As a seasoned analyst with over two decades of experience in financial markets under my belt, I’ve witnessed my fair share of market fluctuations and trends. However, the current Bitcoin rally is one that stands out, not just for its magnitude but also for the diverse factors driving it.

Today, Bitcoin‘s value soared above $71,000. Over the past five days, its price has risen by over 8.5%, moving from $65,600 to a peak of $71,118 on October 29. In just the last 24 hours, BTC‘s value has gone up by 3.8%. This upward trend can be linked to four significant factors:

#1 Bitcoin ETFs Attract Massive Inflows

It appears that the recent increase in Bitcoin’s value is strongly associated with substantial investments into Bitcoin-focused Exchange-Traded Funds (ETFs). Yesterday saw a massive influx of funds totaling approximately $479.4 million. BlackRock was the major contributor with an investment of $315.2 million, followed by Fidelity with $44.1 million, Ark Investments with $59.8 million, and Bitwise Asset Management with $38.7 million. These sizable investments occurred around the same time as Bitcoin’s price climbed from around $68,000 to over $71,000.

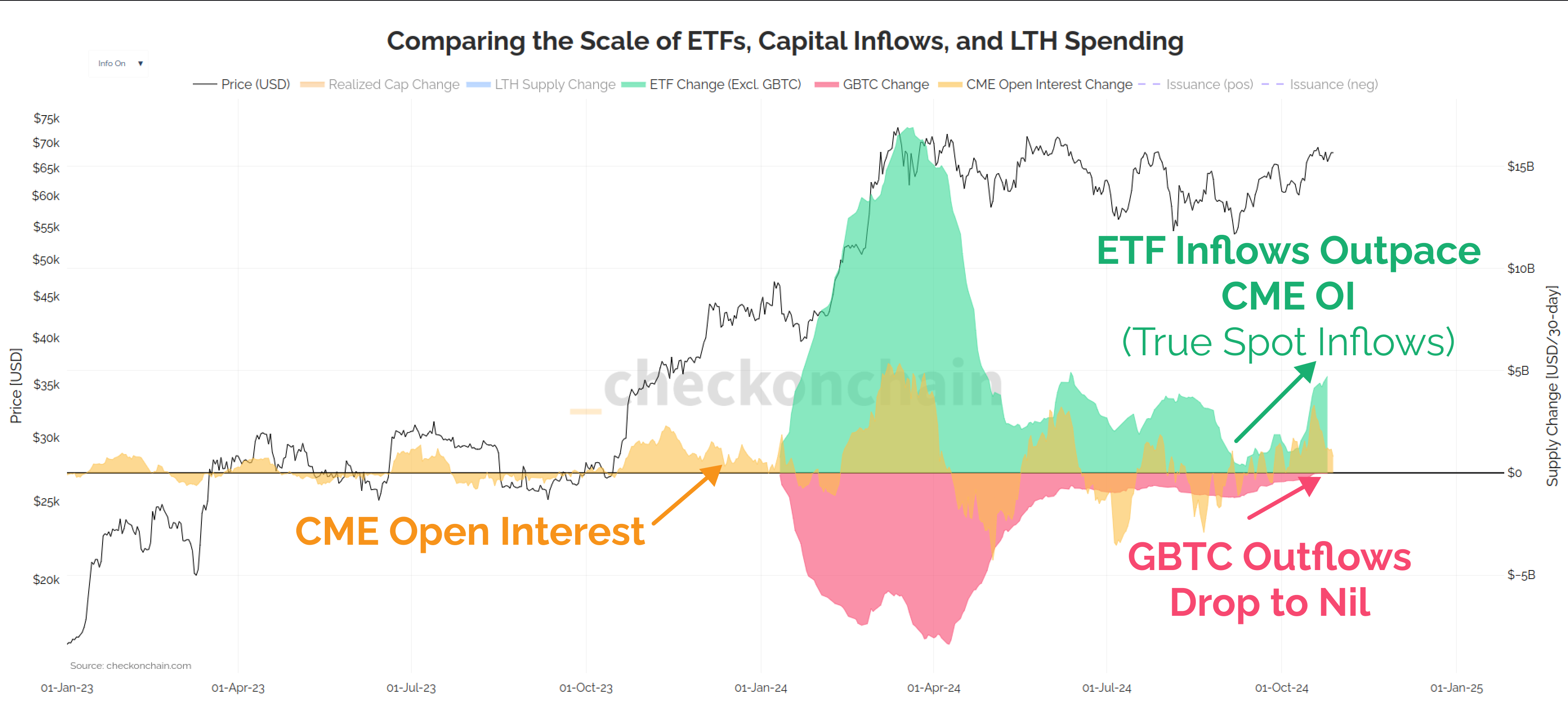

James “Checkmate” Check, a well-known on-chain analyst, pointed out a discrepancy between Bitcoin ETF investments and CME futures activity. He observed that while ETF investments are significantly increasing, the rise in CME Open Interest isn’t as substantial. Additionally, outflows from GBTC are minimal. In essence, he suggested that the current trend appears to be driven more by genuine ETF investments rather than cash-and-carry transactions.

