As a seasoned analyst with over two decades of experience in both traditional and digital markets, I find myself intrigued by the current trajectory of Bitcoin, currently correcting below the $100,000 psychological threshold. Having weathered numerous market cycles, I’ve learned to appreciate the ebb and flow of prices as a necessary part of the investment journey.

Currently, the price of Bitcoin is experiencing a correction phase below $100,000, having dropped by 1.93% over the last 24 hours. However, renowned crypto analyst Titan of Crypto remains confident that Bitcoin will continue its path towards the $110,000 milestone. Despite potential short-term price drops, the analyst predicts that reaching $110,000 is almost certain for Bitcoin.

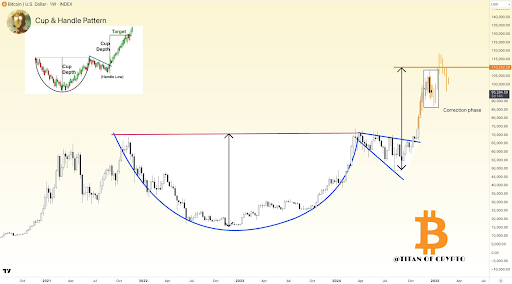

Bitcoin Price $110,000 Path And Current Correction Phase

On December 17, Bitcoin nearly reached the $110,000 milestone but stopped at $108,135 instead. Since then, it’s been on a significant downward trend and is now approximately 12% lower than that peak price. It’s worth mentioning that the Bitcoin price dropped to $92,600 by December 23, which represents a decline of about 14.36% over just five days from its all-time high of $108,135.

Despite experiencing a minor bounce since, the Bitcoin price has continued to dip below the significant $100,000 mark, showing no clear indication yet of a substantial upward surge.

Despite expressing some short-term fluctuations, the Titan of Crypto remains optimistic about Bitcoin’s future, predicting that the $110,000 price point is unavoidable in the long run. His perspective suggests that the current dip in Bitcoin’s price is a natural correction phase, which will eventually give way to another strong bullish surge.

Even though Bitcoin’s correction has been steady above $90,000 so far, there’s a chance it may drop during this period of consolidation. As a precautionary measure, the Crypto Titan noted that if Bitcoin were to fall further, the $87,000 level could signify the “peak of distress.” This is the lowest point the Bitcoin price can reach while still maintaining a bullish outlook among investors.

Technical Analysis Shows Cup And Handle Pattern In Play

The analysis of Bitcoin’s technical behavior is grounded on its price movement after surpassing the top line (neckline) of a cup-and-handle design in its chart. This cup-and-handle pattern has been evident during Bitcoin’s downward trend (bear market) in 2022, its recovery phase in 2023, and its upward surge (bull market) in 2024. Lately, a bullish price increase in October and November led to Bitcoin exceeding the neckline, paving the way for potential further growth.

Previously, a prominent figure in Cryptocurrency predicted a potential price point of approximately $110,000 for a certain coin. They also mentioned that a drop might occur before this target was reached, and that’s exactly what happened as we’ve seen a price decrease over the last fortnight, which aligns with their prediction.

Currently, Bitcoin is being bought for approximately $95,906. If it reaches the predicted goal of $110,000, this would represent a 15% increase in return on investment from the present value.

As a researcher, I came across an intriguing take on the potential peak for Bitcoin this cycle, shared on social media platform X by an analyst. This analyst suggested that we might see Bitcoin reaching $120,000 using Fibonacci Circle analysis – a figure that appears significantly lower compared to other analysts’ predictions, which span from $250,000 to an impressive $1 million.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-12-27 18:04