In Q1 2024, Bitcoin (BTC) put on a strong showing, according to a recent analysis by Messari, a leading provider of market intelligence for the crypto industry. The report pinpoints several reasons behind Bitcoin‘s price growth, its expanding market leadership, and the emergence of fresh trends in the bitcoin market.

Inscription Activities Drive Bitcoin Fees Up

In Q1 2024, the report reveals that Bitcoin’s price underwent a substantial growth, climbing 68.78% compared to the previous quarter, ultimately reaching a new record high of $73,100.

In March 2024, the price hike caused Bitcoin’s market value to account for 49.7% of the total crypto market capitalization. Remarkably, according to the research, this degree of dominance is customary at the onset of a new halving cycle, during which Bitcoin typically takes the lead among cryptocurrencies.

In the fourth quarter of 2023, there was a significant increase in fees due to inscription activities, amounting to a 699.4% jump from the previous quarter. Conversely, subscription-related fees saw a decrease of 41.9% in the first quarter of 2024. Although total fees decreased, inscriptions made up nearly 18.4% of Bitcoin’s overall fees during this period, highlighting their ongoing importance.

The quarterly decrease was 15.3% for the average number of daily transactions, while daily active addresses declined by 4.7%. According to the report, this decrease in transaction activity could be due to a reduction in actions from bots or heavy users. This trend corresponds with the decline in inscription-related activities and fees.

The number of inscriptions made on the network saw a notable rise in February 2023, resulting in a significant increase in transactions. While there was a decrease in inscription activity from Q1 2024 compared to the previous quarter, it still represented a substantial growth when compared to the same period the previous year, demonstrating its ongoing influence on the network.

ETFs Amassed 212,000 BTC In Q1

In Q1 2024, Messari noted that programmable layers in the cryptocurrency marketplace expanded significantly. Leading the charge were established layers like Rootstock and Stacks, which held the largest amounts of value secured (TVL). Meanwhile, emerging layers such as BOB and Merlin saw impressive growth.

The quarter-over-quarter growth rate of TVL (Total Value Locked) in 127% was mainly driven by non-Bitcoin assets. The reason being, Bitcoin funds locked in TVL grew more slowly than in Bitcoin’s alternative networks like Lightning and alt-Layer 1 platforms which hold substantial quantities of BTC.

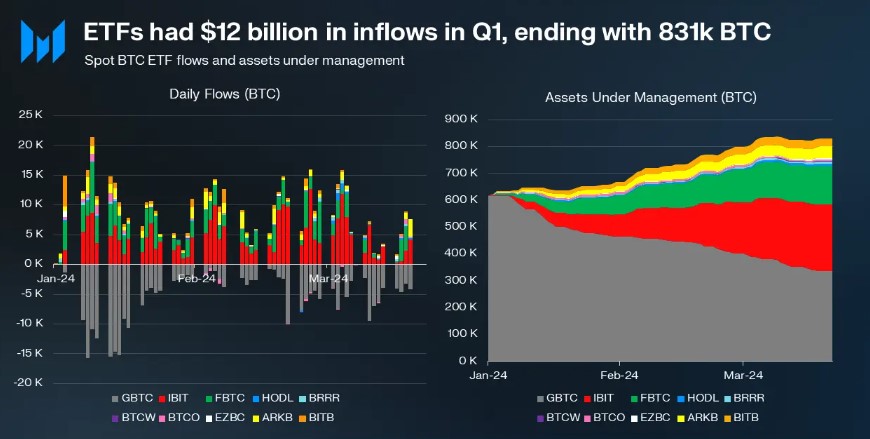

In the end, the green light given to nine Bitcoin ETFs and one ETF conversion signified a major achievement in the recognition of Bitcoin by the US administration and conventional financial institutions (TradFi).

In the initial month, these ETFs attracted approximately $12 billion in new investments. It’s worth mentioning that Bitcoin ETFs held more assets than Silver ETFs. However, Gold ETFs still overshadowed both in terms of managed assets.

In Q1, MicroStrategy, the leading institutional Bitcoin holder, amassed over 215,000 BTC, surpassing the total held by other institutions. Meanwhile, Bitcoin ETFs acquired approximately 212,000 BTC through inflows, underscoring its growing significance within financial markets.

In the first quarter of 2024, Bitcoin stood out with impressive gains, including a substantial price rise and commanding market capitalization, firmly establishing itself as the foremost cryptocurrency.

The eager expectation of a decrease in supply, combined with the achievements of Bitcoin ETFs and the entrance of institutional investors, have significantly boosted Bitcoin’s importance and acceptance within conventional financial markets.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- All Elemental Progenitors in Warframe

- What Happened to Kyle Pitts? NFL Injury Update

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

2024-04-09 06:04