As an experienced crypto analyst, I have closely monitored Bitcoin’s price movements and market indicators for years. The latest development in the world of Bitcoin has piqued my interest as a technical pattern has just turned bullish, which could potentially signal an impending rally for the largest cryptocurrency by market capitalization.

The significant Bitcoin indicator has recently shifted to a positive outlook, fueling anticipation among crypto analysts for an upcoming surge in Bitcoin’s value. This distinctive chart pattern hints at the possibility of Bitcoin’s price continuing to rise, possibly initiating a long-awaited bull market during this particular cycle.

Bitcoin Technical Pattern Flips Bullish

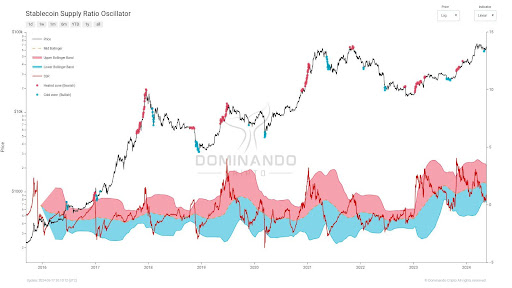

The price of Bitcoin typically displays distinct historical patterns, with most indicators signaling upcoming bull runs or bear markets. A noteworthy signal of an impending Bitcoin bull market is when the Stablecoin Supply Ratio (SSR) Oscillator falls beneath the lower boundary of the Bollinger Bands on the chart. This technical indicator gauges a market’s volatility and momentum, making it a valuable tool for predicting price shifts in Bitcoin.

As a crypto investor, I’ve come across an intriguing analysis tool called the Supply/Demand Ratio (SSR) suggested by Dominando Crypto on platform X, previously known as Twitter. This innovative indicator is specifically designed to assess market sentiment by measuring the ratio of stablecoin supply to Bitcoin. By monitoring this metric, traders and analysts like myself can identify potential buying or selling opportunities for Bitcoin. Furthermore, the SSR also reveals how the 200-day Simple Moving Average (SMA) of this indicator behaves within Bollinger Bands.

Dominando Crypto offers a comprehensive guide on calculating the SSR (Stochastic Oscillator with Moving Average) and decoding its indications for recognizing bullish tendencies in financial markets.

As a researcher, I would explain it this way: “To calculate the oscillator, I subtract the 200-day Simple Moving Average (SMA) of the Stablecoin Supply Ratio (SSR) from its current value, and then divide the outcome by the standard deviation of the SSR over the same time frame.”

The crypto expert presents a price chart illustrating the SSR oscillator’s fluctuations. According to their analysis, when this indicator surpasses the upper Bollinger Bands, it implies that the SSR is notably higher than usual. This finding suggests that stablecoins are currently commanding a larger market share. Consequently, this condition may foreshadow bearish tendencies and a possible Bitcoin price decrease.

From a research perspective, when the oscillator drops beneath the lower boundary of the Bollinger Band, I interpret this as a signal of weak buying pressure for stablecoins. This observation implies a decrease in their controlling influence within the market, potentially foreshadowing a bullish trend for Bitcoin that could result in a price surge.

In the given price chart, Dominando Crypto identified specific areas where the Stochastic Oscillator (SSR) showed bearish and bullish tendencies, labeling them as “heated zones” (bullish) and “cold zones” (bearish) respectively. The market’s recent behavior suggests that the SSR oscillator has moved into a cold zone, implying a potential positive shift for Bitcoin’s price trend.

More Bullish Signs For BTC

On May 18, according to Santiment, a well-known blockchain analysis firm, there’s been a recent trend emerging among smaller Bitcoin (BTC) investors: they have been selling off their BTC holdings despite the cryptocurrency’s recent positive price developments.

When smaller Bitcoin wallets transfer their coins to larger wallets, this historical trend suggests a positive development for Bitcoin. It may be a sign of an upcoming bull market.

As I analyze the current market trends, Bitcoin’s price stands at $66,955 based on data from CoinMarketCap. The cryptocurrency has experienced significant growth recently, with a robust 8.94% gain in the last week and a notable 4.25% rise over the past month.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-05-20 14:46