As a seasoned analyst with over two decades of experience in the financial markets, I find Tony Severino’s analysis intriguing and thought-provoking. Having witnessed the 2017 Bitcoin surge firsthand, I can’t help but draw parallels between that historic run and the current trajectory. It’s fascinating to see history potentially repeating itself in the world of cryptocurrencies.

The Bitcoin price is rapidly approaching the significant milestone of $100,000, as numerous predictions suggest it may hit this figure as early as this weekend. Notably, the highest intraday price for Bitcoin within the past 24 hours was $99,486, leaving it just a mere 0.5% short of reaching the six-figure mark.

While the whole cryptocurrency world is on tenterhooks, waiting for the Bitcoin price to surpass $100,000, crypto analyst Tony “The Bull” Severino offers some intriguing insights into what might follow this potential milestone.

Bitcoin Price Mirrors 2017 Pattern

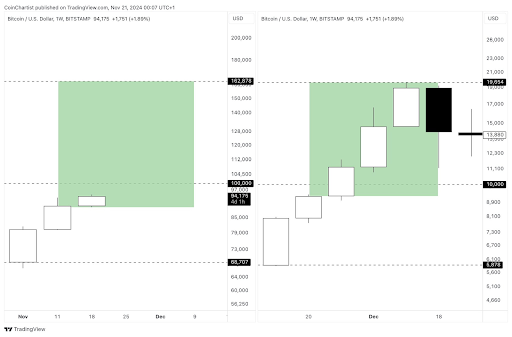

Analyst Tony Severino has compared Bitcoin’s recent price fluctuations to its significant rise in 2017. Back in November 2017, Bitcoin crossed the $10,000 milestone for the first time. Fast forward seven years, and Bitcoin is displaying similar trends as it attempts to surpass the next major level of $100,000.

Reaching and surpassing the $10,000 mark in Bitcoin’s price was a significant turning point, symbolizing a break above a crucial psychological barrier. As highlighted by Severino, following this psychological achievement, the value of Bitcoin almost doubled over the subsequent fortnight.

In simpler terms, Severino compared this move’s results with the recent trends in Bitcoin’s price. Notably, Bitcoin is now approaching the $100,000 threshold, a level that holds more psychological impact on Bitcoin’s future value than the $10,000 benchmark did earlier.

Could Breaching $100,000 Cause Another Excitement?

According to Severino’s perspective, surpassing the $100,000 mark for Bitcoin might lead to another significant surge in its price, similar to what transpired when it hit $10,000 back in 2017. He pointed out that the value of Bitcoin could potentially rise by as much as double from its current level, yet this growth spurt may occur quite rapidly.

This steep climb might signal the last phase of this ongoing bull market trend, leading to a high point and subsequent major adjustment, much like what happened during the 2017 bull cycle. Nevertheless, Severino warned that Bitcoin’s peak may not be imminent within just two weeks; instead, he estimates it could occur around two months from now.

It’s worth mentioning that the Bitcoin market has experienced significant shifts since it surpassed $10,000 in 2017. Back then, the surge was predominantly fueled by individual investors and large Bitcoin holders who had invested early on. Nowadays, institutional interest in Bitcoin is burgeoning, particularly through Spot Bitcoin Exchange Traded Funds (ETFs). This institutional involvement has been instrumental in the consistent increase of Bitcoin’s price this year, with current trends suggesting that this upward momentum will continue.

At the time of writing, Bitcoin is trading at $99,032, up by 2% in the past 24 hours.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best Japanese BL Dramas to Watch

2024-11-23 00:40