As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles that have shaped my understanding of market dynamics. The recent surge and subsequent retracement of Bitcoin (BTC) to surpass $100,000 for the first time is an intriguing development, and it appears to follow a familiar pattern from its 2017 rally.

Following reaching a new high of $100,000, Bitcoin (BTC) experienced its most significant drop in the past month before regaining ground. As Bitcoin’s price action unfolds, certain experts have proposed key levels to monitor and potential destinations for Bitcoin’s continued upward trend.

Bitcoin Rally To Continue Above $100,000

On Thursday, Bitcoin reached a new record peak of $103,600, marking an 8% rise in a single day. This significant cryptocurrency, with the highest market value among all, burst free from a one-month bullish pattern and surpassed the $100,000 threshold for the first time ever.

As an analyst, I’ve observed a significant pullback in Bitcoin’s price after a notable rise. It dipped down to approximately $98,000, momentarily touching the $90,000 support level. This 13% correction is the most substantial drop for Bitcoin since the post-election rally began a month ago and has resulted in around $1 billion worth of liquidations, which is the largest since August.

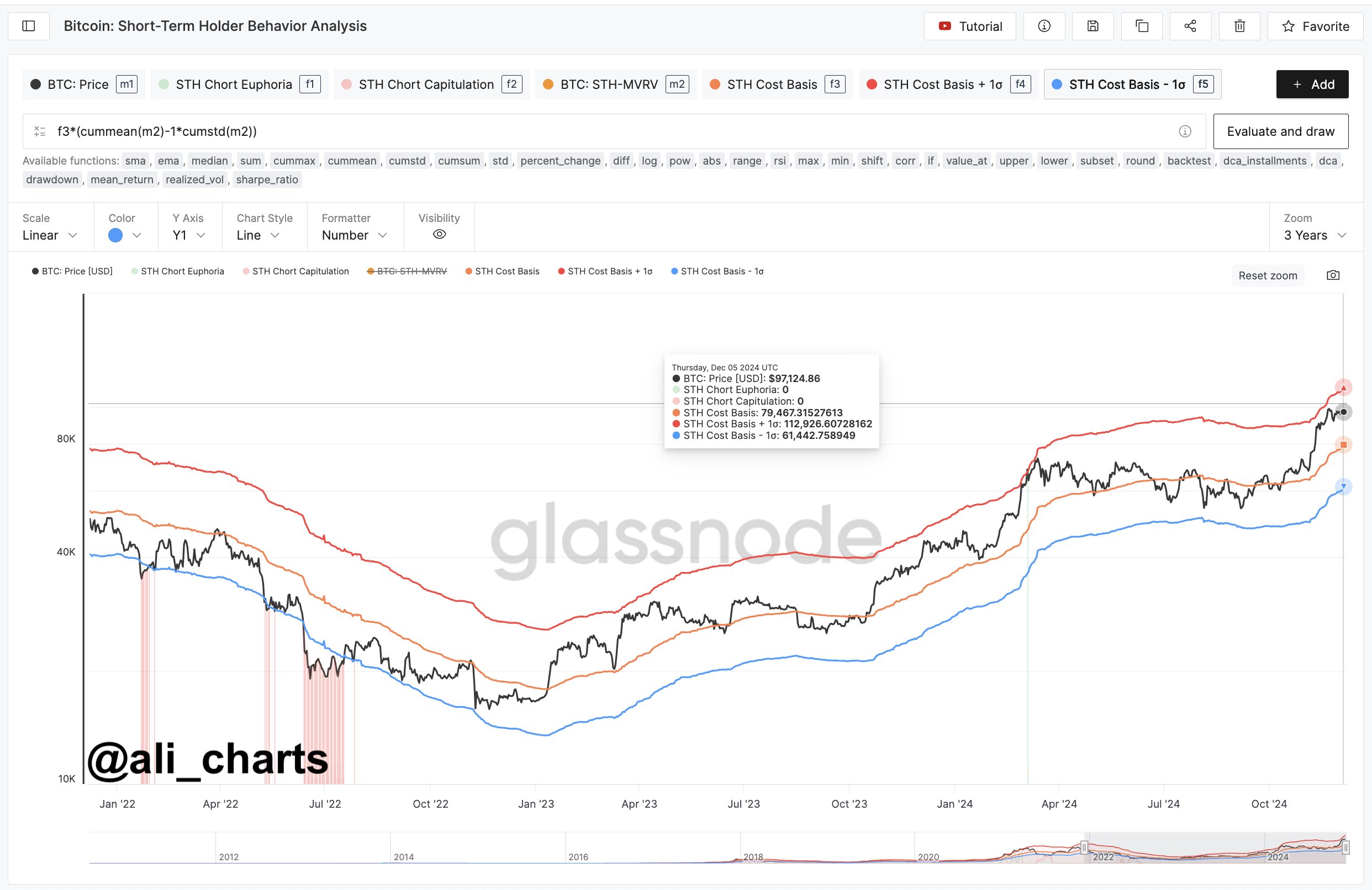

Despite a temporary dip, Bitcoin regained its footing within the $97,000 to $98,000 price range, and then revisited previous all-time high (ATH) levels near $99,000 during Friday morning hours. Notably, crypto analyst Ali Martinez emphasized that Bitcoin’s surge appears to hinge on a crucial support level.

According to Martinez’s analysis, the strongest area of support for Bitcoin lies around $96,870. It’s important to note that approximately 1.45 million Bitcoin addresses collectively own about 1.42 million BTC at this price level. The analyst believes that as long as this demand zone remains stable, there’s a high likelihood that the price of Bitcoin will continue to rise.

Furthermore, he emphasized that the peak in local Bitcoin values has not yet been reached, typically occurring around a 1 standard deviation increase from the Short-Term Holder Cost Basis. According to his analysis, this point was approximately $112,926 at the time of the report, indicating a potential 13% rise before BTC experiences its first significant downturn.

Will BTC Repeat Its 2017 Move?

Crypto analyst Jelle noticed that Bitcoin is still mirroring the pattern from Q4 2023 quite closely, even with its recent drop. He believes that since Bitcoin has now cleared out liquidity on both sides of the market, it will begin moving towards the $100,000 mark again.

Jelle proposed that Bitcoin (BTC) might maintain its current range until Christmas, with a potential significant surge – or “true breakout” – predicted for after this period if the trend follows last year’s pattern. Furthermore, he pointed out that yesterday’s $100,000-sized candle resembles Bitcoin’s candle when it initially exceeded the $10,000 milestone.

On November 2017, I witnessed a significant milestone as Bitcoin surpassed $10,000 for the first time. It then fluctuated within the $11,000 range before experiencing a sharp decline to around $8,500. However, the very next day, the largest cryptocurrency bounced back from this correction and once again challenged the $10,000 mark. On the third day, it managed to hold its ground, ultimately turning $10,000 into a support level.

Subsequently, Bitcoin surged approximately 90% over the next few weeks, reaching a high of $19,000 – its all-time peak in 2017. Given this trend, the analyst posits that the current price fluctuations are quite typical and could potentially rise further if history repeats itself.

Following its recovery, Bitcoin (BTC) has returned to test the optimistic pennant formation, which could potentially lead to a price surge reaching six figures permanently, as per Jelle’s prediction. The anticipated rise aims to reach approximately $130,000.

Currently, the leading cryptocurrency is being traded at approximately $101,050, marking a 4.7% rise over the past seven days.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-12-07 15:40