As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed the rise and fall of countless assets, from the dot-com bubble to the 2008 global financial crisis. In my professional journey, I’ve seen gold maintain its luster through turbulent times, while Bitcoin has shown impressive growth but with significant volatility.

Based on Goldman Sachs’ analysis, the increase in Bitcoin‘s price in 2024 did not adequately balance out its high price fluctuations. Conversely, gold demonstrated stronger risk-controlled gains, further supporting its status as a “safe asset.

Despite The Gains, Bitcoin Fails To Outshine Gold

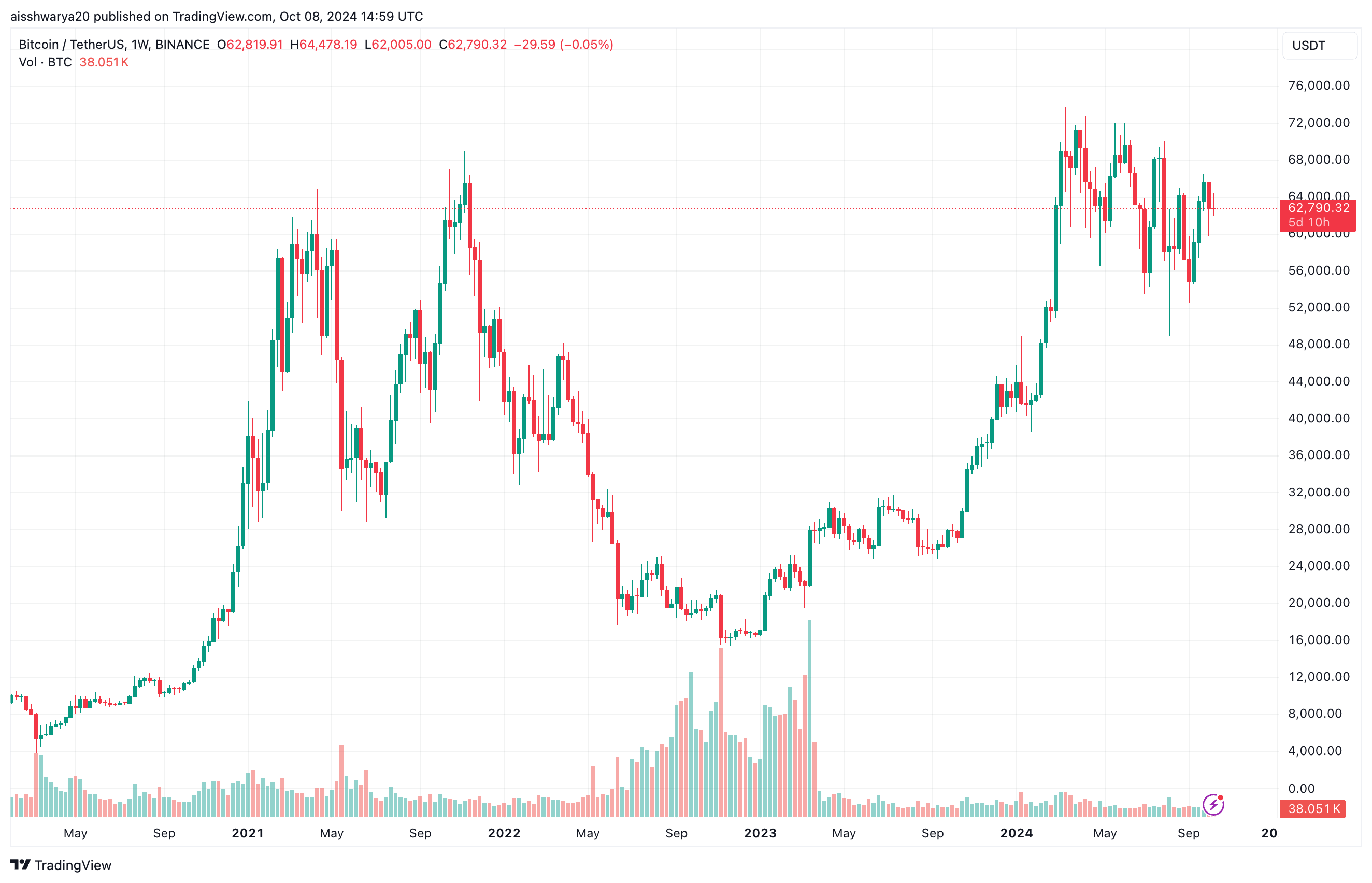

Throughout the year, starting at around $42,000, the most valued digital currency by market capitalization has soared to a peak of approximately $73,000 in March 2024, marking an impressive increase of over 73%. At this moment, Bitcoin’s (BTC) market price stands at about $62,790, still representing more than 40% growth compared to its value from January 2024.

Remarkably, throughout the year 2024, Bitcoin has shown a consistent pattern of surpassing significant stock markets, bonds, gold, and oil prices.

Yet, as per the data monitored by Goldman Sachs, Bitcoin’s significant increases don’t manage to offset its volatility when considering its price performance on an absolute scale.

Goldman Sachs’ examination shows Bitcoin’s year-to-date volatility is nearly 2%, while gold provided a risk-mitigated return of 3%. In a more straightforward manner, this means that Bitcoin has been less stable compared to gold, but gold managed to yield a higher percentage increase of 28% overall.

For beginners, the volatility ratio quantifies the return an investment gives in relation to its level of risk or fluctuation. A larger ratio means the asset offers superior returns compared to the risk assumed, whereas a smaller ratio implies less optimal results.

