As a seasoned researcher who has witnessed Bitcoin’s rollercoaster ride since its inception, I can confidently say that the current trajectory of Bitcoin price is intriguing. The recent surge above $68,000 and consolidation around $69,000 suggests a steady bullish trend.

The cost of Bitcoin climbed beyond the $68,000 barrier and is currently stabilizing, with hopes of further increases surpassing the $69,500 resistance level.

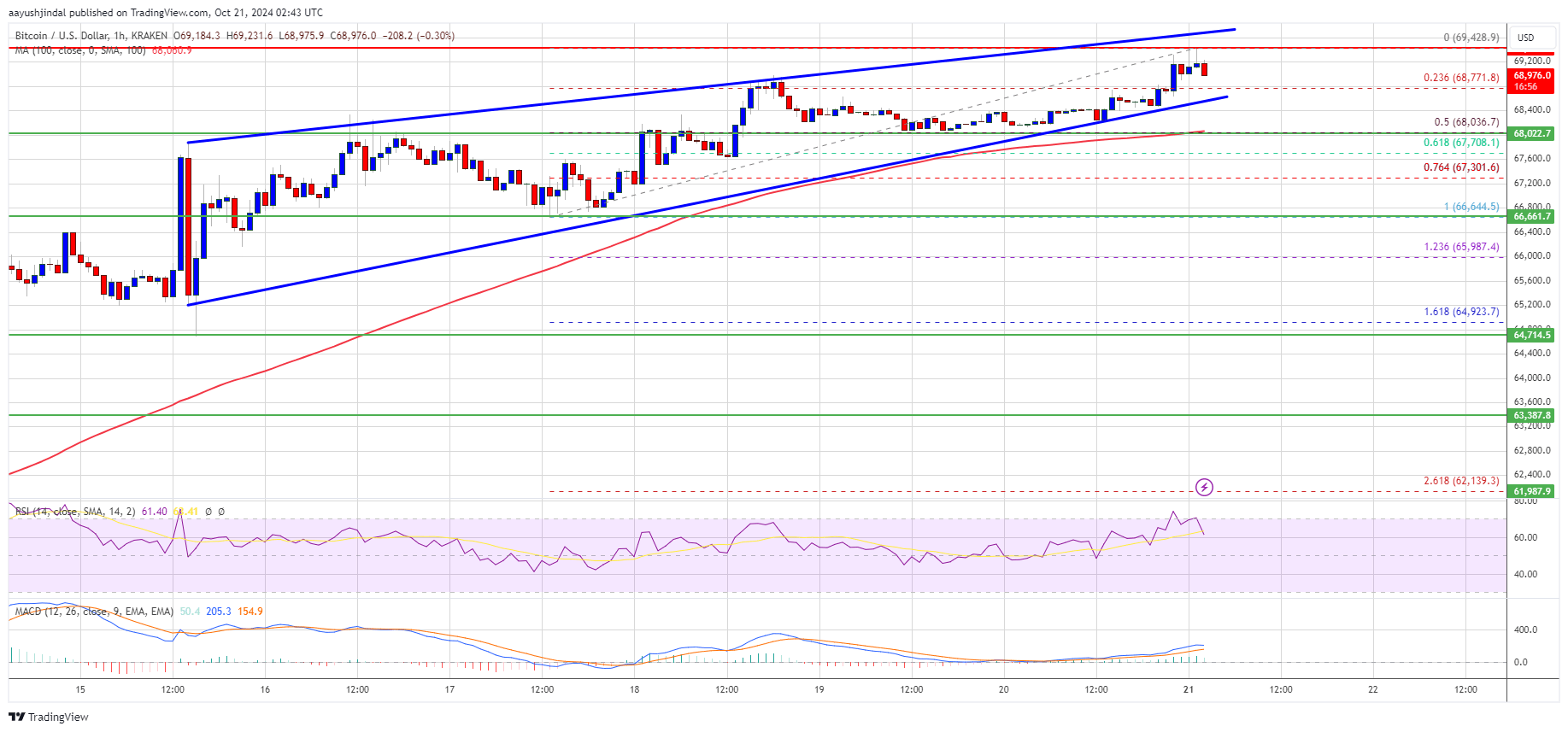

- Bitcoin remained stable and extended gains above the $68,500 zone.

- The price is trading above $68,500 and the 100 hourly Simple moving average.

- There is a key contracting triangle forming with support at $68,750 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could rally further if there is a close above the $69,450 resistance zone.

Bitcoin Price Rises Toward $70,000

Over the past few hours, the value of Bitcoin has been holding steady above the $67,500 mark, demonstrating resilience. Moreover, BTC has shown signs of a minor upward trend, breaking through the resistance at $68,000. Remarkably, the bulls have successfully surpassed the $68,800 level.

The cost surpassed $69,000 and peaked close to $69,428, after which it’s holding steady. There was a brief dip below $69,000, but it has since remained above the 23.6% Fibonacci retracement threshold of the upward trend from the $66,644 minimum to the $69,428 peak.

Currently, the Bitcoin price surpasses $68,200 and aligns with its 100-hour Simple Moving Average. Additionally, a significant contracting triangle pattern is emerging on the hourly chart for the BTC/USD pair, with potential support at approximately $68,750.

On a positive note, there’s a possibility that the price may encounter barriers at approximately $69,200. Initially, a significant barrier lies around $69,500. A decisive break above this barrier might push the price upwards. The next potential resistance could be found at $70,000.

If the price surpasses $70,000, it may trigger additional increases. In this scenario, the price might climb further to challenge the resistance at $71,200. Further growth could potentially push the price up towards the $72,000 resistance point.

Another Decline In BTC?

Should Bitcoin not manage to surpass the $69,500 barrier, it might initiate a new drop. The nearest support can be found around the $68,750 mark, with the trend line of the triangle providing additional support.

Significant resistance can be found around the $68,050 mark, which also coincides with the 50% Fibonacci retracement point of the price increase from its low at $66,644 to its high at $69,428. A secondary support level is now close to the $67,400 area. Further declines could potentially push the price towards the nearby $66,500 support in the short term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $68,750, followed by $68,500.

Major Resistance Levels – $69,500, and $70,000.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

2024-10-21 06:22