As a seasoned researcher who has navigated through numerous market cycles, I find myself standing at the precipice of yet another intriguing chapter in Bitcoin‘s tumultuous journey. Having witnessed the ebb and flow of this digital asset for years, I can confidently say that this latest correction is not entirely unprecedented, nor does it necessarily spell doom for the bullish trend.

After reaching a record high of $108,364 in early November, Bitcoin experienced its first significant decline, falling by 13%. This unexpected drop has caused a stir in the crypto market, leading investors to feel less optimistic and even anxious. The sell-off has been especially tough on alternative cryptocurrencies, as they are losing value rapidly while Bitcoin struggles to regain its footing.

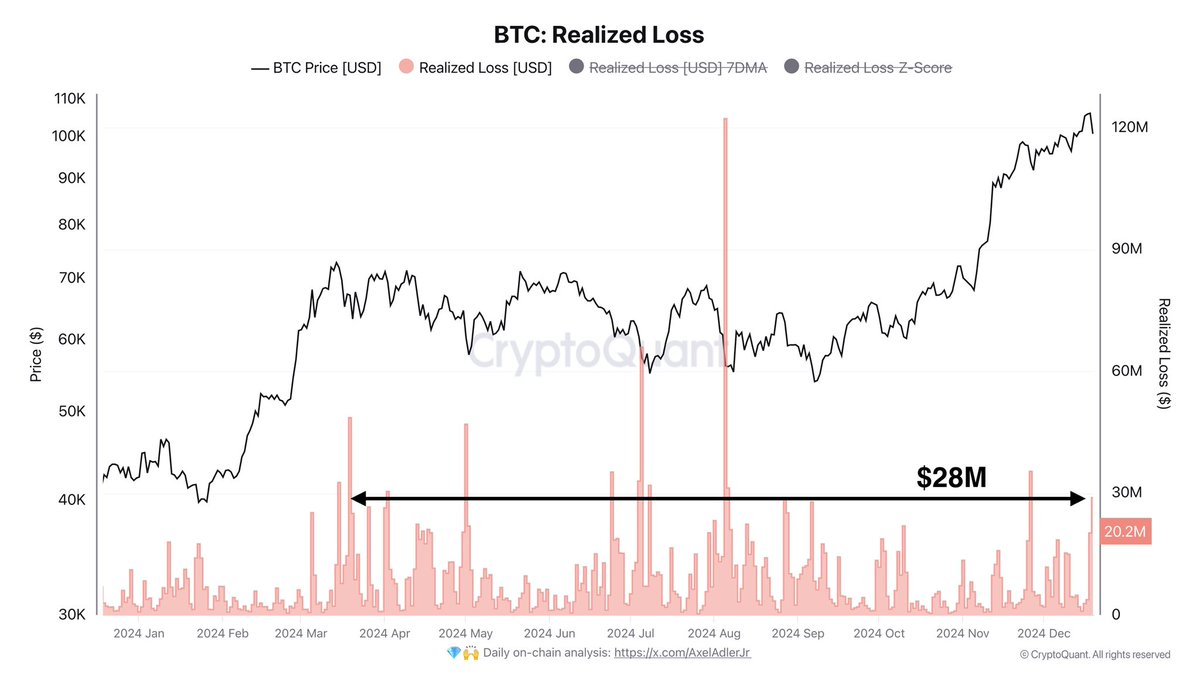

According to data from CryptoQuant, the current situation appears quite severe, with total realized losses reaching $28.9 million – a worrying figure that’s nearly 3.2 times greater than the average for a week. This significant increase in realized losses indicates that some investors may be liquidating their positions as the market adjusts following several weeks of intense upward price action.

The main point of interest currently is determining if this dip is just a normal correction within an overall positive trend, or the initiation of a more significant downturn. Investors are keeping a close eye on whether Bitcoin can maintain key support thresholds and observing the actions of altcoins, as they tend to magnify Bitcoin’s price fluctuations.

Currently, the market stands at a crucial juncture, as we wait to see if Bitcoin will rebound and continue its upward trajectory in the near future, or if this dip is indicative of a longer stretch of instability.

Bitcoin Facing Selling Pressure

Bitcoin is experiencing intense selling due to two consecutive days of strong bearish actions, which could be a crucial turning point for the market. The sudden change in sentiment has made many analysts and investors hesitant, with some even predicting further declines as Bitcoin’s recent trend seems to be slowing down. This downturn has left the market wondering if this price drop is just a temporary halt or a signal of more significant losses ahead.

Analyst Axel Adler has recently disclosed valuable information about X, backed by robust on-chain statistics, which suggest that accumulated losses have spiked to a staggering $28.9 million. This amount is more than three times the usual weekly average, suggesting increased selling actions. Adler’s assessment implies that while the sell-off may appear concerning, it aligns with a typical market correction, particularly after Bitcoin’s impressive climb to $108,300.

Adler points out that the present drop shouldn’t cause alarm but rather encourages patience among long-term investors. He underscores that, for now, it’s advisable to hold onto your investments unless there are further bearish indicators hinting at a longer period of decline. Typically, corrections such as this one supply the market with the required momentum for an uptrend, allowing weaker investors to withdraw and stronger ones to establish strategic positions.

The importance of price movements continues as investors scrutinize the situation, trying to decide if this dip lays a robust base for future expansion or hints at more declines ahead.

BTC Holding Bullish Structure (For Now)

The price of Bitcoin currently stands at approximately $94,400, marking a drop after three consecutive days of heavy selling activity. Yet, despite the apparent downward trend in the market, Bitcoin has been able to hold its ground above the significant support level of $92,000. This level is vital because it indicates the continuation of the upward trend. Remaining above this level shows strength and could lead to a powerful rebound if buyers regain control in future trading sessions.

Although the current price fluctuations suggest hesitancy, the dip hasn’t been as dramatic as the overall market perception might suggest. Overwhelming pessimism has prompted many investors to adopt a conservative approach, but Bitcoin’s resilience in holding above $92,000 underscores a robust foundation within the market dynamics.

Nevertheless, sentiment plays a crucial role in market dynamics. Regaining trust will be vital for Bitcoin to regain higher values and maintain its upward trend. If sentiment fails to improve and prices continue falling, the possibility of a more significant correction increases. Breaking the $92,000 support may open the door to testing lower price ranges, which could lead to increased market turbulence.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-21 05:10