As a seasoned analyst with over two decades of experience in financial markets, I’ve seen my fair share of market cycles and trends. However, the recent predictions about Bitcoin reaching $100,000 by 2024, as suggested by Jamie Coutts and ‘Milkybull Crypto,’ have piqued my interest.

A crypto analyst has predicted that Bitcoin (BTC), the world’s largest cryptocurrency could see its price surging as high as $100,000, representing a 200% increase from its current value. However, the analyst noted that this bullish projection would occur only when certain conditions are met.

Bitcoin Could Rise To $100,000

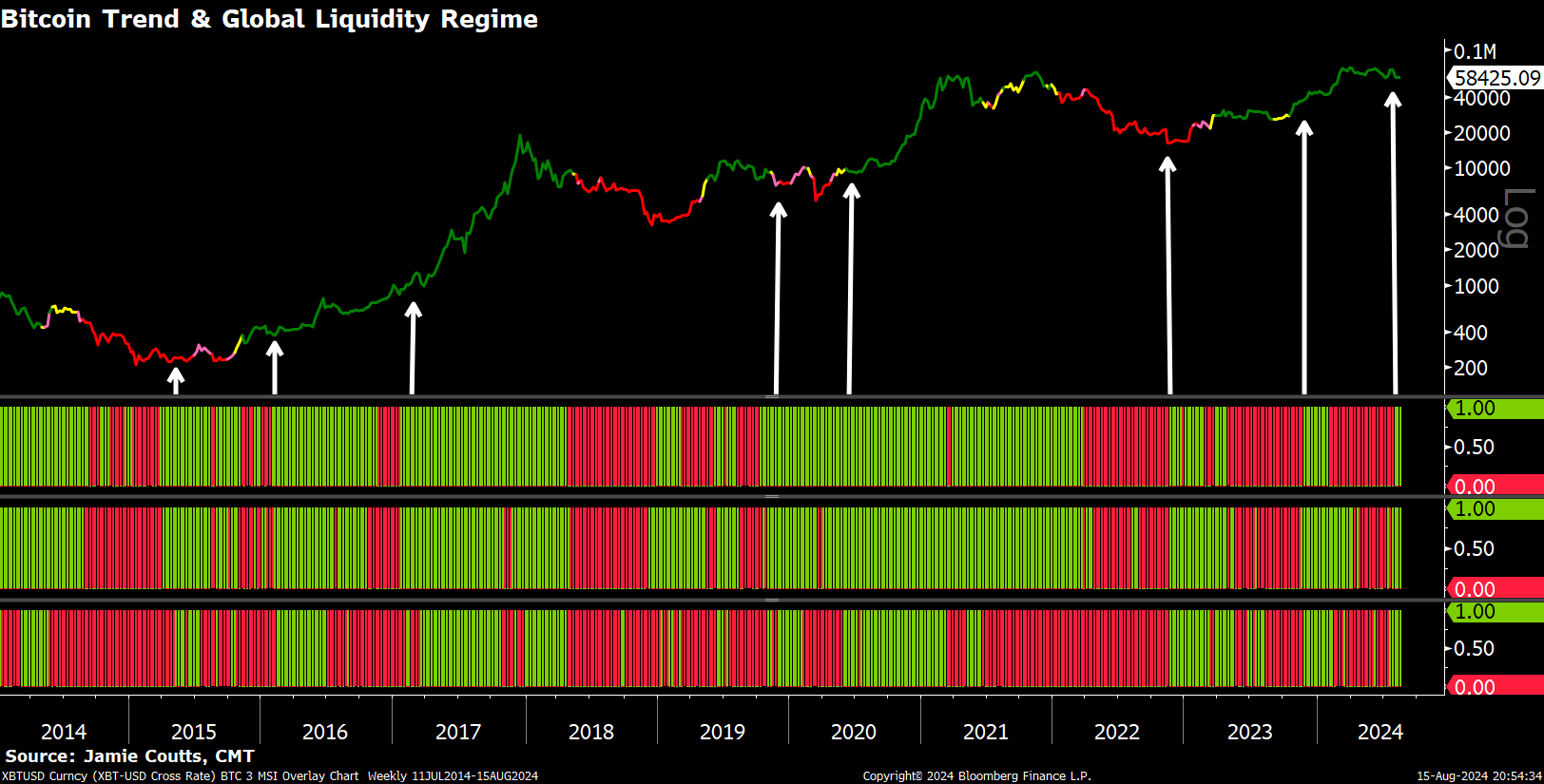

On August 15th, a post on X (previously known as Twitter) saw Jamie Coutts, Real Vision’s Chief Crypto Analyst, express optimistic forecasts for Bitcoin in 2024. According to his predictions, Bitcoin could see a significant increase of around 200%, possibly soaring up to $100,000 by the year’s end.

According to Coutts’ perspective, Bitcoin might experience substantial growth in the coming period due to global financial circumstances, particularly the behavior of Central Banks. The crypto analyst emphasized that central banks are showing signs of surrender, and the flow of liquidity is increasing, which suggests that Bitcoin’s value is poised to rise significantly.

In simpler terms, when we say “Central Banks are capitulating,” it means they’re relaxing their monetary rules, which is typically a response to economic stresses. On the other hand, “opening the liquidity spigots” implies that Central Banks are increasing the amount of money in circulation by employing different strategies.

In his latest update, Coutts shared that the Global Liquidity Momentum Model (MSI) has signaled a bullish phase for the first time since November 2023. Notably, when this same signal occurred in 2023, Bitcoin experienced a surge of approximately 75% from November 2023 to April 2024, before the market trend reversed to bearish.

In the past month, both the Bank of Japan (BoJ) and the People’s Bank of China (PBoC) have significantly increased their funds in the system, totaling approximately $400 billion and $97 billion respectively. Worldwide, this move has led to an increase in the money base (credit), amounting to a staggering $1.2 trillion. This growth can be attributed to the weakening of the United States Dollar (USD). This trend also hints at potential collaboration with the US Federal Reserve (FED).

Based on Bitcoin’s past price increases, such as its 19X rise in 2017 and 6X surge in 2021, Coutts predicts that Bitcoin could experience a 2-3 fold increase in 2024 if the U.S. Dollar Index (DXY) falls below 101. As of now, the DXY is at 102.175 on TradingView. A drop below 101 might occur due to continued Central Bank interventions that could potentially swell the global money supply (M2) beyond $120 trillion in this cycle.

In summary, Coutts emphasized his belief in the growth of Bitcoin by explaining that within our current banking system, which operates on credit and a fractional reserve basis, the money supply needs to consistently circulate and increase to accommodate the existing debt. If this flow isn’t maintained, there’s a risk that the entire financial structure could crumble.

Massive BTC Rally Incoming

In a more contemporary post on platform X, an analyst known as ‘Milkybull Crypto’ expressed his extremely positive outlook for Bitcoin. He presented a chart showing the historical movement of Bitcoin from 2016 to 2025 and predicted that we might witness a spectacular parabolic rise in its value, potentially reaching a peak of $190,000.

According to the analyst’s prediction, there might be a significant increase, or “surge,” in the last three months of 2024 (Q4). He proposes that this possible growth aligns with traditional market trends, emphasizing that past patterns have often repeated themselves, stating that “history tends to repeat itself.”

Currently as I speak, the value of one Bitcoin is being exchanged for approximately $58,548. This represents a modest drop of 1.71% over the past 24 hours, based on data from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-20 09:40