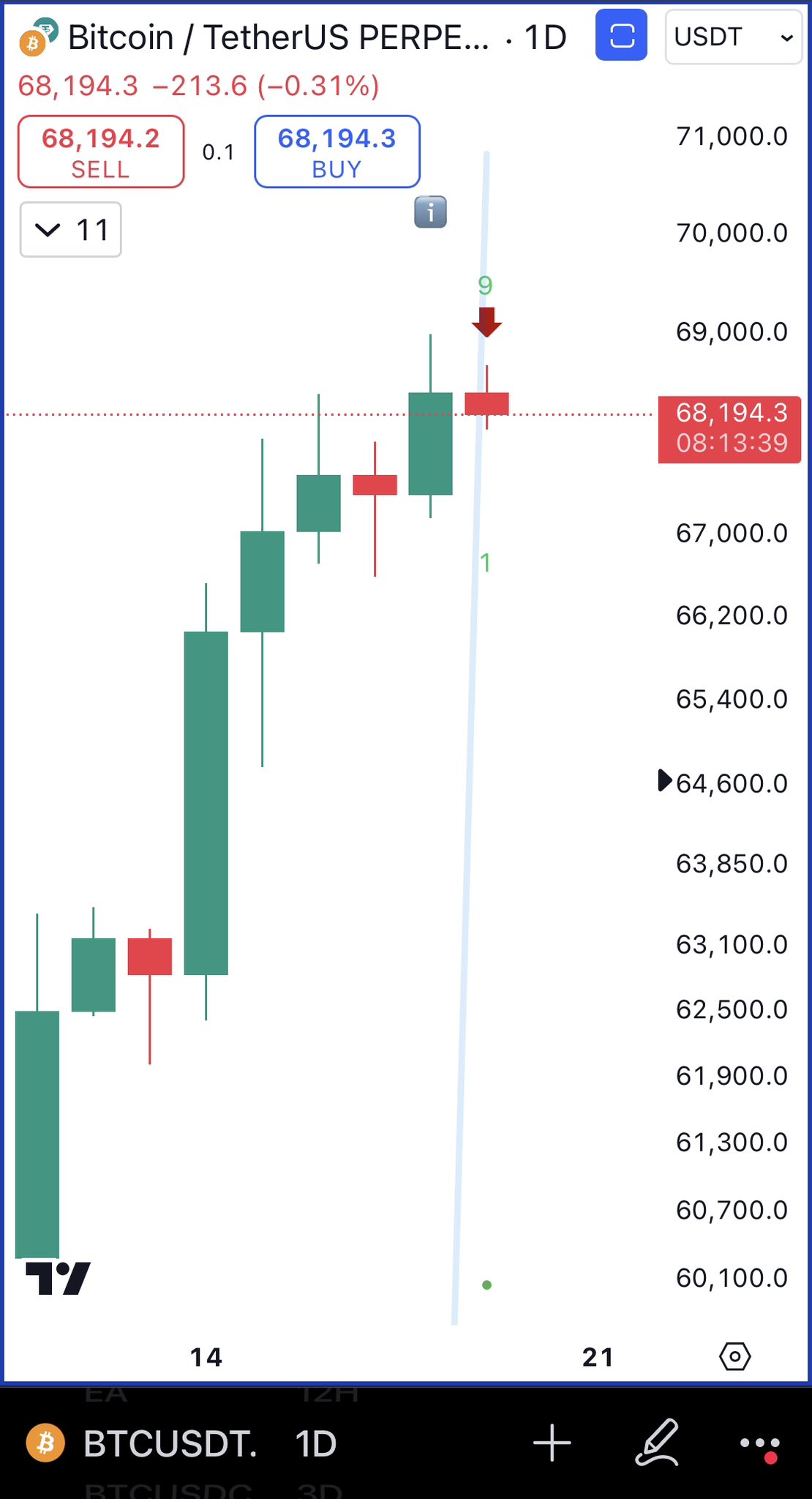

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find myself constantly intrigued by the predictions and fluctuations in Bitcoin’s price. In this particular instance, the analysis by Ali Martinez on platform X has piqued my interest. The TD Sequential, a tool often overlooked but known for its uncanny ability to predict trend exhaustion, has flashed a sell signal on BTC‘s daily chart.

On the weekend, the Bitcoin price didn’t quite match its midweek strength, staying close to the $68,000 mark. Even though it showed little activity over the past day, Bitcoin has successfully maintained its position above $68,000.

On the contrary, a well-known cryptocurrency analyst on social media platform X predicts that the price of BTC might not sustain its current level for an extended period. This prediction has sparked doubts among many investors, leading them to question whether this possible dip is just a temporary setback or a full reversal in the ongoing bull run revival.

Analyst Says Bitcoin Price To Face Brief Correction — What Next?

In a recent update on the X platform, crypto expert Ali Martinez predicted that Bitcoin could experience a temporary decrease in value in the near future. He based this prediction on the “Tom Demark” (TD) Sequential, which showed a sell signal for Bitcoin’s price on the daily graph.

The TD Sequential is an indicator in technical analysis used to identify potential points of trend exhaustion and price reversal. This technical analysis tool comprises two major phases; namely the TD Setup phase and the TD Countdown phase.

In simpler terms, during the Setup phase, we see a sequence of nine candles with the same direction (either bearish or bullish). When the Setup phase starts bullishly, the first point is marked on a candle that ends with a higher closing price than its preceding candle four periods ago.

In simpler terms, a “Setup” that is bearish occurs when the initial candle opens at a higher price but ends up closing lower than it did four candles ago, marked by the number “1”. A possible reversal point can be spotted if the TD Sequential indicator shows a bullish or bearish signal at the top or bottom of a candle during an ongoing trend.

According to the graph presented, the figure “9” has recently been placed atop a candlestick on the Bitcoin daily chart, indicating the end of the Setup phase. Given that Bitcoin’s price initially followed a bullish trend, it seems that the leading cryptocurrency might experience a short-term correction for several days ahead.

Lately, there’s been a lot of talk about Bitcoin’s price potentially returning and even exceeding its previous record high. However, Martinez suggests that investors should prepare for a short-term dip in Bitcoin’s price before it might reach new peak levels again.

Bitcoin Price At A Glance

Currently, the cost of Bitcoin hovers around $68,272, showing only a slight decrease of 0.5% within the past day. However, according to statistics from CoinGecko, Bitcoin has experienced a substantial increase of almost 9% over the last week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-20 13:16