As a seasoned researcher with years of experience tracking Bitcoin’s price movements, I can confidently say that we’re currently observing a consolidation phase for Bitcoin. The struggle to break above the $70,000 resistance and subsequent correction down to the $66,500 zone is not uncommon in the volatile world of cryptocurrencies.

Initially, the Bitcoin price dipped and touched the $66,500 area before stabilizing. At present, Bitcoin appears to be gathering strength, potentially targeting another rise surpassing the $67,800 mark.

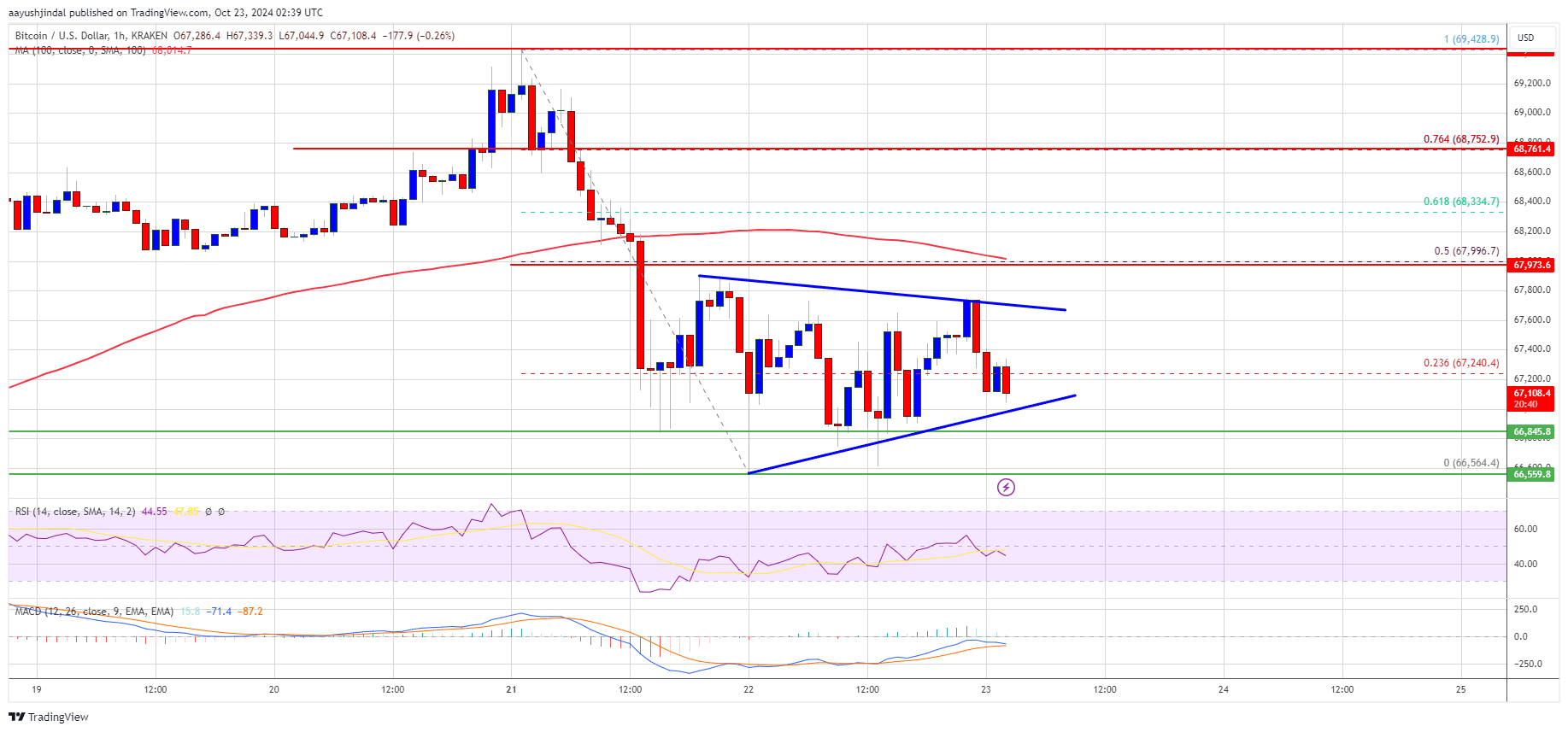

- Bitcoin struggled to test the $70,000 resistance zone and started a downside correction.

- The price is trading below $67,500 and the 100 hourly Simple moving average.

- There is a short-term contracting triangle forming with support at $67,100 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh increase unless there is a close below the $66,500 zone.

Bitcoin Price Starts Consolidation Phase

The price of Bitcoin found it challenging to advance further towards the $70,000 mark and instead began a decline. It dipped below the $68,500 and $67,500 thresholds in its descent.

The price dipped as low as $66,564, testing a potential support area at $66,500. Since then, it has been holding steady, recovering slightly from its losses. A brief uptick was observed beyond the $66,850 mark. Additionally, the price rose above the 23.6% Fibonacci retracement level of the recent downward trend from the peak of $69,427 to the trough of $66,564.

Currently, Bitcoin’s trading value hovers slightly below the $67,500 mark and under its 100-hour Simple Moving Average. As it moves upward, potential obstacles might arise around the $67,100 price point. Additionally, a temporary pattern known as a “short-term contracting triangle” is emerging on the hourly BTC/USD chart, with $67,100 serving as its lower support level.

Initially, a significant barrier for the price lies around $68,000 or at the 50% retracement point of the fall from the peak of $69,427 to the trough of $66,564. If we see a strong break above this $68,000 barrier, it could push the price upwards. The subsequent resistance level might be around $68,500.

If the price breaks through the $68,500 barrier, it could lead to further increases. In such a scenario, the price may ascend and challenge the $69,200 resistance point. Any additional increases might push the price towards the $70,000 resistance mark.

Another Decline In BTC?

If Bitcoin doesn’t manage to break through the barrier at $67,100, there might be a subsequent drop. The closest level of support if that happens could be around $66,800.

The primary reinforcement lies around the $66,500 mark. Currently, additional support can be found close to the $66,200 area. If there are further drops, the cost may trend towards the nearby $65,500 support in the short term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $66,800, followed by $66,500.

Major Resistance Levels – $67,100, and $68,000.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-23 06:05