As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull runs and bear markets alike. However, the current Bitcoin rally stands out as one of the most extraordinary events I’ve ever observed. The relentless upward momentum, driven by robust demand from US investors, is truly a testament to the digital asset’s growing maturity and mainstream adoption.

Bitcoin has climbed above $99,800, reaching a new peak and approaching the significant $100,000 milestone. Although it momentarily touched that level, Bitcoin hasn’t broken through it yet, leaving investors and analysts on tenterhooks, waiting for the next development. Given the ongoing strong interest, it seems likely that Bitcoin will soon surpass this crucial threshold in the near future.

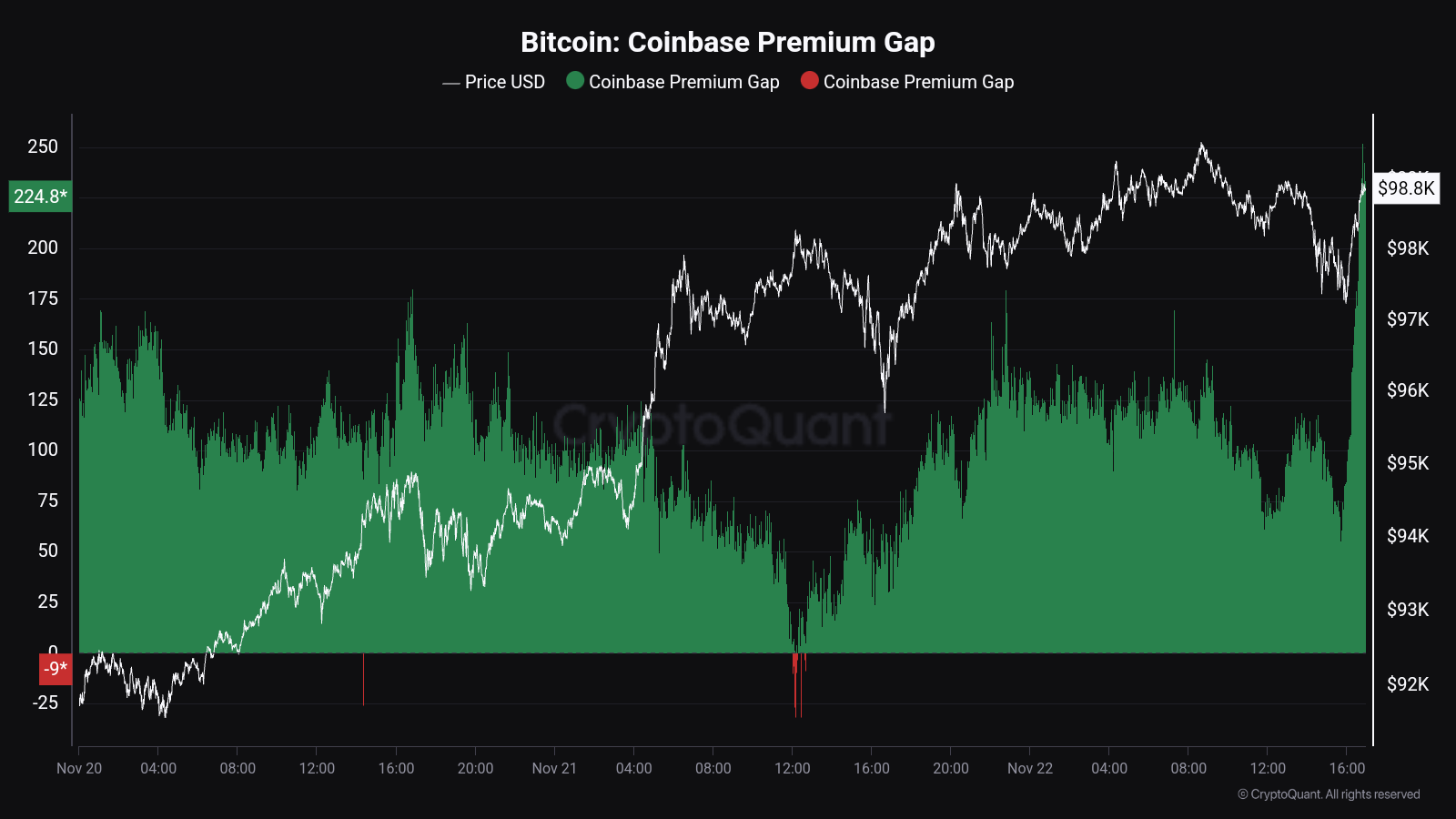

Recent data from CryptoQuant highlights a significant factor driving this rally: the Coinbase Premium Gap, which currently sits at $224. This metric, representing the price difference between Bitcoin on Coinbase and other global exchanges, signals strong buying activity from US Coinbase investors.

The unstoppable rise of Bitcoin has strengthened its control in the cryptocurrency sector, leading many analysts to consider the $100,000 mark as a crucial resistance point. Although the price hasn’t breached this level yet, the continuous surge suggests that Bitcoin’s extraordinary bull run may still be ongoing. As we approach this significant juncture, everyone is watching to see if Bitcoin can maintain its pace and set fresh records, shaping the trends for the coming weeks.

Bitcoin Price Action Remains Strong

Since November 5, Bitcoin has been on an unyielding upward trend, with no indications of vulnerability as it consistently hits fresh highs. Despite not surpassing the $100,000 mark yesterday, its price behavior continues to show great strength. The bullish sentiment is robust, and if Bitcoin manages to maintain above significant demand zones, the much-awaited milestone of $100,000 could be reached swiftly.

Maartunn, an analyst at CryptoQuant, has disclosed that American investors’ strong interest is a significant factor fueling this market surge. His analysis indicates that the Coinbase Premium Gap, which measures the price disparity between Bitcoin on Coinbase and other international exchanges, currently stands at approximately $224.

The elevated cost associated with this positive investment reflects a substantial contribution from American transactions driving the present market’s upward trend. A premium at such a level implies that Coinbase investors are eager to pay more than usual, which is a robust sign of increased interest and demand.

Keeping a close eye on its progress, Bitcoin’s persistence in moving upwards depends on consistently staying above crucial support points. The significant resistance at $100,000 continues to be tough, but the persistent interest from American investors suggests further robustness in the near future. With such robust foundations, several analysts anticipate that Bitcoin will experience another powerful surge as soon as the $100,000 threshold is confidently surpassed.

BTC Rally Is Only Starting

As a crypto investor, I’m currently observing Bitcoin trading at approximately $98,800 following an unsuccessful push beyond the much-hyped $100,000 threshold. However, this brief hiccup doesn’t seem to have dampened the overall bullish sentiment, as BTC persists in maintaining its position above crucial support zones, demonstrating its robustness and tenacity within the current market conditions. The fact that it hasn’t retreated to lower prices suggests that the bullish momentum remains unbroken, leaving investors hopeful for a future breakout.

If Bitcoin stays above the significant support of $95,000, it becomes more probable that it will break through the $100,000 psychological mark. Keeping above this level suggests strong demand and possible future gains, suggesting Bitcoin could continue its bullish trend in the short term.

If Bitcoin doesn’t sustain its position above $95,000, a drop to areas with less buyer interest might signal a temporary decrease. This decline could offer the required momentum for the next surge, as it would enable the market to gather strength before another push towards breaking the $100,000 threshold.

Currently, everyone is watching closely as Bitcoin tries to hold onto its crucial support points, with the market eagerly waiting for the next significant shift during this remarkable uptrend.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-11-24 11:46