As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull runs and bear markets, and I must say that the current Bitcoin price action is reminiscent of some of the most exciting moments I’ve seen in my career. Tony Severino’s analysis resonates with me, as he has a proven track record of making insightful predictions about the cryptocurrency market.

On November 6, the price of Bitcoin reached a record peak, soaring beyond $73,700 and reaching an astounding $75,000. In light of this significant increase, renowned cryptocurrency analyst Tony Severino has shared his insights on what we might anticipate next for this leading digital coin.

Bitcoin Price Ready For “Fireworks” After New ATH

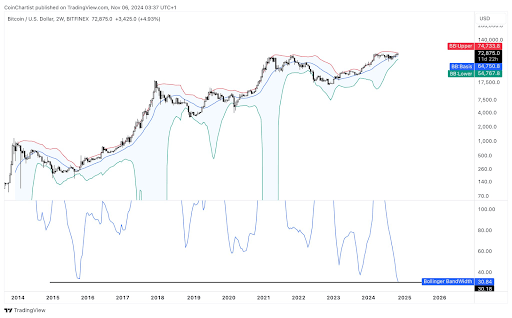

In a recent post on X, Tony Severino predicted that the price of Bitcoin is poised for a spectacular surge, suggesting that fireworks could erupt above $75,000. This crypto expert further noted that Bitcoin was approaching the upper boundary of the 2-week Bollinger Band, with these bands being tighter than they’ve ever been based on BBWidth, indicating potential volatility.

As an analyst, I’ve recently come across a chart indicating a potential increase in Bitcoin’s price, with predictions reaching up to $140,000 by 2025. Previously, Tony Severino hinted that we were nearing the peak of the bull run and elaborated on how this could potentially push Bitcoin’s value to around $133,000, based on past market trends.

It appears that the Bitcoin price is moving towards its most robust phase of growth due to reaching a fresh record high. This recent surge in price to a new peak is largely attributed to Donald Trump’s election as the next U.S. president, as he has expressed his backing for Bitcoin and other digital currencies. Consequently, this endorsement from the incoming U.S. leader creates a positive outlook for Bitcoin and the overall crypto market.

Apart from Trump’s win being significant, it’s also noteworthy that Bitcoin’s price has never dipped below its level on US presidential election days in history. This suggests that the current price range could be the lowest before Bitcoin embarks on another surge in its bull market.

A Fed Rate Cut Is Also On The Way

As a researcher, I’ve been closely observing the Bitcoin market, and I believe there are several factors that could trigger another Bitcoin bull run. Among these, one significant catalyst is the anticipated Fed rate cut, slated for November 7th. Today marks the commencement of the US Federal Reserve’s FOMC meeting, and a decision on this rate cut is expected by tomorrow. This potential reduction in interest rates tends to be favorable for Bitcoin prices.

According to CME Fedwatch data, there’s a 97.6% likelihood that the Federal Reserve will lower interest rates by 0.25%. This increases optimism for Bitcoin’s price because it suggests additional capital could be directed towards its market. Furthermore, institutional investors are holding back their investments, but they may pour more money into Spot Bitcoin Exchange-Traded Funds (ETFs) following the US elections and a Fed rate reduction.

Currently, as I’m typing this, the price of Bitcoin is approximately $74,500, marking an increase of more than 9% within the past day, based on information from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-11-06 17:10