As a seasoned researcher with a keen interest in cryptocurrencies and a knack for spotting trends, I find the recent Bitcoin price surge intriguing. Having closely followed the crypto market since its inception, I have learned to tread carefully when it comes to predictions. However, the latest report from CryptoQuant has caught my attention.

Over the last week, the cost of Bitcoin persisted in its record-breaking surge, setting new peak values within just four days. Although Donald Trump’s victory in the U.S. elections could have sparked the recent surge, it seems that the rise of Bitcoin, as well as the broader cryptocurrency market, has begun to take on a momentum of its own.

Four Reasons Why $100,000 Is Possible For Bitcoin Price: CryptoQuant

As a crypto investor, I’ve been closely monitoring the latest insights from CryptoQuant, and here’s what caught my eye: Despite Bitcoin’s recent positive surges, it’s not yet overvalued, according to their analysis. Intriguingly, they suggest that the world’s leading cryptocurrency might soon breach the highly-anticipated $100,000 price mark.

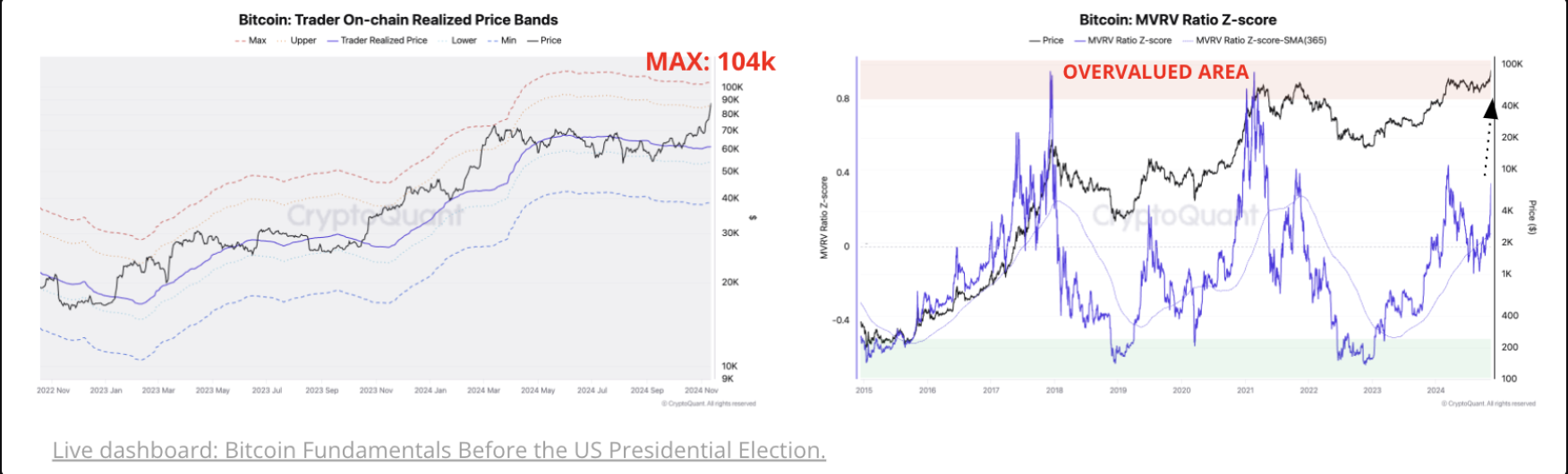

According to CryptoQuant’s analysis, Bitcoin’s current pricing doesn’t appear inflated, as indicated by the MVRV metric staying below the zone signaling overvaluation. This implies that the bullish market trend hasn’t reached its boiling point yet, suggesting there’s potential for further price increase.

Furthermore, the Trader On-chain Realized max band is indicating a potential new high of $100,000 for Bitcoin’s price, as suggested by CryptoQuant. Notably, the last occasion when the max band reached this level was in March 2024, coinciding with Bitcoin breaking through the $70,000 mark for the first time.

One noteworthy point from on-chain analysis that reinforces the ongoing Bitcoin price surge is the increasing demand among investors. CryptoQuant notes a resurgence of investor interest in the U.S. since the presidential election, as evidenced by Coinbase Premium staying positive during recent days.

In summary, the circulation of cryptocurrency markets has grown noticeably in recent weeks due to an influx of stablecoins onto trading platforms. To provide some perspective, over $3.2 billion worth of USDT has been transferred to exchanges since the U.S. election, hinting at a prolonged surge in Bitcoin prices.

Tread With Caution

Yet, CryptoQuant’s report issued a cautionary note, suggesting potential selling activity might occur after the recent price surge. Some Bitcoin miners have begun to sell their holdings for gain, and CryptoQuant, the blockchain firm, also mentioned that the current selling is relatively minor but could escalate rapidly in the near future.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-11-16 21:04