As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I find myself both intrigued and cautiously optimistic about the recent analysis by Trader Tardigrade and others predicting Bitcoin’s price trajectory.

crypto expert Trader Tardigrade has pointed out a similarity between the current Bitcoin price fluctuations and those seen in 2023, offering interpretations on potential implications for Bitcoin’s future direction.

Bitcoin Price Mirroring 2023 Movements

According to a recent post on X, Trader Tardigrade predicts that Bitcoin’s price is continuing its projected trajectory towards 2023. He also noted that the flagship cryptocurrency has recently experienced a downturn, but this pullback is now over. The crypto analyst then stated that after this dip, there will be a significant increase in value above $100,000, followed by a period of stabilization around that level.

It’s worth noting that Trader Tardigrade foresaw the Bitcoin price surpassing $200,000 by early 2025, as per his analysis, and this significant increase should occur around March 2025, according to the chart he provided.

The graph showing the increase in Bitcoin’s value up to $200,000 could follow a pattern similar to its surge from late December last year, where it peaked at around $73,000 in March this year – which was its highest price ever. It’s also important to note that Trader Tardigrade isn’t alone in predicting Bitcoin can reach this level during this market cycle.

Previously, analysts from Bernstein projected that the price of Bitcoin might hit $200,000 by December 31, 2025, calling it a ‘moderate’ estimate. Likewise, Geoffrey Kendrick, who heads research at Standard Chartered, shared a similar viewpoint and suggested that Bitcoin could potentially reach this price prediction within the same timeframe.

Nevertheless, crypto expert Tony Severino expresses doubt about Bitcoin’s price reaching $200,000 during this bull run. Instead, he has offered a more moderate forecast, suggesting that the primary cryptocurrency might max out around $160,000. The analyst bases this prediction on the fact that the golden ratio falls within this range, making it a more practical target.

BTC Is “Far Away” From A Market Top

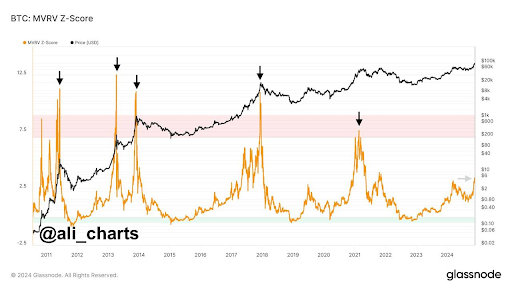

In a recent post on X, cryptocurrency analyst Ali Martinez suggested that the price of Bitcoin is not close to reaching a market peak. He supported this claim by referring to the Market Value to Realized Value (MVRV) indicator, which helps determine if an asset is overpriced or underpriced. The graph indicated that Bitcoin has yet to attain its actual worth.

Currently, the price of Bitcoin is experiencing a notable adjustment or drop, following its continuous surge since Donald Trump’s election victory. However, as per Martinez’s analysis, this dip might be an excellent opportunity to invest. He explains that the TD Sequential indicates a buy signal on the Bitcoin hourly chart, while simultaneously a bullish divergence takes shape relative to the Relative Strength Index (RSI). This situation could potentially propel Bitcoin back up towards $95,000 and $96,000.

Currently, as I’m typing this, the value of a single Bitcoin is approximately $93,400. However, it has decreased slightly over the past 24 hours based on information gathered from CoinMarketCap.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Brody Jenner Denies Getting Money From Kardashian Family

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

2024-11-27 19:16