Over the last day, Bitcoin has fallen below the significant $100,000 point and is currently finding it tough to stay above $94,000 following a brief recovery from a recent drop to $91,000.

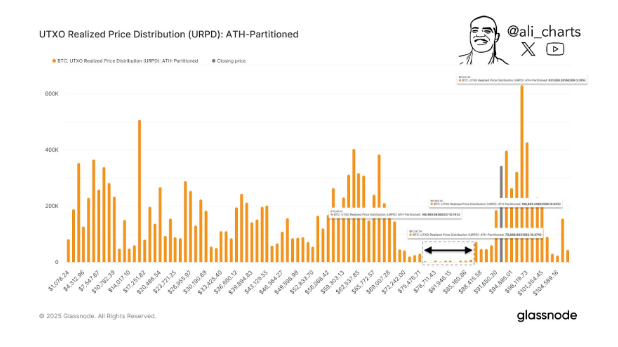

From my perspective as an analyst, I’ve noticed a shift in Bitcoin’s price forecast that carries a note of caution. Crypto expert Ali Martinez has pointed out an empty gap between approximately $87,000 and $75,000 on the chart. This void, identified through the Bitcoin UTXO Realized Price Distribution (URPD) ATH-Partitioned analysis, suggests a scarcity of robust support in this range, potentially setting the stage for a rapid drop towards $75,000.

$12,000 Void Shows Lack Of Support Between $87,000 And $75,000

Data from Bitcoin’s Unspent Transaction Output Realized Price Distribution (URPD) at All-Time High (ATH) segmentation indicates a noticeable absence of significant realized price activity within the range of $87,000 to $75,000. The UTXO serves as a relatively subdued yet crucial technical indicator, offering insights into Bitcoin’s distribution across varying price levels and concentrating on Unspent Transaction Outputs (UTXOs).

In other words, examining Unspent Transaction Outputs (UTXOs) allows us to determine where Bitcoin owners have accumulated profits or incurred losses based on the prices they originally purchased their coins.

According to Ali Martinez’s analysis, the price range from $87,000 down to $75,000 leaves a $12,000 gap that could potentially turn negative for Bitcoin. This is due to this range having “minimal or no support,” which means there isn’t enough past evidence of buying activity to prevent Bitcoin’s price from falling if it enters this area. Consequently, this empty space increases the likelihood of a significant drop should Bitcoin dip below the upper limit.

Market Implications Of The $12,000 Void

If Bitcoin falls below its current price of $87,000, the potential risk of a $12,000 loss would materialize. However, despite recent corrections since November, Bitcoin has generally maintained prices above $90,000. The latest dip to $91,000 could pave the way for further drops below this mark. This risk is heightened by the Crypto Fear and Greed Index moving towards a neutral zone and an increase in negative sentiment about Bitcoin on social media.

If Bitcoin falls below $90,000, it might trigger a downward trend towards approximately $87,000. Such a move could potentially accelerate and take the price to around $75,000. This potential development would challenge the confidence of investors in the bullish outlook for Bitcoin and its long-term predictions of an upward trajectory.

Instead of saying “On the other hand,” you could say “Alternatively.” Alternatively, it can be strongly suggested that the continuous unification provides a chance to amass more BTC. As per an analyst on CryptoQuant, the immediate SOPR indicator is presently less than 1, indicating that many brief-term Bitcoin investors are offloading the cryptocurrency at a loss. However, history demonstrates this situation frequently precedes a significant uptrend, suggesting it could be a favorable period for hoarding.

At the time of writing, Bitcoin is trading at $94,350.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-01-11 17:11