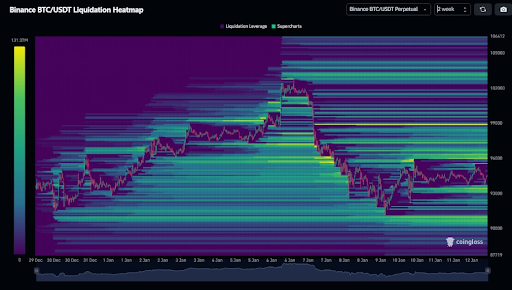

For the past week, Bitcoin‘s price has mainly hovered near the $94,000 level, showing potential for movement in either direction. As per a cryptocurrency expert, the recent fluctuations in Bitcoin’s value have resulted in the formation of liquidity pockets between approximately $86,000 and $104,000. This situation suggests an equal chance of Bitcoin rising to $104,000 or falling to $86,000 from its current price.

Massive Liquidity Blocks In Both Directions

In simpler terms, Bitcoin’s price stability hasn’t provided much insight into its future direction, and this is also reflected in the liquidation heatmap. As noted by cryptocurrency analyst Kevin (@Kev_Capital_TA), this heatmap shows large blocks of liquidations ranging from $86,000 to $90,000, extending up to $104,000.

Based on expert analysis, these large sale blocks could lead to Bitcoin’s price fluctuating between approximately $86,000 and $104,000 throughout the month, with an overall trending up and down. However, falling to $86,000 might significantly impact Bitcoin’s value, potentially causing it to drop further to around $75,000. The all-time high (ATH) partition of the Bitcoin UTXO Realized Price Distribution suggests a gap in support below this price level, at about $12,000.

The predicted trajectory for Bitcoin’s price suggests it may continue fluctuating within the range of approximately $86,000 to $104,000. If Bitcoin manages to surpass $108,000, it would break its current peak and set new record highs, potentially establishing a stronger and more enduring bullish trend.

The analyst underscores the significance of tracking US Dollar Tether (USDT) influence, which is at about 3.7%. Kevin contends that understanding the clear division of USDT influence is crucial for a more secure and optimistic market scenario. Conversely, when USDT dominance decreases, investors tend to swap their stablecoins into Bitcoin and other digital currencies.

Logical Approach To The Liquidation Blocks

Kevin suggested paying close attention to market fluctuations, especially during the anticipated volatile swings. This strategy is particularly useful for active traders focusing on ongoing transactions and current market dynamics.

From a different perspective, traders who’ve held onto their investments since the lowest points of the bear market might find it less challenging to navigate the present market turbulence. This is because the overall optimistic forecast suggests that prices could continue to rise until at least 2025.

Currently, Bitcoin is being exchanged for approximately $94,050, representing a minor decrease of 0.5% over the past day. Additionally, its value has dipped by 5.46% during the same period.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Overwatch 2 Season 17 start date and time

2025-01-13 14:10