As a seasoned crypto investor with a knack for deciphering market trends and a penchant for keeping my fingers on the pulse of the digital currency world, I find myself intrigued by the recent BTC price action. The Federal Reserve Chairman’s speech has indeed sparked a fresh wave of optimism, propelling Bitcoin above the $64,000 mark once more. However, as we approach the $66,250 level, I can’t help but feel a sense of déjà vu – it seems like just yesterday that BTC was flirting with this price point and beyond.

Over the past week, the Bitcoin market trend has been less than exciting, reflecting a similar pattern across the entire cryptocurrency sector. Yet, towards the end of the week, there’s been a surprising surge in Bitcoin prices, which could indicate a positive turnaround.

After Federal Reserve Chair Jerome Powell’s Jackson Hole speech, the value of Bitcoin seems to have been invigorated, once more soaring past $64,000 and climbing approximately 7%. The intriguing aspect here is: How high could the Bitcoin price go next?

Here’s Why $66,250 Is A Crucial Level For BTC

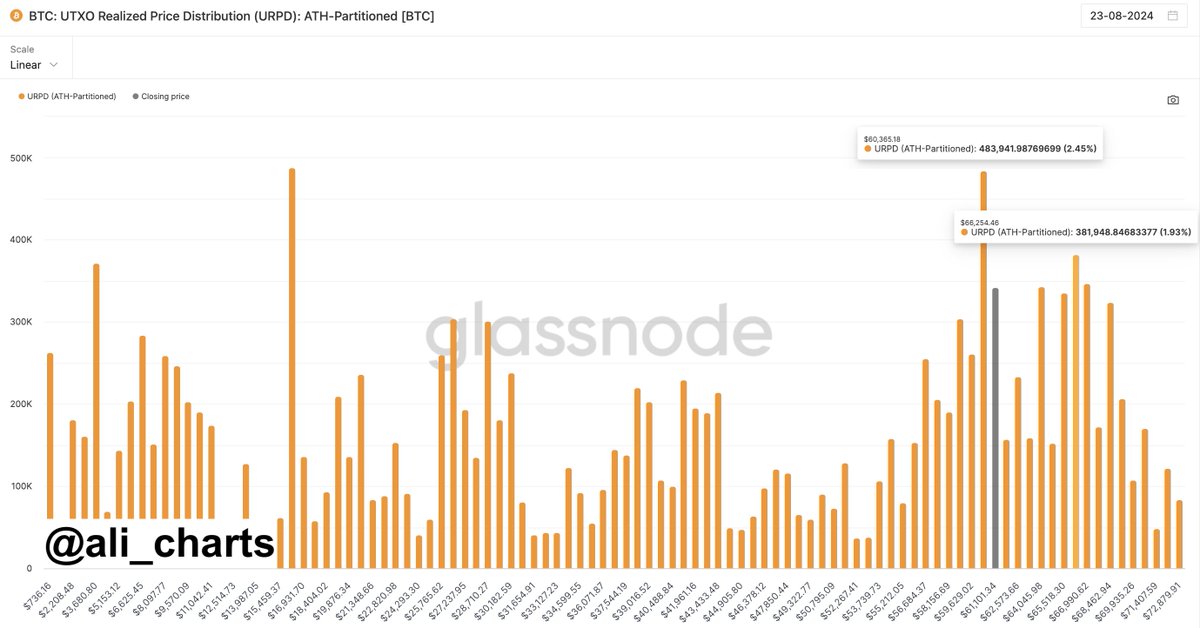

Noted crypto analyst Ali Martinez recently posted on the X platform his prediction for Bitcoin’s price movement in the coming days, utilizing the Glassnode “UTXO Realized Price Distribution” (URPD) metric as a key indicator. This URPD metric tracks how much of a specific cryptocurrency was bought at particular price points.

Generally speaking, the probability of a price level serving as a support or resistance zone in the blockchain is influenced by the number of coins that were initially purchased at that particular price point, including any transaction fees involved. To clarify, an investor’s cost basis represents the original price they paid for a coin or token when it was acquired.

In simpler terms, areas where Bitcoin is trading below its current value and has a lot of buyers tend to provide support, preventing further falls. Conversely, regions above the current Bitcoin price may become resistance points where sellers could halt any potential increase in price. The graph you see illustrates the distribution of Bitcoin prices near the current market rate.

As an analyst, I’ve observed two significant resistance levels on the chart: $64,045 and $66,250. The Bitcoin price seems to have surpassed the former, yet the latter, at $66,250, remains untested. Interestingly, Glassnode data indicates approximately 382,000 coins were moved within that price range, suggesting potential resistance at this level.

The last occasion BTC surpassed the $66,250 threshold, it reached up to approximately $70,000 but then faced some obstacles. It’ll be intriguing to observe how high the price of this leading cryptocurrency might rise now, given that there seems to be no significant barrier above the $66,250 zone based on the URPD indicator.

Bitcoin Price At A Glance

Currently, Bitcoin’s value hovers close to $64,000, signifying a roughly 7% surge over the last day. This substantial daily growth is also evident on the weekly chart, where Bitcoin has risen approximately 10% during the past seven days.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-08-24 12:40