As a seasoned crypto investor with a decade of experience under my belt, I’ve weathered countless market fluctuations and learned to read between the lines of technical analysis charts like the back of my hand. The latest Bitcoin price dip is a familiar sight, but it doesn’t have me too worried just yet.

I remember when BTC first dipped below $10,000 in 2017, only to skyrocket to nearly $20,000 by the end of that year. The market is volatile, and while it might be disheartening to see Bitcoin back below $94,500, I’ve learned to stay patient and wait for the right opportunity to buy at a lower price.

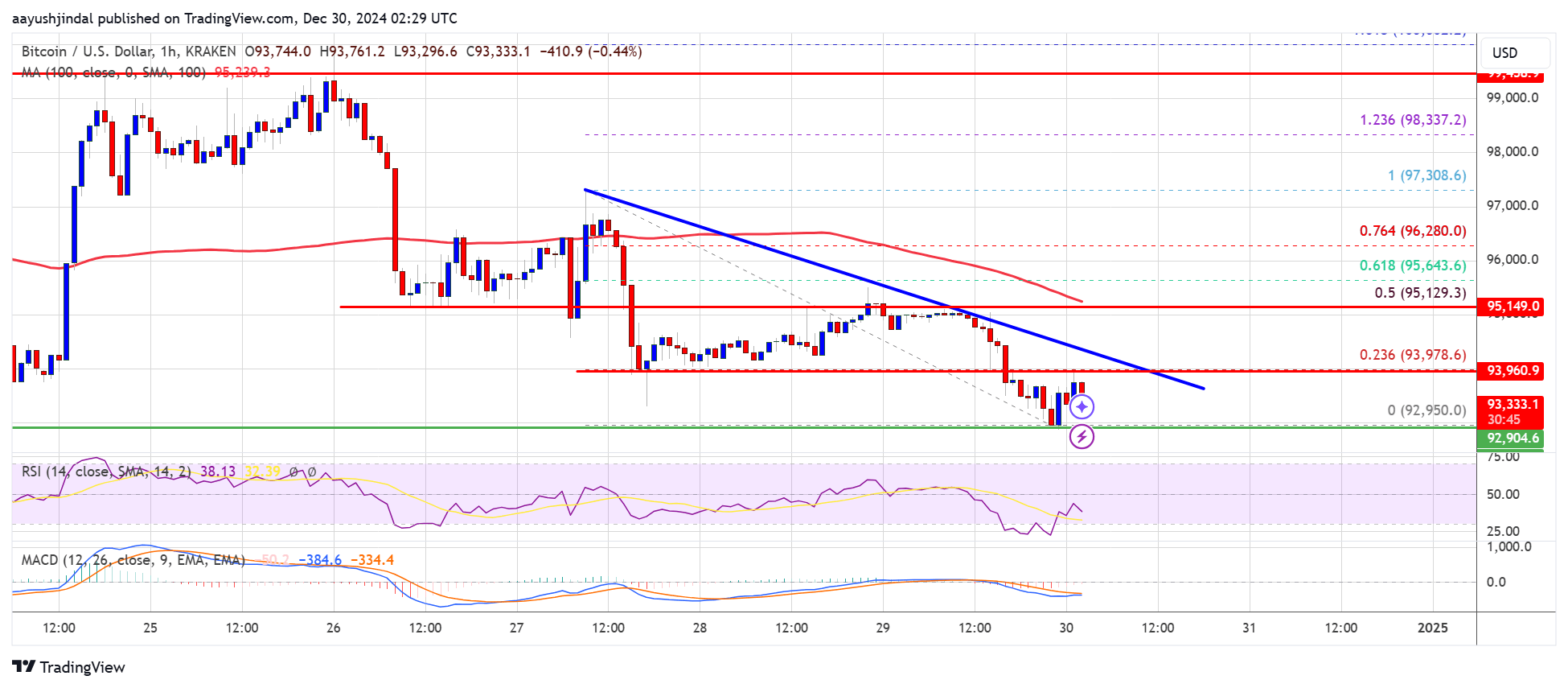

The current trend line forming with resistance at $94,000 on the hourly chart of the BTC/USD pair is concerning, but it also presents a potential buying opportunity if Bitcoin can hold above the $92,500 support zone. If that happens, we could see another upward move towards $96,500 and potentially beyond, as the price has already proven its ability to bounce back from losses.