As a crypto investor, I’ve noticed a shift in preference – it seems investors are opting for a more straightforward approach to Bitcoin investment by choosing Exchange-Traded Funds (ETFs) directly, rather than engaging in cash and carry trades involving futures contracts. The cash and carry strategy, when applied to US spot Bitcoin ETFs and CME futures, essentially means buying the ETF (which mirrors the spot price of Bitcoin) while simultaneously selling, or shorting, Bitcoin futures on the CME.

As a researcher, I’m focusing on a strategy that leverages the gap between future prices and current market prices, often referred to as contango. This strategy is particularly useful when futures are trading at a premium to spot prices. The growing trend towards Exchange Traded Funds (ETFs) suggests a positive outlook among investors, as they seem to be betting on future price increases.

#2 The “Trump Trade”

As an analyst, I find that political events are playing a significant role in the recent surge of Bitcoin’s value. Specifically, the interview between former President Donald Trump and Joe Rogan on the podcast has garnered over 32 million views, which has noticeably increased Trump’s Polymarket odds to above 66%. Despite Bitcoin being referred to as the “Trump Trade,” it appears that the speculation surrounding a potential Trump election victory is contributing to the upward trend in Bitcoin’s price.

As a researcher, I’ve observed that Bitcoin has only seen an 8% increase this October compared to the average of 21% in previous years. This suggests that if current levels persist, October 2021 could potentially rank as one of Bitcoin’s fourth-worst performances over the past decade. However, with total Bitcoin perpetual futures open interest across exchanges reaching $27 billion – nearing this year’s peak – a break above the $70,000 mark might trigger new record highs, especially given the growing number of leveraged long positions involved.

#3 Shorts Squeeze Amplifies Price Surge

Recent market data suggests a substantial increase in long positions (or “short squeeze”) may have played a significant role in the recent surge of Bitcoin’s price. According to Coinglass, over the past day, approximately 65,622 traders were forced out of their positions, collectively resulting in liquidations worth around $228.51 million across all cryptocurrencies. A large portion of these liquidations, around $169.47 million, were from short positions. In the case of Bitcoin alone, around $83.61 million in short positions were liquidated. The single largest liquidation order took place on Binance‘s BTCUSDT pair, worth approximately $18 million.

A significant reduction in short positions indicates that numerous traders anticipated a decrease in price, but were compelled to exit their trades because the market shifted in the opposite direction. This rapid closure of short positions often sparks a chain reaction where traders repurchase securities to safeguard their investments, which can intensify upward trends in the market.

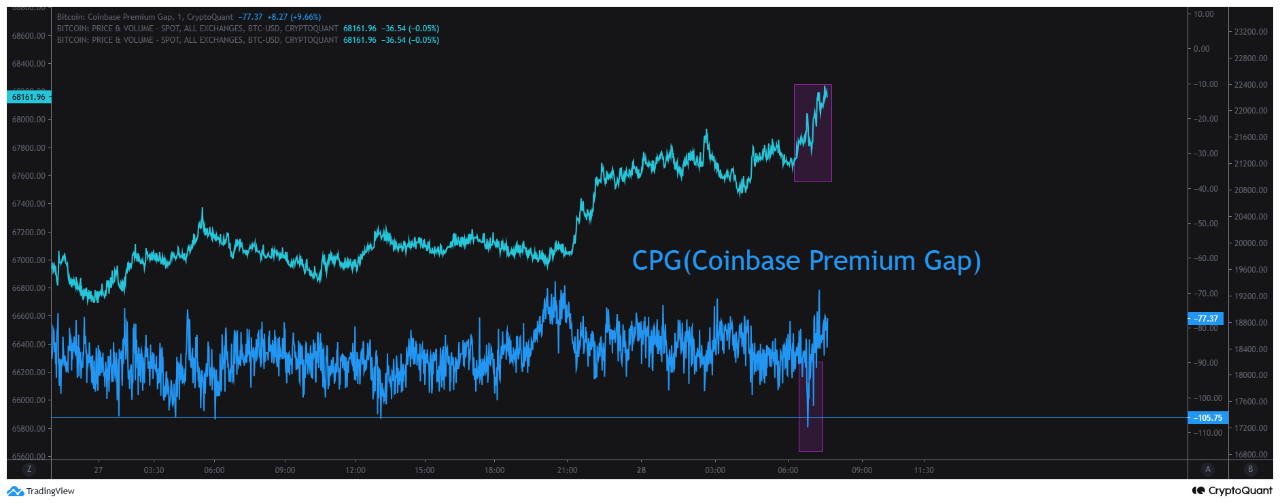

As an analyst, I’ve noticed a significant influence of large-scale investors, or “whales,” in the current market surge. Specifically, Bitcoin’s rally appears to be fueled by increased activity on the Binance exchange. Two weeks ago during Asian trading hours, these whales significantly entered the market on Binance, and the recent decrease in the Coinbase Premium Gap (CPG) combined with price increases is a clear indication of their intervention.

Mignolet clarified that this situation doesn’t indicate a drop in U.S. interest, but rather an increased purchasing power from Binance. Over the last fortnight, there has been a significant increase in demand for U.S.-based Bitcoin spot ETFs, with roughly 47,000 Bitcoins flowing in. Since many ETF products rely on Coinbase, fluctuations in CPG data are closely linked to ETF demand. In summary, Mignolet suggested that the current Bitcoin price is being influenced by “whales” from Binance, as there has been consistent influx of U.S. investment.

At press time, BTC traded at $71,340.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-10-29 19:35