As a seasoned crypto investor with a knack for navigating the volatile Bitcoin market, I find myself standing at a critical juncture yet again. The price drop below $95,000 is a stark reminder of the unpredictable nature of this digital gold.

As a researcher studying Bitcoin’s market trends, I observe that the Bitcoin price has continued to dip, falling below the $95,000 region. The current chart patterns suggest a bearish outlook, indicating potential further declines, possibly dropping significantly below the $92,000 mark.

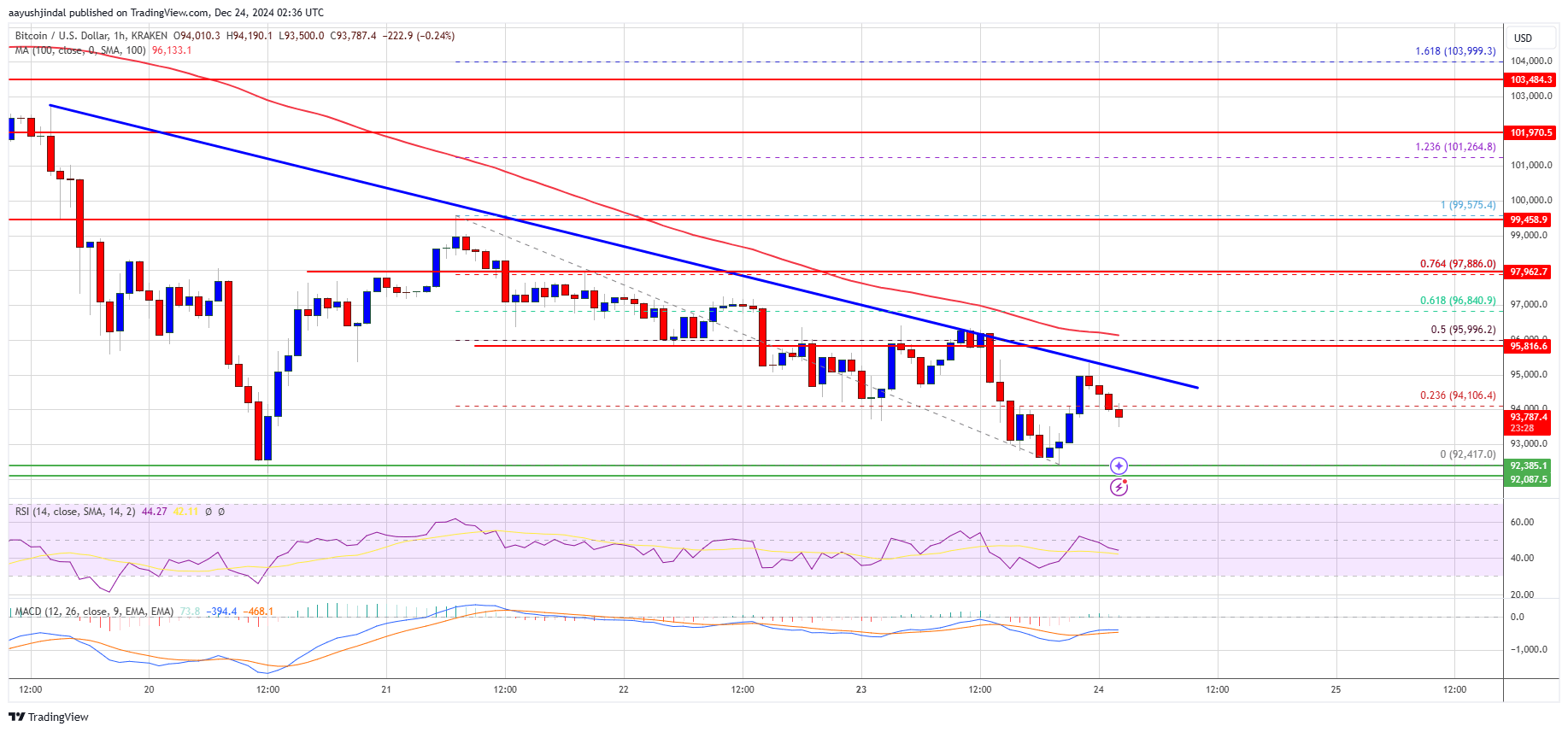

- Bitcoin started a fresh decline below the $95,000 zone.

- The price is trading below $94,000 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $95,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh increase if it stays above the $92,000 support zone.

Bitcoin Price Revisits Support

The price of Bitcoin struggled to initiate further growth and instead continued to fall beneath the $98,000 region. The cryptocurrency picked up negative momentum as it dropped below the resistance levels at $96,500 and $95,500.

Initially, the cost plummeted below the $92,500 mark, reaching a low point at $92,417. Currently, the value is stabilizing after incurring losses. There was a slight uptick that surpassed the $94,000 threshold. The price also breached the 23.6% Fibonacci retracement level from the high of $99,575 to the low of $92,417.

Currently, Bitcoin’s price is dipping below the $95,000 mark and its 100-hour Simple Moving Average. Additionally, a significant bearish trend line is developing, with resistance at around $95,000 on the hourly BTC/USD chart.

Positively speaking, there’s a strong likelihood that resistance will be encountered around the $95,000 mark. The primary level of resistance could be found at approximately $96,000 or at the 50% Fibonacci retracement point from the price drop between the $99,575 peak and the $92,417 trough. Overcoming this resistance at $96,000 may potentially lead to further price increases.

As an analyst, I’m projecting that the next significant resistance we might encounter lies at approximately $96,800. If our current position manages to surpass this resistance, it could potentially propel us higher. In such a scenario, we might see the price reaching and testing the $97,500 resistance level. Any further gains could then push the price towards the $98,000 mark.

More Downsides In BTC?

Should Bitcoin not manage to break through the $95,000 barrier, there’s a possibility it might keep falling. The nearest support lies around the $92,400 mark if it falls further.

The primary reinforcement is found around $92,000. Currently, the secondary reinforcement lies within the vicinity of the $91,200 area. If there are further losses, the price might trend towards the $90,000 support in the immediate future.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $92,500, followed by $91,200.

Major Resistance Levels – $95,000 and $96,000.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-24 05:46