Of course, nothing is guaranteed in the world of crypto, but I’ve learned to embrace the uncertainty and ride the waves rather than fight them. As they say, “Buy the dip” – or at least that’s what I tell myself when I’m feeling nervous about market fluctuations!

Joke: Why did Bitcoin go to therapy? Because it had a lot of unrealized gains.

As a seasoned cryptocurrency investor with years of experience under my belt, I’ve seen Bitcoin’s price fluctuations more times than I can count. Today, unfortunately, we witnessed yet another instance where the price failed to break through the $95,500 resistance level and instead plummeted back down below $94,500. It seems that BTC might retrace its steps to the $91,200 support zone once again. This is a stark reminder of the inherent volatility in this market, but I’ve learned to take these dips in stride and remain optimistic for future price movements.

- Bitcoin started a fresh decline from the $96,500 zone.

- The price is trading below $95,500 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $94,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $92,500 support zone.

Bitcoin Price Dips Again

The price of Bitcoin commenced an encouraging uptrend surpassing the significant resistance at approximately $93,500. Subsequently, it scaled beyond the obstacles at $94,200 and $94,500 resistance points.

As someone who has been trading cryptocurrencies for several years now, I have learned that market trends can be quite unpredictable and volatile. The recent movement of the BTC/USD pair caught my attention when it managed to surpass the $95,000 resistance level, but it quickly became apparent that upward momentum was limited. The subsequent decline in price and trade below the $93,500 level left me with a sense of caution.

A low was formed at $92,950, which suggests a bearish sentiment among traders, and now the market seems to be consolidating losses. Upon closer examination of the hourly chart, I noticed a bearish trend line forming with resistance at $94,000. This indicates that the bears may still have some control over the market in the short term.

While it’s always important to remain adaptable and open-minded when trading, my personal experience tells me that it’s best to exercise patience and caution when dealing with such a volatile market. I will be watching closely for any potential opportunities to enter or exit positions based on future price action and technical indicators.

The graph shows that Bitcoin’s price trend is approaching the 23.6% Fibonacci retracement level following a recent drop from its peak at $97,308 to its low at $92,950. Currently, Bitcoin’s trading value has dipped below $95,000 and also falls under the 100-hour moving average line.

As a seasoned trader with over a decade of experience under my belt, I see potential in the market trend we are currently observing. Based on my analysis, it appears that immediate resistance is close to the $94,000 level, which could present an opportunity for cautious traders. However, it’s important to keep an eye on the first key resistance near the $95,000 mark or the 50% Fib retracement level of the recent decline from the $97,308 swing high to the $92,950 low. If the price manages to break through this barrier, it could signal a further upward movement. But remember, trading always comes with risks and it’s crucial to have a well-defined strategy and risk management in place before making any moves.

If we manage to break through the current resistance at $95,500, it could lead us to climb even higher. As a result, we might reach and challenge the resistance at $96,500. Any additional growth could potentially propel the price towards the $98,000 mark.

More Losses In BTC?

If Bitcoin doesn’t manage to break through its resistance at approximately $94,500, it might keep falling instead. The next significant support can be found around the $93,500 mark.

The primary reinforcement is close to the $92,800 region. The subsequent backup is currently around the $92,500 area. Further declines could push the value towards the $91,200 reinforcement in the immediate future.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $93,500, followed by $92,500.

Major Resistance Levels – $94,500 and $95,500.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2024-12-30 05:47