As a seasoned researcher with over a decade of experience in the crypto market, I have witnessed the rollercoaster ride that is Bitcoin’s price action. The recent 1.83% decline may seem concerning to some, but it’s important to remember that such fluctuations are par for the course in this volatile market.

The value of Bitcoin dropped by about 1.83% over the last week and fell below $97,000. Even with this dip, there is a lot of optimism in the market regarding Bitcoin because it gained around 61% since early October. However, Bitcoin’s recent steep increase in value might be leading to some negative trends in the market.

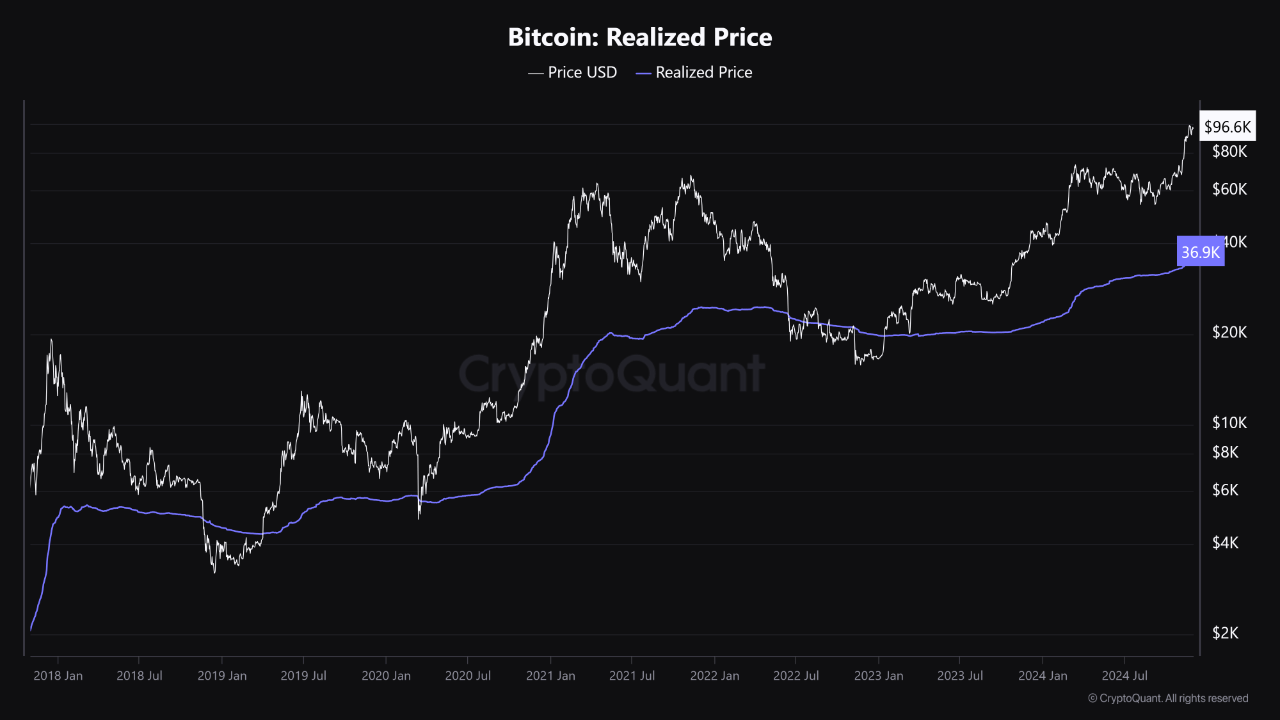

Bitcoin Realized Price Up ‘Only’ $37,000 Amidst Charge To $100,000

In a Quicktake post on CryptoQuant, an analyst with username Grizzly shared an intriguing insight on Bitcoin’s realized price following the asset’s recent price surge. According to Grizzly, as Bitcoin moved from $60,000 to almost $100,000 in the past two months, its realized price only rose from $31,000-$32,000 to $37,000 indicating a widening gap between both values which produces multiple implications.

