As a seasoned researcher with years of experience tracking Bitcoin’s price movements, I must admit that this current rally has been nothing short of exhilarating. The relentless march towards $100,000 is reminiscent of a rollercoaster ride – full of thrilling highs and nail-biting lows.

The value of Bitcoin has soared past $99,800, reaching a new record high and moving steadily towards the significant $100,000 milestone. Although it hasn’t officially broken through this psychological barrier yet, its impressive performance continues to excite investors, who anticipate that Bitcoin will soon surpass the $100,000 mark due to strong market demand.

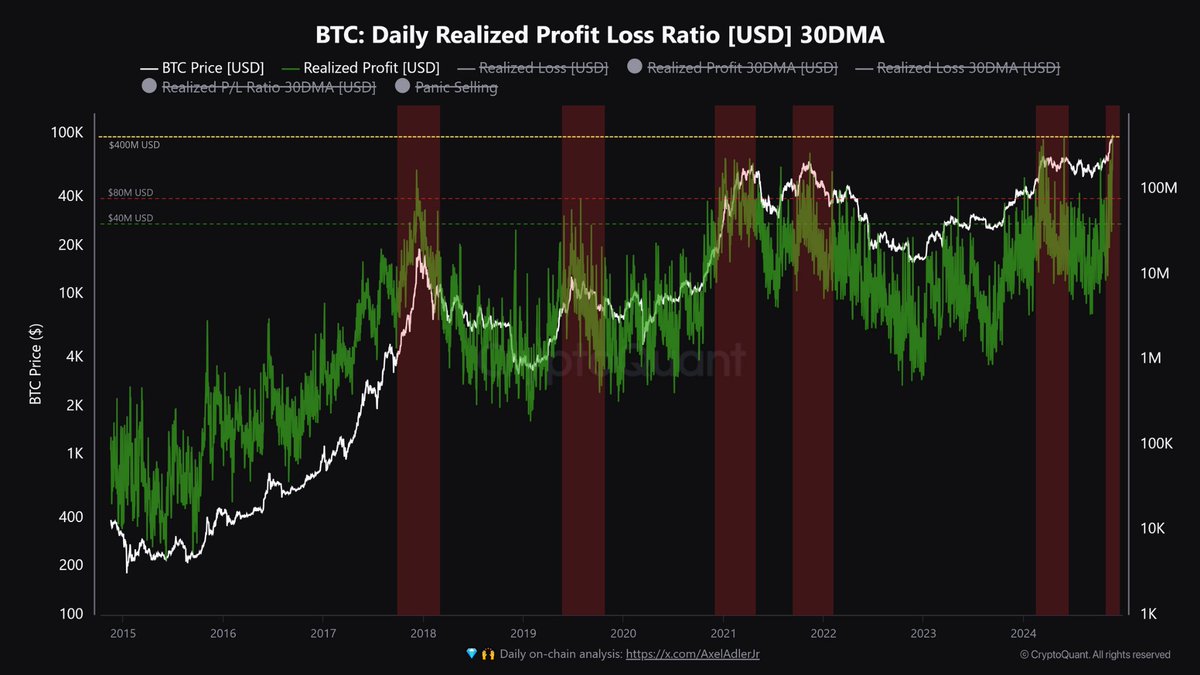

Information from CryptoQuant indicates that Bitcoin’s Realized Profit has hit an unprecedented daily peak of $443 million. This suggests strong demand in the market, with traders and long-term investors cashing out on exceptional profits. However, this massive profit-taking is causing some unease among investors. They worry that the upward trend could slow down, viewing the increase in realized profits as a potential indicator of a possible temporary peak.

Regardless of some conflicting indicators, the general feeling about the market is optimistic, or “bullish.” Bitcoin has managed to stay above significant support points, implying that the desire to buy it remains robust and could fuel further growth. As Bitcoin nears a major leap forward, the upcoming moments will be crucial in deciding whether its momentum can push it past $100,000 without pause, or if there might be a brief period of stabilization first.

Bitcoin Rally Could Continue Above $100K

2024 has seen an extraordinary and unforeseen surge in Bitcoin’s value, as it climbed from $66,800 to $99,800. With prices nearing the much-discussed $100,000 threshold, skeptics who once questioned Bitcoin’s ability to reach this level this year are now adjusting their outlook. This upward trend is fueled by robust demand and growing market confidence, making a leap over $100,000 appear imminent. If this happens, experts predict that Bitcoin will continue its bullish run, strengthening its position as the leading force in the cryptocurrency world.

The path towards reaching $100,000 might encounter obstacles due to market fluctuations, and it’s not uncommon for corrections to occur during this stage. These corrections could even be advantageous as they allow the market to stabilize, offering an opportunity for altcoins to regroup and potentially launch their own upswings. In simpler terms, a dip in the market can create a pause that allows altcoins to recover and possibly start new rallies.

Insights from analyst Maartunn at CryptoQuant offer valuable perspective on the current rally’s intense character. The data reveals Bitcoin’s Realized Profit has reached an unprecedented daily high of $443 million, indicating substantial profit-taking actions among investors. Although this underscores strong demand for Bitcoin, it simultaneously stirs apprehension among prudent investors who view the escalation in profits as a possible indication of a temporary peak.

Although there are worries, Bitcoin’s path still has potential for expansion. Keeping its price above $95,000 will preserve bullish energy, but a well-timed dip from the current prices could offer the necessary push to soar past $100,000 in the coming days.

BTC Testing Crucial Supply

I’m riding high on my Bitcoin investment right now, as it’s steadfastly holding above the $97,000 level. The bullish momentum is palpable, with everyone looking towards a breakthrough above the $100,000 milestone. This mark presents a substantial psychological and technical hurdle, but the market’s optimism about Bitcoin’s ability to clear it is running high. With demand continuing to be robust, many of us are gearing up for an explosive surge that could shape Bitcoin’s trajectory in the coming weeks.

Nevertheless, there’s mounting apprehension about Bitcoin reaching a temporary peak. If it does, the price might slow down and stabilize for an extended period, possibly multiple weeks while investors process recent growth. Market experts propose that maintaining the value above $98,000 over the next few days could preserve bullish trends and open opportunities for further advancement beyond $100,000.

From my research perspective, if Bitcoin doesn’t manage to sustain above the $97,000 mark, it might indicate the onset of a corrective phase. In such a scenario, the price could potentially drop to around $92,000 – a significant demand area that has historically shown robust support. A retreat to this level would provide Bitcoin with an opportunity to regroup and strengthen its underlying structure, setting the stage for another bullish rally, thus reinforcing its overall bullish trend.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-25 04:34