As an experienced analyst, I believe that the current market situation for Bitcoin holders is quite interesting. The long-term holders are now back in profit following the recent price surge, which was to be expected given their historical trend of holding through bear markets and accumulating during bull markets. However, the short-term holders are still facing significant unrealized losses due to their timing in entering the market.

Long-term investors of Bitcoin have regained profits thanks to the latest price increase. On the other hand, many short-term investors are still in the red due to their earlier purchases at higher prices.

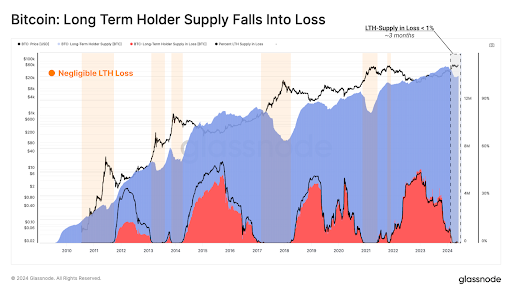

Only 0.03% Of Long-term Bitcoin Holder Supply In Loss

According to a recent market analysis by Glassnode, the quantity of bitcoins held by long-term investors (LTHs) at a loss is insignificant, with just 4,900 BTC or 0.03% of LTH supply being bought above Bitcoin’s current price. These LTHs in loss are believed to be those who purchased at the peak of the 2021 market cycle and have continued holding since then.

As an analyst, I’ve observed that long-term Bitcoin holders currently control over 85% of the total Bitcoin supply, with profits accrued from their investments. According to Glassnode, this outcome was predictable due to the tendency of LTHs to minimize their losses during market euphoria phases, which typically results in a diminishing presence of LTHs holding at a loss. Consequently, as the bull run continues, I anticipate that long-term holders will remain responsible for the majority of the profitable supply.

Investment tokens that have been held for over 155 days are classified within this Long-Term Holder (LTH) supply. It is reasonable to assume that most investors in this group are those who maintained a strong conviction during the previous bear market, unwilling to sell even when Bitcoin dipped below $20,000. During that period, this LTH cohort experienced significant unrealized losses, making up a substantial portion of the overall loss tally.

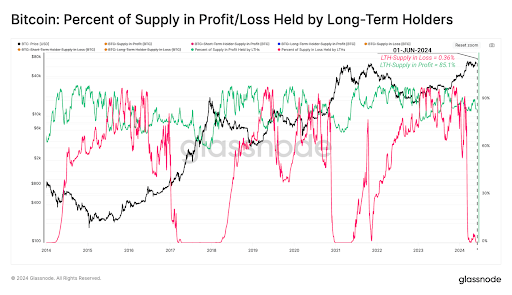

Short-Term Holder Supply Accounts For Most Unrealized Loss

According to Glassnode’s analysis, a significant portion of the current market losses can be attributed to short-term investors. These investors have purchased Bitcoin close to its local and record-high prices, causing them to incur losses each time the cryptocurrency experiences a price correction.

As a crypto investor, I closely monitor data from reliable sources like Glassnode to keep abreast of market trends. According to their latest findings, approximately 1 million Bitcoin (around 26.6% of the 3.35 million BTC representing the STH or “strong hands” supply) are currently in the red. This means that these coins were bought at a higher price than their current market value. Moreover, an astounding 56% or 1.9 million Bitcoin from the STH supply have entered the unrealized loss category following Bitcoin’s recent price correction to around $58,000 per coin.

according to Glassnode, a substantial number of Shib tokens have been amassed near the current market value. This is noteworthy because investors holding these coins might respond differently to price swings, whether upward or downward. A sizable Bitcoin price change could prompt these investors to sell their tokens.

As a crypto investor, I’m always keeping an eye on different groups within the market. According to Glassnode, there’s a category of investors called “Single-Cycle holders.” These investors have held onto a substantial amount of unrealized profits since Bitcoin surpassed the $40,000 mark. They cashed in some of their coins when Bitcoin reached its previous all-time high ($73,000) in March and are expected to sell more as Bitcoin approaches another new record price.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-06-07 00:04