As someone who has closely followed and invested in Bitcoin since its early days, I find the predictions for its future fascinating yet cautiously optimistic. The potential for Bitcoin to reach $1 million by 2025 is indeed intriguing, especially considering its meteoric rise over the past decade.

At present, Bitcoin stands at an impressive value of approximately $72,400, commanding a market capitalization of around $1.33 trillion. This recent surge represents a 1.80% increase within the past 24 hours, a significant 7.70% growth over the last week, and a substantial 12% ascent in the last month, according to TradingView, sparking interest among crypto enthusiasts worldwide.

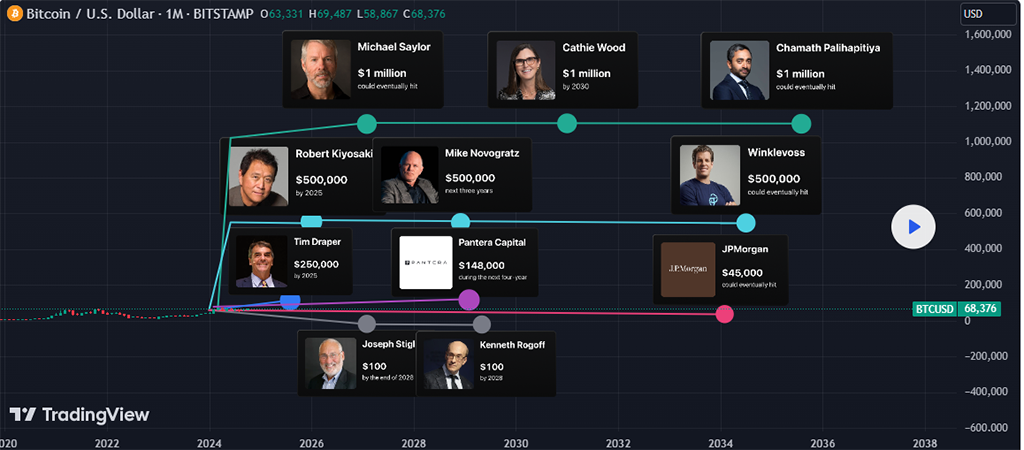

Source: TradingView

2021 has been a tough year for the top digital currency, with approximately 65% of its worth in the market being eroded. Incidents such as the Terra Luna collapse, the fall of FTX, economic pressures on a global scale, and legal problems related to Binance have all played a role in this decline. However, Bitcoin has shown remarkable strength by bouncing back strongly towards the end of the year, despite these obstacles.

Bitcoin’s Record Highs and Resilient Market Trends in 2024

As a crypto investor in March 2024, I witnessed an unprecedented surge in the value of Bitcoin. On the 8th of that month, it smashed its previous record high of $69,170, reaching an astounding $70,083. Six short days later, on the 14th, it experienced another spike, skyrocketing to $73,750. This dramatic rise propelled Bitcoin’s market capitalization to a staggering $1.44 trillion, significantly contributing to a total crypto market cap of a whopping $2.77 trillion. This growth underscores the robust performance of Bitcoin amidst a revitalized market.

After exceeding $31,000, Bitcoin underwent a bearish phase, falling below $30,000 for most of the last year. But, the later part of the year witnessed an impressive rebound; BTC rose approximately 140.82% over the year. By mid-October, it was being traded at $67,129, with the total cryptocurrency market capitalization standing at around $2.3 trillion.

2023 saw Bitcoin, a key cryptocurrency, reach and briefly hold above the significant $30,000 barrier for the first time since June 2022. However, it subsequently dipped below $26,000. Later in May 2022, Bitcoin rallied to reach $45,203. Experts are hopeful that this level could serve as a stepping stone for further growth and recovery.

According to industry experts, if Bitcoin maintains a value above $45,000, it could potentially rise to $60,000 by the end of 2024. In the first quarter of the year, BTC peaked at an unprecedented $73,750.

Investors continue to exercise caution due to previous market instability. The Indian government has taken a firm stance on cryptocurrencies by classifying all crypto transactions under the Prevention of Money Laundering Act (PMLA). This means that digital asset transactions are now subject to PMLA regulations. Some may view this as restrictive, but the cryptocurrency industry sees it as a step towards proper regulation, which could lead to improved supervision and fewer inconsistencies.

