As a seasoned crypto investor with over a decade of experience in this volatile market, I have seen my fair share of bull and bear cycles. The recent analysis by Gert van Lagen, while alarming, is not entirely unprecedented or unreasonable.

A cryptocurrency expert has predicted a 98% drop in Bitcoin‘s price after it reaches an impressive peak of $250,000. Surprisingly, this analyst remains optimistic that Bitcoin will eventually hit this lofty goal of a quarter-million dollars. However, they urge caution as the price may plummet significantly once profits are realized, reaching new record lows.

Bitcoin Price Projected To Crash 98%

On October 30th, crypto expert Gert van Lagen shared his insights with his 106,700 followers (previously on Twitter), predicting that the Bitcoin price might dip to around $24,000 if it reaches $250,000. Van Lagen explained that some investors have become overly optimistic, underestimating the possibility of another 98% price drop for Bitcoin, particularly with the launch of Spot Bitcoin Exchange Traded Funds (ETFs).

Responding to such overzealousness, the crypto expert argued that ETF holdings typically suffer substantial devaluation during economic downturns. As a result, this analyst foresees Bitcoin’s price spiking initially, reaching up to $250,000 as an unprecedented record. However, once investors begin realizing their profits, a wave of selling could ensue due to the high liquidation demands before potential price drops.

According to Lagen’s assessment, when the collective opinion about Bitcoin’s price changes, significant institutional investors who fueled the $250,000 surge might decide to offload their assets. Lagen refers to this massive sell-off as a “century-long shakeout,” which could result in a drastic drop of up to 98% in Bitcoin’s value.

It implies that if Bitcoin’s price reaches $250,000, there’s a possibility it could plummet to around $2,000, making Ethereum (currently priced at $2,635) more valuable in comparison, as per CoinMarketCap.

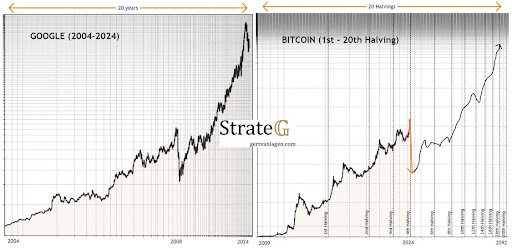

Through the use of a Syslog scale for visualizing Bitcoin’s price movement, Lagen observed an HTF rising wedge formation, indicating a potential price range between $1,000 and $10,000. In a previous post, he had also suggested that if Bitcoin undergoes the projected downturn to $1,000, it would require four halving events before it could potentially rebound to its previous high of $200,000.

BTC To Break Above $73,000 And Rally Higher

Currently, the Bitcoin price stands at approximately $72,433 following a significant 7.8% rise during this week. According to analysts like Lagen, this upward movement suggests the formation of a “potential bearish continuation triangle pattern,” which often indicates a possible downturn in cryptocurrency values.

The crypto analyst has set a new target of $71,200 for Bitcoin, suggesting that if the cryptocurrency follows through with the triangle bearish continuation pattern, its price could decline significantly. On the flip side, Lagen has predicted that if Bitcoin can break the $73,000 threshold, it would invalidate the triangle bearish continuation pattern. This could indicate the end of the downtrend and potentially lead to a stronger upward momentum.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-10-31 15:04