As a seasoned researcher who has witnessed the crypto market’s volatile yet fascinating journey since its inception, I can confidently say that Bitcoin’s latest surge to an all-time high ($93,435) is a testament to its resilience and potential. The price consolidation near $90,000 indicates a temporary pause rather than a sign of weakness.

The cost of Bitcoin has climbed past $90,000 and is currently holding steady. There’s a possibility that it may try to rise further in the short term as it hovers around this level.

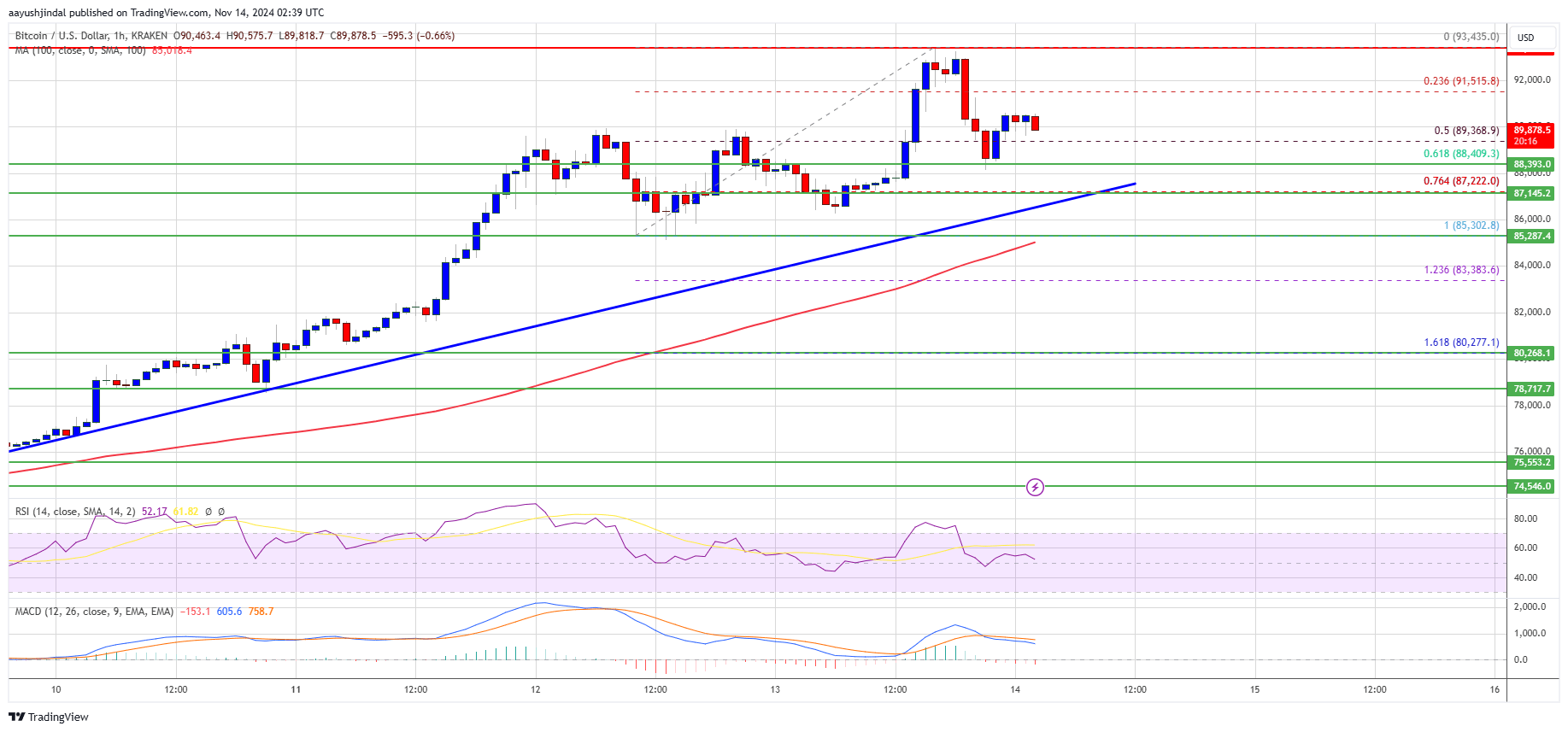

- Bitcoin extended its increase and traded above the $92,000 zone.

- The price is trading above $87,500 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $87,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it stays above the $85,400 zone.

Bitcoin Price Sets Another ATH

The cost of one Bitcoin has begun a new surge, surpassing the $88,000 mark. Having broken through the $90,000 barrier, Bitcoin reached an unprecedented peak before stabilizing. It peaked at $93,435 and is now holding its recent gains.

The price dropped briefly below $91,500 and fell short of the 50% Fibonacci retracement level following its upward swing from $85,302 to $93,435. Yet, bulls remain vigilant near the $88,500 support area.

Currently, Bitcoin’s price is surpassing $87,500 and aligning with its 100-hour Simple Moving Average. Additionally, a significant bullish trend line is shaping up, offering support at approximately $87,200 on the hourly BTC/USD chart. This trend line is near the 76.4% Fibonacci retracement level stemming from the price drop from $85,302 low to the $93,435 high.

On the upside, the price could face resistance near the $90,500 level. The first key resistance is near the $91,200 level. A clear move above the $91,200 resistance might send the price higher. The next key resistance could be $93,500. A close above the $93,500 resistance might initiate more gains. In the stated case, the price could rise and test the $95,000 resistance level. Any more gains might send the price toward the $100,000 resistance level.

More Downsides In BTC?

If Bitcoin fails to rise above the $90,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $88,400 level.

The first major support is near the $87,200 level or the trend line. The next support is now near the $85,400 zone. Any more losses might send the price toward the $82,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 80 level.

Major Support Levels – $88,400, followed by $87,200.

Major Resistance Levels – $90,500, and $91,200.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-14 06:04