According to the analysis, Bitcoin’s volatility was lower compared to Ethereum‘s native ETH token, the S&P GSCI Energy Index, and Japan’s TOPIX index in terms of growth-sensitive investments that do not involve fixed income.

The relatively stable nature of Bitcoin versus Gold, as shown during recent events like Iran’s attack on Israel where Bitcoin dropped while Gold rose, reinforces Gold’s reputation as a “safe haven asset.

Still A Long Way To Go For Bitcoin

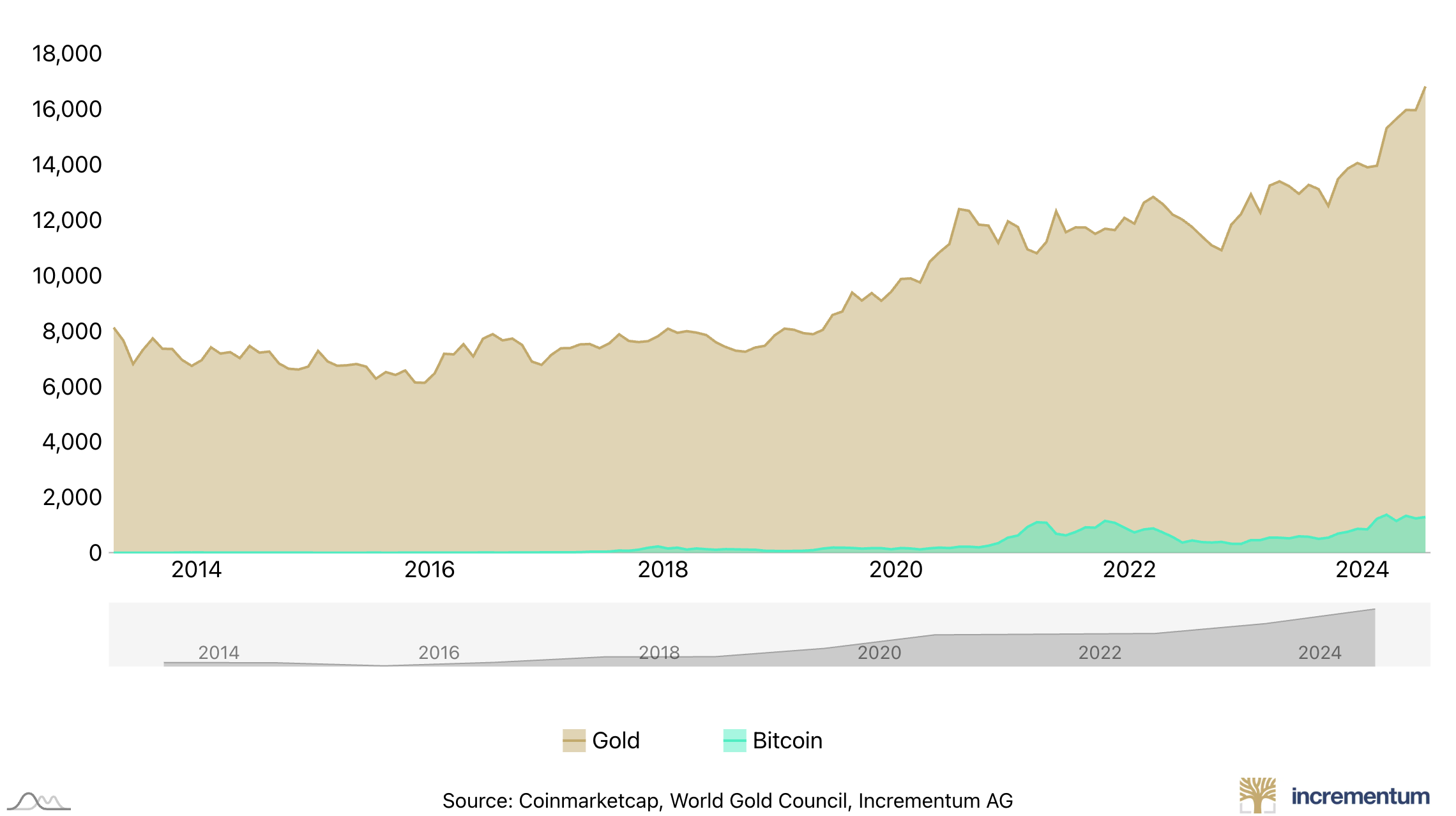

Starting from the aftermath of the 2008 financial crisis, Bitcoin’s climb towards becoming a one trillion dollar market capitalization asset is truly astounding.

The fixed supply of 21 million, decentralized network architecture, and halving every four years make BTC an appealing asset. However, the market cap gap between Bitcoin and gold remains vast.

In essence, numerous cryptocurrency experts believe that Bitcoin’s value will surpass that of gold in the forthcoming years. For example, experienced analyst Peter Brandt has dared to forecast that by the year 2025, Bitcoin’s price could potentially increase by a staggering 400% compared to gold.

By the year 2024, in August specifically, VanEck’s CEO, Jan van Eck, predicted that the price of Bitcoin might reach an astounding $350,000 due to increased adoption.

Lately, the investment management company BlackRock has labeled Bitcoin as an “alternative to gold” because of its limited supply and growing trust among investors that it can combat inflation and preserve value during turbulent economic periods.

Contrary to some beliefs, I, as a crypto investor, acknowledge the views of billionaire Ray Dalio on the Bitcoin vs. gold debate. He believes that Bitcoin will not entirely supplant gold. At this moment, the value of BTC stands at $62,790, marking a 2.3% decrease over the past 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-09 14:10