As a seasoned researcher with over two decades of experience in financial markets, I find myself intrigued by this fascinating interplay between traditional and digital assets. The Bitcoin market is indeed showing some interesting patterns, with the MVRV ratio dipping below its 365-day moving average, a signal often associated with potential market bottoms.

Lately, the cryptocurrency market has experienced some rollercoaster rides, particularly with Bitcoin undergoing numerous price swings. As per a recent analysis by ‘CryptoSeason’ on CryptoQuant, the Bitcoin Market Value to Realized Value (MVRV) ratio has fallen beneath its 1-year moving average.

In simpler terms, this particular signal frequently points out possible turning points in the market where a downturn might end and a rebound may start. A decrease in the MVRV ratio may hint at a chance for long-term investors, but the expert advises exercising care.

Bitcoin Will Recover If Its MVRV Does This

In the realm of cryptocurrencies, the Market Value to Realized Value (MVRV) ratio serves as a tool for evaluating whether a digital asset, such as Bitcoin, appears overpriced or underpriced in comparison to its “actual worth.

In simpler terms, Market Value is the product of an asset’s current price and the total amount currently in circulation. This is equivalent to calculating its market capitalization.

The Realized Value is determined by adding up the worth of every coin based on the price at which it was last transferred within the blockchain system, thus providing an overview of how much network participants spent on their assets.

As per Mevsimi’s analysis, historically, when the Bitcoin MVRV ratio surpasses its 365-day average, it typically triggers increased optimism within the market. This phenomenon is often indicative of a “longer lasting uptrend” becoming imminent.

Given the present economic landscape, which is characterized by persistent economic uncertainties, it seems that Bitcoin’s recovery might take more time.

In the meantime, the analyst advises investors to maintain a balanced outlook, noting:

Therefore, maintaining a measured and balanced perspective is essential. A positive outlook is understandable, but it should be tempered with awareness of the broader risks until the MVRV ratio confirms a more sustained upward momentum.

Buy Signal Identified In BTC

At present, while the MVRV ratio indicates certain challenges, Bitcoin’s price appears to be bouncing back as we speak. Earlier today, it dipped below $58,000 but has since changed course, climbing 1.2% and currently standing at $58,463.

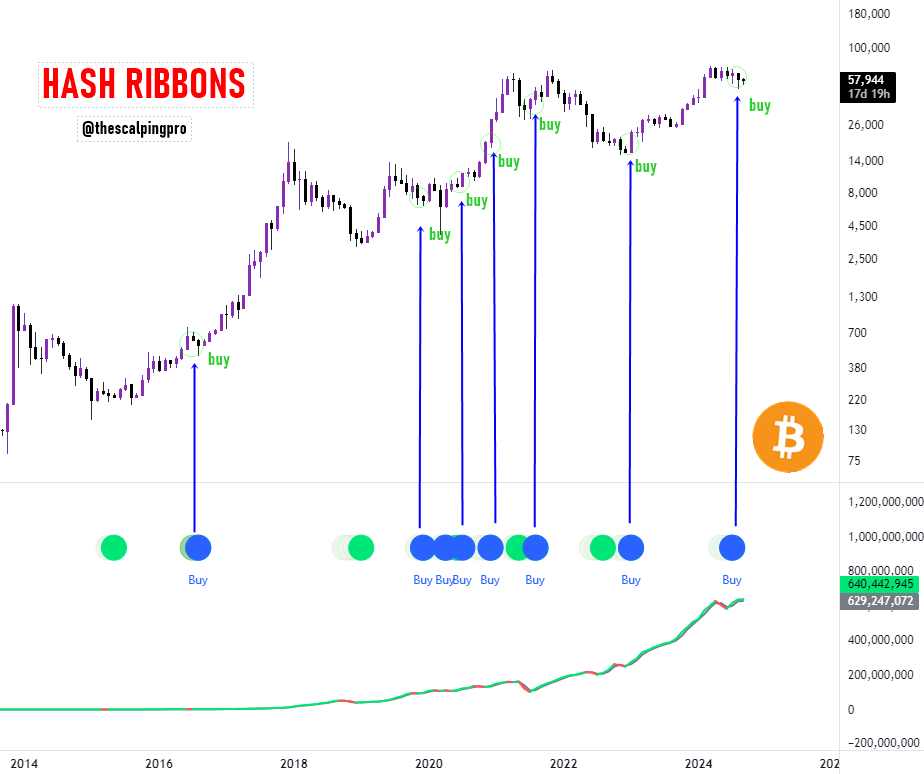

crypto expert Maggs recently emphasized on platform X that a significant bullish sign was apparent: the Bitcoin Hash Ribbon. In Maggs’ opinion, this specific indicator often considered highly dependable in predicting Bitcoin’s price fluctuations, has triggered a buy signal.

Mags mentioned that every time this signal appeared, it was followed by a significant price surge, giving traders reason to believe that Bitcoin could see a bullish breakout soon.

#Bitcoin – hash ribbon flashed a buy signal.

Historically, this has been one of the most reliable indicators for Bitcoin.

Every time we’ve seen this signal, it’s often followed by a massive pump in BTC!

— Mags (@thescalpingpro) September 13, 2024

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-14 11:28