As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I must admit that Bitcoin’s current correction from the $73,500 zone is not entirely unexpected. I have seen this market ebb and flow like the tides, and it seems we are experiencing another wave of volatility.

The price of Bitcoin is adjusting its growth from around $73,500. Currently, Bitcoin has moved beneath the $70,000 mark and exhibiting some indications that suggest a potential downtrend.

- Bitcoin started a fresh decline from the $73,500 zone.

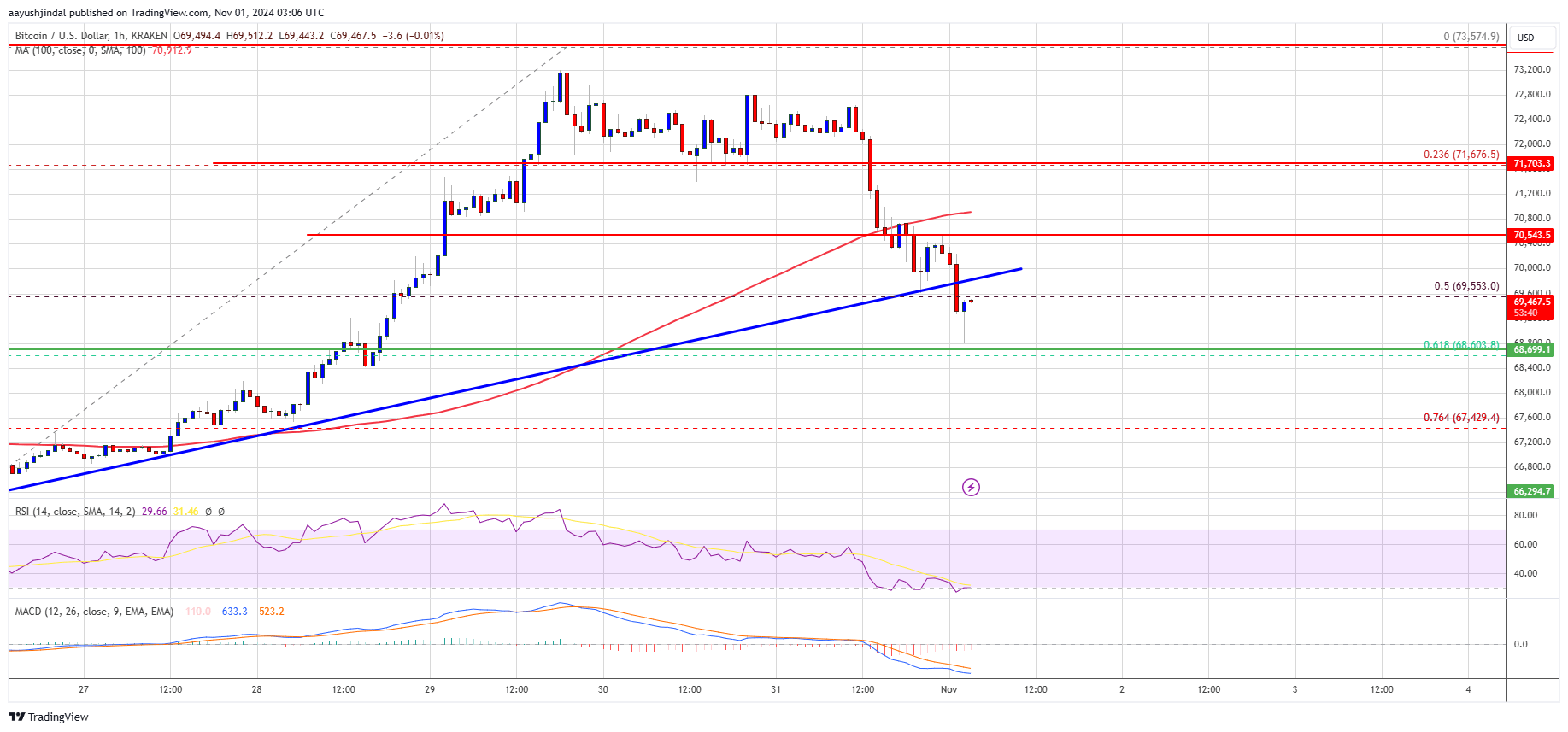

- The price is trading below $71,500 and the 100 hourly Simple moving average.

- There was a break below a key bullish trend line with support at $70,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is showing a few bearish signs and might test the $68,500 support zone.

Bitcoin Price Trims Gains

The price of Bitcoin didn’t manage to reach a new record high and instead began a decline after encountering resistance at approximately $73,500. It dropped below the support levels at $72,500 and $72,000.

The cost dropped beneath the 50% Fibonacci retracement point of the rise from the $65,531 minimum to the $73,575 maximum, and also it broke below a significant bullish trendline with support at $70,000 on the hourly BTC/USD chart. This suggests potential bearish trends in the market.

Bitcoin’s price has dropped more than 5%, dipping below the $70,000 mark and is currently trading beneath its 100-hour Simple Moving Average. It’s moving towards the potential support of around $68,500, which coincides with the 61.8% Fibonacci retracement level from the price range between $65,531 (swing low) and $73,575 (high).

On a positive note, there’s a possibility that the price may encounter obstacles around the $70,000 mark. The initial barrier is approximately at $70,500. If the price surpasses this first hurdle at $70,500, it might push higher. The next potential resistance could be around $71,200.

As an analyst, if the Bitcoin price manages to surpass the $71,200 resistance, it could potentially spark further increases. Should this occur, the price may escalate and challenge the $72,500 resistance threshold. If the upward trend persists, it might propel the price towards the $73,200 resistance level. Under such circumstances, a test of the $73,500 mark might become imminent.

More Downsides In BTC?

If Bitcoin doesn’t manage to break through the barrier at $70,000, it might keep falling instead. The closest support level if that happens would be around $68,800.

As an analyst, I’m noting that the primary resistance I see is around the $68,500 mark. Should we encounter any further declines, the immediate support seems to be nestled within the $67,400 region. If losses persist, it’s possible we could see a drop towards the $66,500 support in the near future.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $68,500, followed by $67,400.

Major Resistance Levels – $70,000, and $71,200.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-01 06:22