As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. However, the current bull run in Bitcoin is unlike anything I have ever seen before. The rapid surge in its price and the increasing institutional interest are truly remarkable.

Bitcoin’s current price of $104,198 has surpassed its previous record high, pushing the overall crypto market cap to a new all-time high of $3.67T. With increased buying pressure over the weekends, the bullish sentiment is building up, suggesting potential entry into unprecedented price territories.

During this ongoing recovery phase, altcoins are picking up pace. Notably, Ethereum is soaring past $3,926, and its 24-hour volatility stands at a modest 1.3%. With a market cap of $473.29 billion and a trading volume of $32.71 billion in the last 24 hours, Ethereum’s price is closing in on exceeding the $4,000 mark. Meanwhile, as optimism in Bitcoin continues to build, the price difference between Bitcoin and Gold is widening.

Bitcoin Is Now Worth ~40 Oz of Gold

Reaching a historic high, Bitcoin’s value surpasses a fresh record. Notably, this has caused the Bitcoin-to-gold ratio to spike as well. In a notable development underscoring Bitcoin’s growing influence, the ratio currently stands at 40.04, implying that approximately 40 ounces of gold are needed to acquire a single Bitcoin.

In a recent tweet, Peter Dant, an independent and well-known chart trader, highlighted the new all-time high for the Bitcoin-to-gold ratio. The massive rally and incredible short-term surge have registered a price jump of more than 10% over the past five days.

According to Peter Brandt’s chart analysis, an inverted head-and-shoulder pattern has been observed in the Bitcoin-to-gold ratio, predicting a potential value of approximately 89.33 for this ratio. In simpler terms, if his prediction holds true, one Bitcoin could be equivalent to around 89 ounces of gold in the foreseeable future, indicating Bitcoin’s increasing significance relative to traditional assets.

Bitcoin ETFs to Surpass Gold amid US BTC Reserve Chances

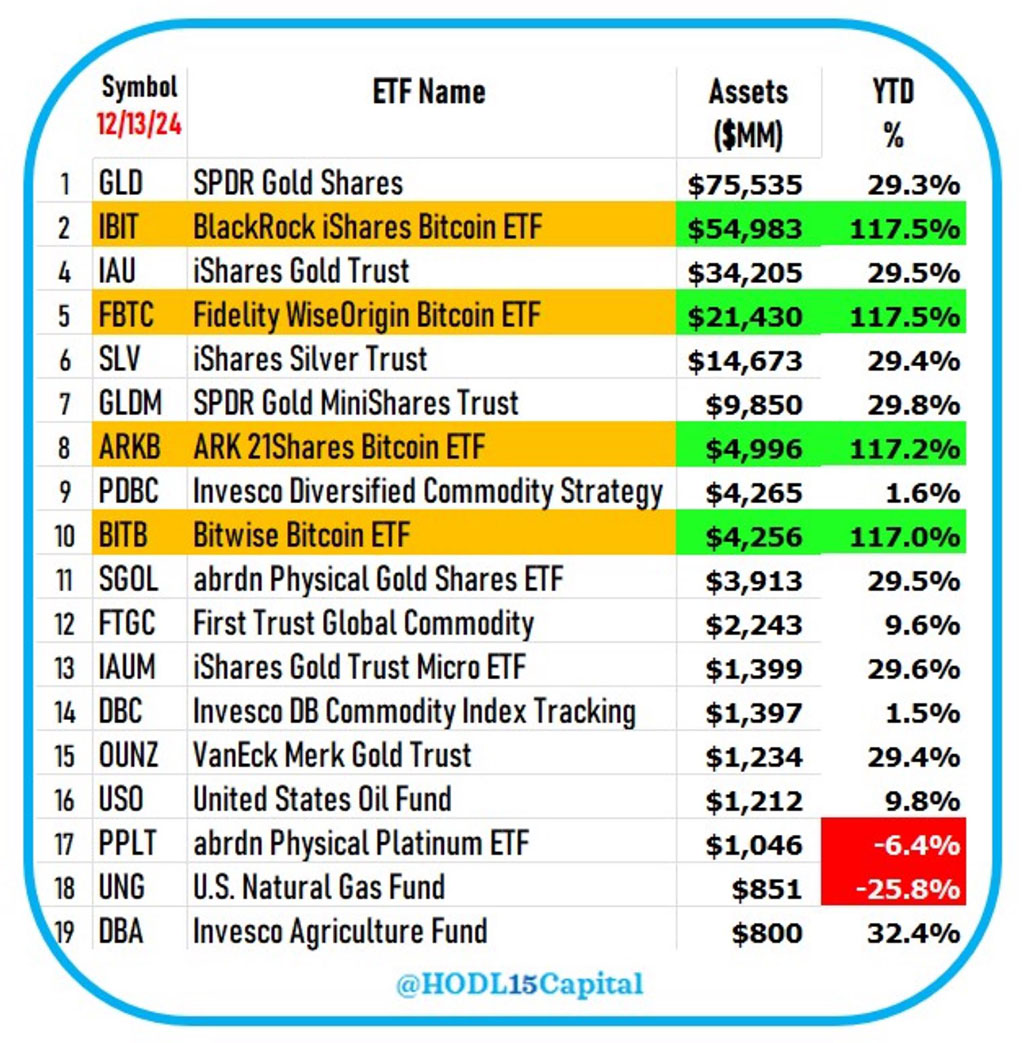

In a recent tweet, HODL 15 Capital shared that BlackRock’s iShares Bitcoin ETF (IBIT) has become the second-best-performing US ETF. This milestone further validates the institutional interest in Bitcoin as an asset class.

Managing a staggering $54.983 billion in assets, IBIT now leads iShares Gold Trust with its $34.205 billion under management. Only slightly behind SPDR Gold Shares (GLD) and its $75.535 billion, IBIT has experienced an impressive 117.5% growth this year, demonstrating the increasing preference for Bitcoin over conventional gold-backed ETFs.

The total net assets under the 12 US spot BTC ETFs have reached $114.97B, with a weekly net inflow of $2.17B. This continuous inflow highlights the increasing confidence in BTC ETFs among institutional investors.

In a recent interview on CNBC, ex-President Donald Trump revealed his intentions to establish a strategic Bitcoin reserve, likening it to America’s oil reserve system. He explained that he aims to do this in much the same way as the U.S. maintains its Strategic Petroleum Reserve.

We aim to achieve remarkable things with cryptocurrency, as we don’t want to fall behind nations like China in this innovative field.

This comes as part of a broader initiative to position Bitcoin as a strategic asset.

Bitcoin Channel Breakout Targets $108K

The pattern on Bitcoin’s 4-hour chart suggests a steady increase within an upward channel. However, there’s been a bearish turn at the upper trendline, making it challenging for Bitcoin’s price to continue its upward surge.

At present, the Bitcoin price has formed a four-hour bearish candle following nine straight bullish ones. However, the persistent uptrend suggested by the Moving Average Convergence Divergence (MACD) and its signal line indicates an underlying resilience.

Additionally, if exchange-traded funds (ETFs) continue to provide backing, it might prolong the upward trend. If this happens, a surge in prices could potentially reach the significant resistance point at $108,301 – the R1 pivot level. Conversely, the robust support at $101,275 is holding firm.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-16 14:48