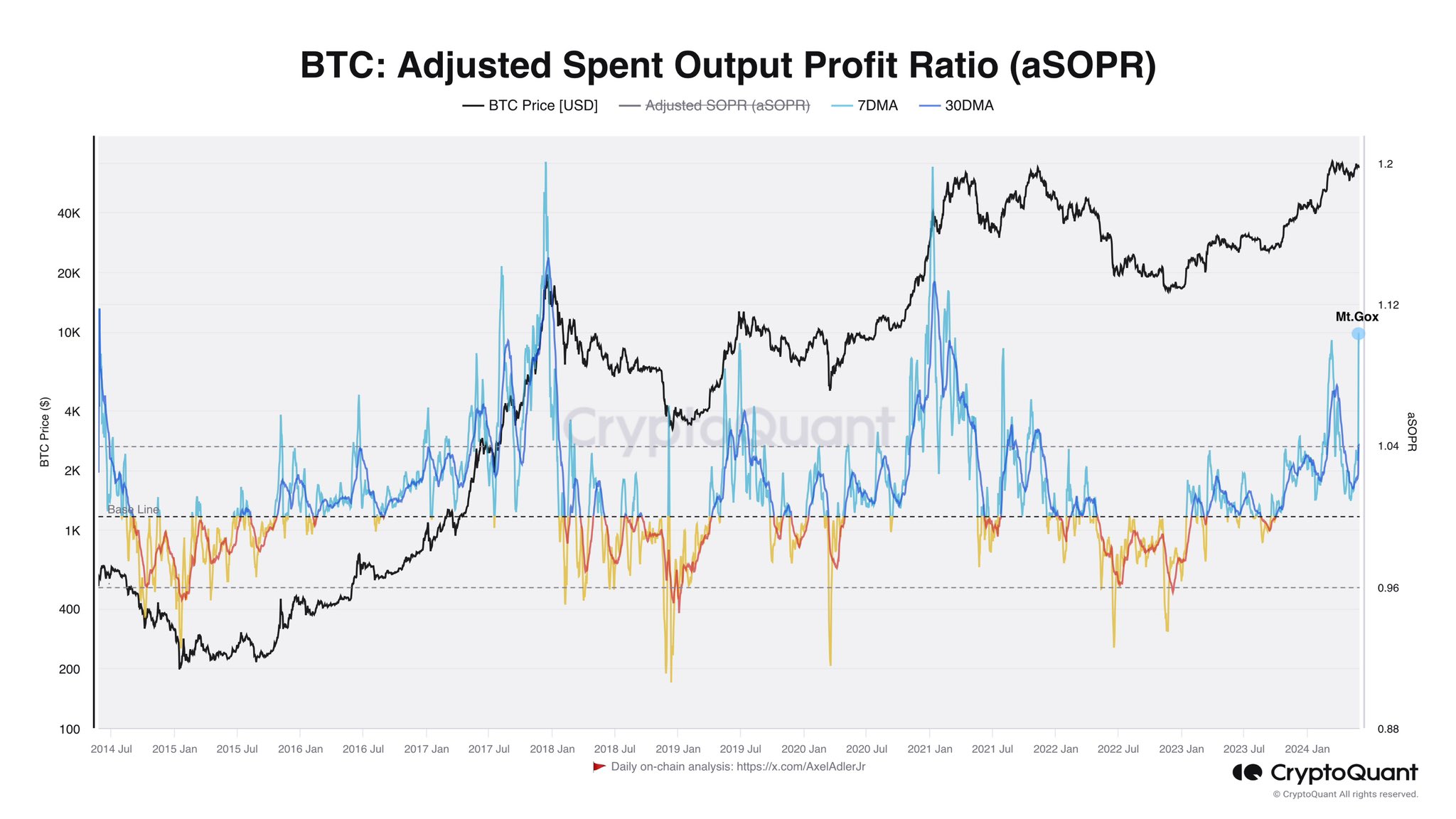

The analyst has cited the Bitcoin Adjusted Spent Output Profit Ratio (aSOPR) chart as an example.

The Average Spend Output Profit Ratio (aSOPR) monitors the collective profits or losses accrued by investors in the network. Given that the Bitcoins held in Mt. Gox wallets were stationary for an extended period, it’s no wonder that their recent transaction activity has “realized” substantial gains.

This surge in the indicator doesn’t truly represent profit-taking actions, making it an insignificant factor influencing the market.

BTC Price

Bitcoin has declined over the past day as its price is now down to $66,800.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-06-01 01:16