Bitcoin‘s Realized Cap Breaks New Ground as $100K Inflows Slow

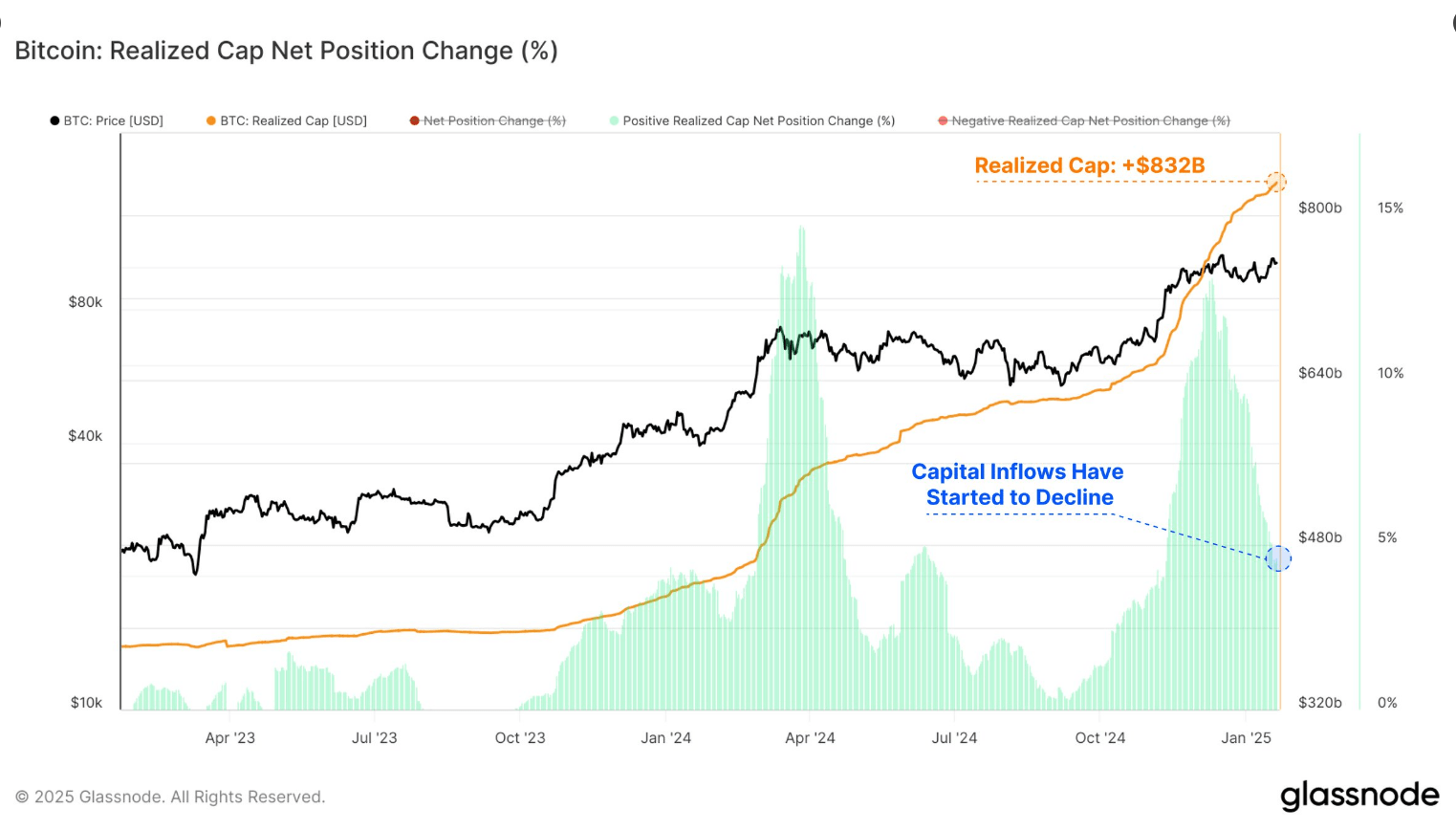

The soaring value of Bitcoin has astounded market experts with its ability to surpass expectations, even as capital inflows begin to slow down. The Realized Capitalization of Bitcoin has reached an unprecedented high of $832 billion, a testament to the growing confidence of investors and the resiliency of the asset, according to insights from market analysis firm Glassnode.

