As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. After examining the technical analysis presented by Pejman Zwin, I must admit that his chart paints a compelling picture for Bitcoin’s near-term price action.

If Bitcoin can’t maintain its crucial upper price limits, there’s a chance it might plummet, potentially dropping down to around $89,000 according to an expert in cryptocurrency analysis. The persistent selling pressure beneath the $100,000 threshold has been hindering Bitcoin’s climb higher.

Bitcoin Price Correction To $89,000 Possible

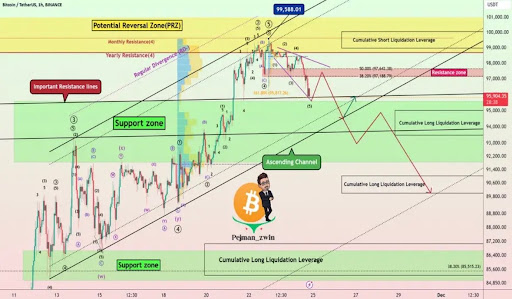

On the 26th of November, crypto analyst Pejman Zwin from TradingView posted a comprehensive diagram showcasing his technical analysis on Bitcoin’s price fluctuations within a one-hour time span. The Bitcoin price graph emphasized crucial resistance levels, potential support areas, and technical signs pointing towards an upcoming drop.

At the peak of the price graph, there’s a yellow-marked area called the Potential Reversal Zone (PRZ), where Bitcoin may encounter strong opposition as it strives for the $100,000 target. The graph also underlines a horizontal barrier at approximately $95,904, a level that Bitcoin found challenging to surpass in the past.

Currently, Bitcoin’s resistance is around $97,000 to $98,000 according to Zwin. If Bitcoin manages to break through these levels, it might witness a substantial increase in value, potentially reaching $100,000.

Conversely, there’s a possibility that Bitcoin’s value might plummet significantly if it doesn’t surpass the predicted resistance points. However, the analyst’s graph indicates potential ‘safe zones’ in green, signifying areas where Bitcoin may rebound if its price drops.

As a researcher, I’ve analyzed Bitcoin’s price movement and noticed that if it falls below the support levels ranging from $95,600 to $92,000 and breaches the lower boundary of its ascending channel on the chart, Zwin predicts a potential crash. This predicted downturn could see Bitcoin’s price plummeting as low as $89,000 during this bull cycle. The analyst refers to this point as the “cumulative long liquidation leverage,” suggesting that Bitcoin might experience a correction between $91,000 and $89,000, equating to an 8% to 10% drop for the trailblazing cryptocurrency.

Key Factors Pushing The BTC Price Upwards

Conversely, Zwin shared in his Bitcoin analysis report that the cryptocurrency is experiencing another surge, fueled by a surge of optimistic market sentiment due to recent news in the crypto world. This analyst stated that the court’s confirmation of Bitcoin and crypto ownership legality in China has been a significant factor driving the sharp increase in BTC prices.

Moreover, Donald Trump’s proposed appointment of a White House cryptocurrency advisor has given Bitcoin a substantial push, causing its price to reach present levels and surpass crucial resistance barriers.

According to the chart we’ve looked at, it appears that Bitcoin has moved into five fresh upward trends as per the Elliott Wave Theory. This positive trend emerged following Bitcoin surpassing significant resistance barriers.

Furthermore, Zwin’s Bitcoin price chart illustrates a “Peak and Plunge Top Model,” where Bitcoin is said to have already finished the “Peak” stage and moved into the “Plunge” phase. Based on this analysis, if Bitcoin manages to break past $98,700, it may be anticipated to soar upwards towards $100,000.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best Japanese BL Dramas to Watch

2024-11-26 15:04