Bitcoin Exchange-Traded Funds (ETFs) have significantly contributed to Bitcoin’s expansion. Once the U.S. Securities and Exchange Commission (SEC) approved these ETFs, they ignited substantial curiosity among individual investors, propelling Bitcoin past its prior record-high prices.

Towards the close of September, after the U.S. Federal Reserve reduced interest rates by 50 basis points and the Bank of Japan maintained its current rates, Bitcoin’s trading value hovered around $67,000. A 3% increase in Bitcoin’s price was observed shortly following these central bank declarations.

Bitcoin’s 2024 Halving Spurs Accumulation

2024 witnessed the fourth reduction of miner rewards in Bitcoin, lowering it to 3.125 BTC on April 20th. Typically, such events boost Bitcoin’s price because they decrease the circulating supply. Yet, unlike previous years, this halving event did not lead to the anticipated price increase, and instead, Bitcoin has experienced a downward trend since then. In the past, halvings have instilled long-term optimism in Bitcoin due to its scarcity and deflationary characteristics.

Major Bitcoin investors, often referred to as “Bitcoin Whales”, have resumed buying Bitcoin. As of October 2024, these whales are reportedly holding about 248,600 BTC, according to CoinMarketCap statistics. This accumulation could boost the Bitcoin price and continue its rise. With around 19.74 million Bitcoins in circulation, the supply remains limited, adding to Bitcoin’s appeal and potential worth.

Sathvik Vishwanath, the CEO of Unocoin, points out Bitcoin’s tendency to rise during specific periods of the year, hinting at potential growth by the end of 2021. He mentions that on average, Bitcoin has increased by 26% in October, 36% in November, and 11% in December based on past performance. Furthermore, Vishwanath explains that reduced interest rates encourage investors to invest in high-growth assets such as Bitcoin, which can thrive when the US dollar weakens.

Looking back, Bitcoin’s past performance doesn’t predict future results. However, its underlying strengths suggest that it could continue to grow over the long term. Keep in mind that volatility might still be a factor, but it’s possible that prices below $100,000 will soon become a thing of the past. As we speak, Bitcoin is trading at around $72,400 with a market cap of approximately $1.43 trillion. The halving event, which took place at block height 840,000, has played a significant role in shaping Bitcoin’s monetary policy by limiting the rate at which new coins are introduced.

What Experts Say about Bitcoin’s Future

Himanshu Maradiya, the founder of CIFDAQ Blockchain, acknowledges the ambitious nature of predicting Bitcoin to reach $1,000,000 by 2025. He states:

Although predicting Bitcoin will hit $1,000,000 by 2025 might appear overly optimistic, there are several reasons this scenario could become a reality. The growing acceptance of Bitcoin, the approval of BTC exchange-traded funds (ETFs) in multiple countries, the devaluation of traditional currencies due to hyperinflation, and increased profitability for Bitcoin mining are all factors that may substantially increase its worth.

As a crypto investor myself, I wholeheartedly agree with MicroStrategy CEO Michael Saylor’s perspective on Bitcoin. Just like him, I see a potential $1 million valuation for Bitcoin in the future. To me, it’s not just another digital currency; it’s a superior form of value storage compared to traditional fiat currencies and even gold.

Source: TradingView

Chamath Palihapitiya, a venture capitalist, holds the belief that Bitcoin could be worth $1 million due to its capacity to serve as a safeguard against worldwide economic turmoil. He highlights Bitcoin’s distinctive traits that shield it from risks within conventional financial systems, predicting that its role will become even more crucial as economies encounter increasing strains.

Experts such as Robert Kiyosaki and Mike Novogratz anticipate more conservative yet significant projections for the future of cryptocurrency. Specifically, they estimate that the price of Bitcoin could reach around $500,000 within the next few years, with this growth attributed to factors like increasing inflation, devaluation of traditional currencies, and the limited supply of Bitcoin itself, as well as its growing acceptance among users.

In the meantime, the Winklevoss twins, along with Tim Draper, are advocating for significant growth in Bitcoin. Specifically, Draper has stated that he believes the value of Bitcoin could reach $250,000 by 2024, highlighting its growing acceptance as both a financial investment and a widely used technology.

Even though Bitcoin seems promising with its optimistic outlook, its history of unpredictability should encourage investors to handle it carefully. Every market phase has had its ups and downs, proving Bitcoin’s ability to bounce back. It remains to be seen if Bitcoin can reach the remarkable goal of $1,000,000 by 2025 or encounter fresh obstacles along the way.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-10-30 12:19