Unraveling the Enigma of Realized Cap

Realized Capitalization provides a more refined and nuanced view of Bitcoin’s value compared to the commonly used market cap. This innovative metric calculates the value of each Bitcoin by considering its most recent transaction price, rather than the market price for all cryptocurrencies. By doing so, Realized Cap unveils the flows of Bitcoin, revealing the withdrawal of profits by long-term holders or the entrance of new investors, thereby depicting a more holistic picture of the market situation.

#Bitcoin’s capital inflows have taken a breather after ascending above the $100K price threshold. Nonetheless, the#BTC‘s Realized Cap struck an all-time high of $832B and continues to grow at a rate of $38.6B per month:

— glassnode (@glassnode) January 22, 2025

Bitcoin’s continued ability to draw in new capital indicates that it retains value within the network, suggesting an increased confidence in the cryptocurrency’s potential as a long-term store of value.

Mixed Signals from Capital Inflows

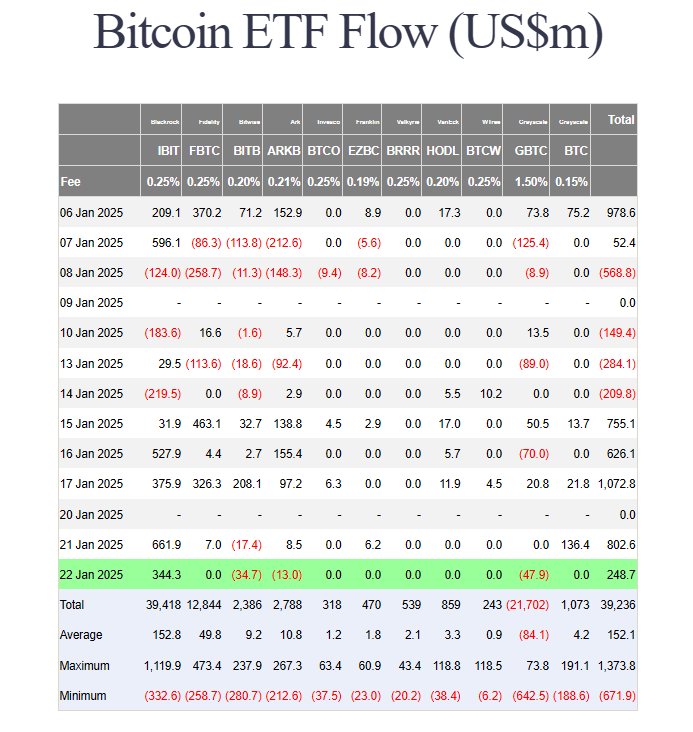

The milestone achievement of Realized Cap is underscored by a period of inconsistent capital inflows into Bitcoin. In a strange twist of events, Bitcoin ETFs witnessed considerable outflows of approximately $1.21 billion, seemingly pointing towards a decrease in institutional investors’ sentiment.

However, a mere few days later, the narrative took an unexpected turn with a massive influx of over $1 billion on January 17 alone, driving the total inflow into Bitcoin ETFs to a notable $3.26 billion between January 15 and 17. This sudden 180-degree turn underscores the persistent demand for Bitcoin, despite occasional volatility in capital inflows.

Long-Term Holders: The Driving Force Behind Growth

The importance of long-term holders in the Bitcoin ecosystem cannot be overstated, as they are now in a position to maximize their profits, as confidence in Bitcoin’s resilience to maintain value over time continues to bolster. At the same time, new entrants enter the fray, purchasing cryptocurrencies at a higher price, thus adding to the Realized Cap metric.

These dynamics reveal an essential truth: Bitcoin’s growth is no longer dependent solely on speculative trading but, increasingly, becoming a long-term investment for many, akin to gold or other conventional stores of value.

Challenges Loom on the Horizon

While the rise in Realized Cap paints an optimistic picture, the market, overall, still grapples with several challenges. If capital inflows remain slow for an extended period, this could pose problems down the line. Nevertheless, Bitcoin’s capacity to establish new milestones amidst such circumstances demonstrates that it is maturing as an asset, akin to traditional investments, opening up new perspectives for its potential adoption and use.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-01-23 15:05