In simpler terms, the realized price signifies the typical cost at which all existing Bitcoins were bought. This figure reflects the total expense that all Bitcoin owners have collectively invested. It’s frequently used for analyzing investor tendencies and recognizing market trends and cycles.

An increase in the actual price of Bitcoin is usually a favorable trend, suggesting a surge in investment capital as more investors are buying Bitcoin at higher prices. Additionally, a higher realized price suggests that there’s less pressure to sell from long-term holders, even with substantial price increases, which is a clear demonstration of market trust and optimism.

Nonetheless, Grizzly points out that when the market price exceeds the realized price significantly, it’s often a short-term sign of overheating, suggesting an inflated and unsustainable price growth fueled by speculation rather than solid fundamentals. Interestingly, the analyst also notes that Bitcoin has experienced similar widening gaps during past bull phases, which have been followed by continued price growth. This trend can be linked to the steep price increases commonly observed in a bull market.

Consequently, it appears that the increasing disparity between Bitcoin’s realized price and its market price might not significantly impact its ongoing upward trend.

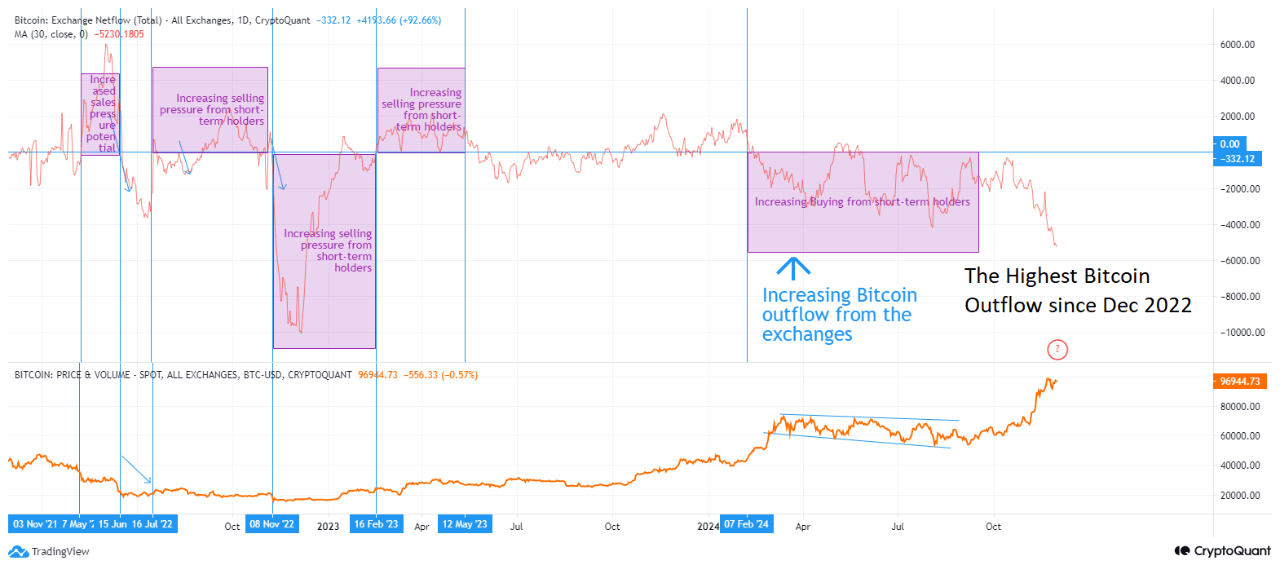

BTC Records Largest Exchange Withdrawal In Two Years

In recent updates, there has been a significant decrease in the amount of Bitcoin held on exchanges, which is the largest drop since last December, as reported by CryptoOnChain. This trend suggests that Bitcoin’s bullish surge may still have plenty of potential for growth.

Currently, Bitcoin holds the top spot among cryptocurrencies with a value of approximately $96,468 per unit. This comes after a minor decrease of 0.08% over the past day. Despite this small dip, Bitcoin has shown significant growth on longer time scales, recording a 38.22% increase in value over the last thirty days. With a market capitalization of around $1.91 trillion, it continues to be the largest digital asset, making up about 55.9% of the entire crypto market.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-12-01 15:04