As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I find the latest analysis by Ali Martinez particularly intriguing. The TD Sequential chart suggests a critical moment for Bitcoin traders, flashing a buy signal that could potentially mark an end to the bearish momentum and the start of a rebound.

A cryptocurrency expert has posted a TD Sequential chart implying that the Bitcoin cost is giving off a significant buy warning within the 4-hour time scale. This indication indicates that Bitcoin’s downward trend may be weakening, which could make this an important juncture to think about investing in the market.

Bitcoin Price TD Sequential Flashes Buy Signal

A TD Sequential is a specialized technical tool that pinpoints when trends are likely to end and price fluctuations may reverse, offering buy or sell suggestions. As per a post by crypto analyst Ali Martinez on X (previously known as Twitter), Bitcoin’s 4-hour graph exhibits a green “9” candle, potentially indicating a beneficial buying opportunity.

In a downtrend, a green 9 candle is often seen as a buy signal, suggesting that the downward pressure may be weakening, possibly paving the way for a price increase. Additionally, Martinez places an “A13” marker on the TD Sequential chart. This marker signifies a phase where it tracks 13 more candles and signals a stronger trend exhaustion.

When the TD Sequential A13 appears during a falling trend in cryptocurrency, it can hint at a possible slowdown or end to the sell-off, potentially leading to a price increase. The recent buy signal for Bitcoin emerged as its value surpassed $94,000, indicating an opportune time for investment. Traders looking to profit from a potential Bitcoin price rise might consider entering the market at approximately $94,915.

As a researcher studying market trends, I’ve found that while the TD Sequential indicator offers valuable insights for identifying buy and sell signals, it’s crucial to consider other factors such as volatility, overall market sentiment, and more before making investment decisions. If the current buy signal holds true, according to Martinez, we might expect a price rebound. However, if the price doesn’t maintain its current level, there could be further downward pressure on Bitcoin, possibly pushing it towards its next critical support level.

BTC Market Top Set At $168,500

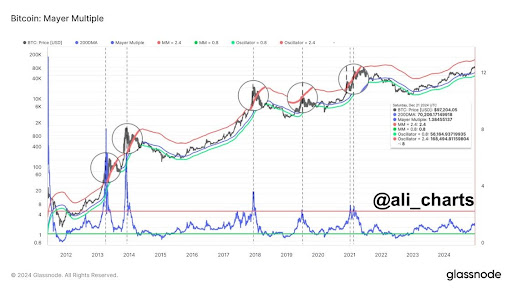

In a more contemporary post on platform X, Martinez shared a graph illustrating Bitcoin’s price fluctuations. He forecasted a market peak exceeding $168,500 using the Mayer Multiple as his basis. This Mayer Multiple is a tool that measures Bitcoin against its 200-day Moving Average (MA).

On the chart, the red line signifies the Mayer Multiple (MM) at 2.4, whereas the green line highlights an MM value of 0.8. Furthermore, the blue line follows the fluctuations of the Mayer Multiple over time.

Historically, significant peaks in Bitcoin’s price have occurred when the Mayer Multiple (MM) exceeds or equals 2.4. At present, the MM for Bitcoin is 1.3845 on the chart. Should Bitcoin’s price continue to climb and the MM reaches 2.4 again, according to Martinez, we might expect a market top for Bitcoin that surpasses $168,500.

Currently, the value of one Bitcoin stands at approximately $94,692. If we consider a potential rise to $168,500, that represents an increase of about 78% compared to its current market price.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Overwatch 2 Season 17 start date and time

2024-12-23 20:10