As an experienced crypto analyst with a keen interest in Bitcoin’s price action, I find TechDev’s analysis thought-provoking and worth considering. His observation of the similarities between Bitcoin’s current price action and that of the 2017 bull run is compelling. If history does indeed repeat itself, we could be on the cusp of a parabolic rise that sends Bitcoin to new heights.

Expert Insight: Crypto analyst TechDev has shared his perspective on Bitcoin‘s (BTC) potential future trend. According to his analysis, Bitcoin is presently displaying price behavior similar to its 2017 performance and may be on the verge of experiencing another parabolic surge as seen during that period.

History Could Repeat Itself

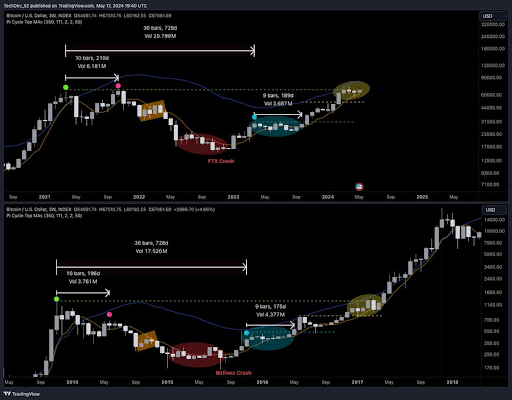

As a researcher, I came across an intriguing post by TechDev on his X platform, previously known as Twitter. He accompanied a chart with the thought-provoking caption, “The more things change, the more they stay the same.” The graphic depicted Bitcoin’s current price trend, which appeared remarkably similar to its 2017 bull run. During that period, Bitcoin experienced an astounding price increase of approximately 1,200% en route to reaching a peak price of $20,000.

As an analyst, I’ve observed that the crypto market behavior in 2017 and now bears striking resemblances. In 2017, Bitcoin’s price plummeted after the Bitfinex crash, only to consolidate and later experience a parabolic rally leading it to $20,000 by 2018. Similarly, in this market cycle, following FTX’s collapse, Bitcoin seems to have found a bottom. It is likely that we may witness a period of consolidation before another potential surge.

Based on TechDev’s analysis, I believe history might repeat itself as Bitcoin undergoes a prolonged consolidation phase before potentially surging towards $100,000. The chart presented by the crypto analyst reveals that this market cycle has seen a longer period of consolidation compared to 2017. Rekt Capital’s perspective is that this extended pause is crucial for Bitcoin’s price growth.

In his discourse, he pointed out that Bitcoin had been advancing at an impressive rate of nearly 200 days in this market cycle. He further explained that a prolonged period of consolidation would be beneficial for Bitcoin as it would help align its progression with past bull markets. This extended pause is an encouraging indication of Bitcoin’s resilience and potential for expansion. In a recent blog post, he shared that Bitcoin was making an attempt at the “post Bull Flag breakout retest,” which could solidify the continuation of the upward trend.

In their following Bitcoin-related post on X, Rekt Capital presented a graph indicating that surpassing the $66,000 threshold might trigger the resumption of Bitcoin’s bull market, potentially pushing its value beyond $100,000.

“Optimal Targets” For Bitcoin In This Market Cycle

Crypto expert Mikybull recently shared in a Reddit thread that the ideal prices for Bitcoin during this bull market are anticipated to be within the range of $138,000 and $150,000. Remarkably, he made this projection while drawing parallels between Bitcoin’s current price behavior and its 2017 trend. Mikybull’s forecast implies that a price increase of approximately 1,200% similar to the one seen in 2017 is not very plausible.

It’s important to mention that while my analysis may suggest a more modest outlook for Bitcoin’s price, it’s crucial to acknowledge that other respected analysts like PlanB hold more optimistic views. Their forecast indicates that Bitcoin could experience a tenfold increase from its current value by 2025. In fact, according to PlanB’s prediction, the price of Bitcoin could reach as high as $1 million during that year.

Currently, Bitcoin is priced approximately at $67,000 based on the latest information from CoinMarketCap, representing a decrease in value over the past 24 hours.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-05-21 00:04