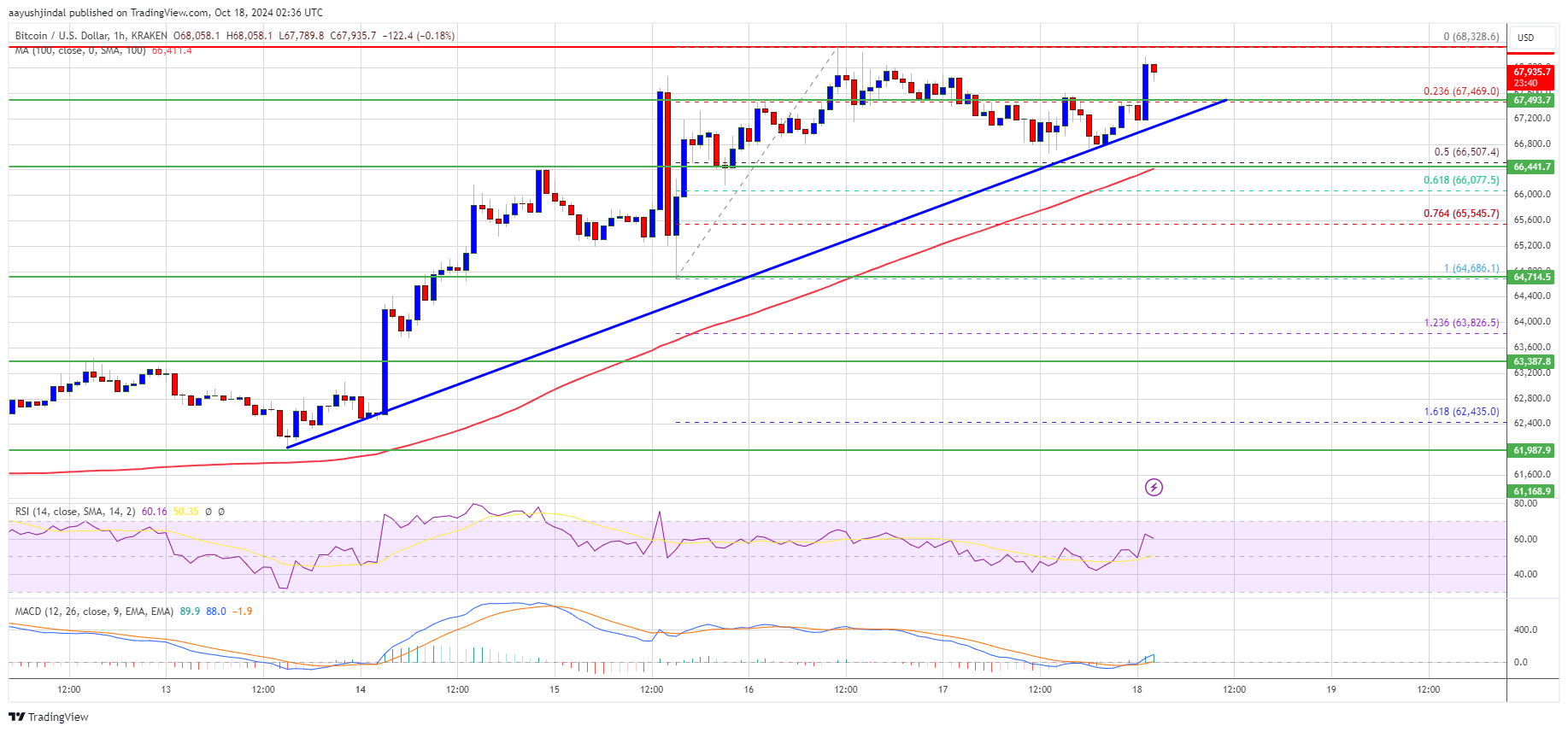

Bitcoin‘s price remains stable above the significant barrier at around $67,000, suggesting a potential push towards further growth beyond the $68,350 resistance level. Currently, Bitcoin is gathering strength before potentially moving higher.

- Bitcoin remained stable and extended gains above the $67,500 zone.

- The price is trading above $67,400 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $67,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could rally further if there is a close above the $68,200 resistance zone.

Bitcoin Price Eyes More Upsides

The cost of Bitcoin consistently held above a significant level at roughly $67,000. For the most part, Bitcoin maintained its position within a range, with buyers actively engaged above the $66,500 mark. There was a slight retreat from the recent peak of $68,328.

The cost dipped under the $67,000 threshold, dropping below the 23.6% Fibonacci retracement level based on the rise from the $64,685 trough to the $68,328 peak. Despite this, buyers showed signs of activity above the $66,500 mark. Additionally, a significant bullish trend line is emerging with support at $67,400 on the hourly chart for the BTC/USD pair.

Currently, Bitcoin’s value is transacting over $67,200 and is also above its 100-hour Simple Moving Average. If it continues to rise, potential hurdles for the price lie around the $68,000 mark. The initial significant barrier is found at approximately $68,200. Overcoming this obstacle might propel the price further. A subsequent resistance could be seen at $68,850.

If the price breaks through the $68,850 barrier, it may lead to further increases, potentially pushing the price up to challenge the $71,650 resistance point. Should additional gains occur, the price could continue climbing towards the $72,000 resistance level.

Another Drop In BTC?

If Bitcoin doesn’t manage to break through the $68,000 barrier, there might be another drop. The closest support can be found at around $67,200 and the trendline.

1) The primary resistance can be found at approximately $66,500 and also coincides with the 50% Fibonacci retracement point of the rise from $64,685 low to $68,328 high. A secondary support now lies around the $66,000 region. Further declines may push the price towards the nearby $65,500 support level in the short term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $67,200, followed by $66,500.

Major Resistance Levels – $68,000, and $68,200.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2024-10-18 05:46