As a seasoned researcher with over two decades of experience in financial markets, I have witnessed numerous instances where monetary policy decisions by central banks have significantly impacted various asset classes, including Bitcoin. The upcoming 50 bps rate cut by the Fed could potentially send shockwaves through the market, causing a flight to safety and a sell-off of riskier assets like Bitcoin.

10x Research warns that a reduction of 50 basis points in interest rates by the U.S. Federal Reserve (Fed), effective from this month, could potentially lead to a decrease in Bitcoin‘s (BTC) market value.

50 BPS Rate Cut Could Spook The Market

In March 2022, the Federal Reserve increased interest rates to combat high inflation caused by supply chain issues and excessive money circulation due to COVID-19. Now, they’re preparing to lower interest rates in an effort to boost the economy. But if they reduce rates by 50 basis points, it could signal a buying opportunity for risky assets like Bitcoin.

On September 6, 2024, data from the Bureau of Labor Statistics revealed a slight drop in unemployment rates, but the US economy produced fewer jobs than anticipated. This development has set the stage for the Federal Reserve to initiate a series of interest rate reductions. The central bank aims to prevent excessive interest rates from inflicting severe harm on businesses.

10x Research indicates that if the Federal Reserve reduces interest rates by 50 basis points on September 18, 2024, it could imply a sense of concern about the economy. Moreover, such a move might inadvertently suggest that the Fed feels it’s too late to address the impending economic recession, causing investors to shift their focus from riskier assets like stocks and cryptocurrencies.

To clarify for those not familiar, one basis point equals 1/100th of a percentage point. Commonly, central banks adjust interest rates in increments of 25 basis points (bps), but the exact amount can vary based on the level of necessity. Interestingly, during 2022, the Federal Reserve raised interest rates not only by 25 bps but also by larger amounts such as 50 and even 75 bps to combat inflation.

In a note shared with clients today, Markus Thielen, founder of 10x Research, stated:

A reduction of 0.5 percentage points by the Fed could raise eyebrows in the financial markets, suggesting more profound worries. However, the Fed’s main objective will be addressing economic threats instead of trying to control market responses.

Adding:

There’s just a 29% chance for a 0.5% reduction in interest rates, which goes against what many people are expecting and believing. More voices are joining together, suggesting that the Federal Reserve has fallen behind by not recognizing early signs of a weakening labor market following their surprise in July.

Critical For The Fed To Walk The Thin Line

In a recent post, macro trader Craig Shapiro concurred with 10x Research’s conclusions, stating that while there’s intense market pressure on the Federal Reserve to implement larger and quicker rate reductions, it would be unwise for the Fed to initiate a 50 basis point cut as its first move.

Shapiro stated that markets are dependent on liquidity, and without it, they react negatively, selling off and searching for a lower price point that compels the Federal Reserve to quickly reduce interest rates and supply more liquidity. Essentially, Shapiro is saying that if risk assets don’t get what they need from the Fed, their value will decrease until the Fed yields and satisfies the market’s demands.

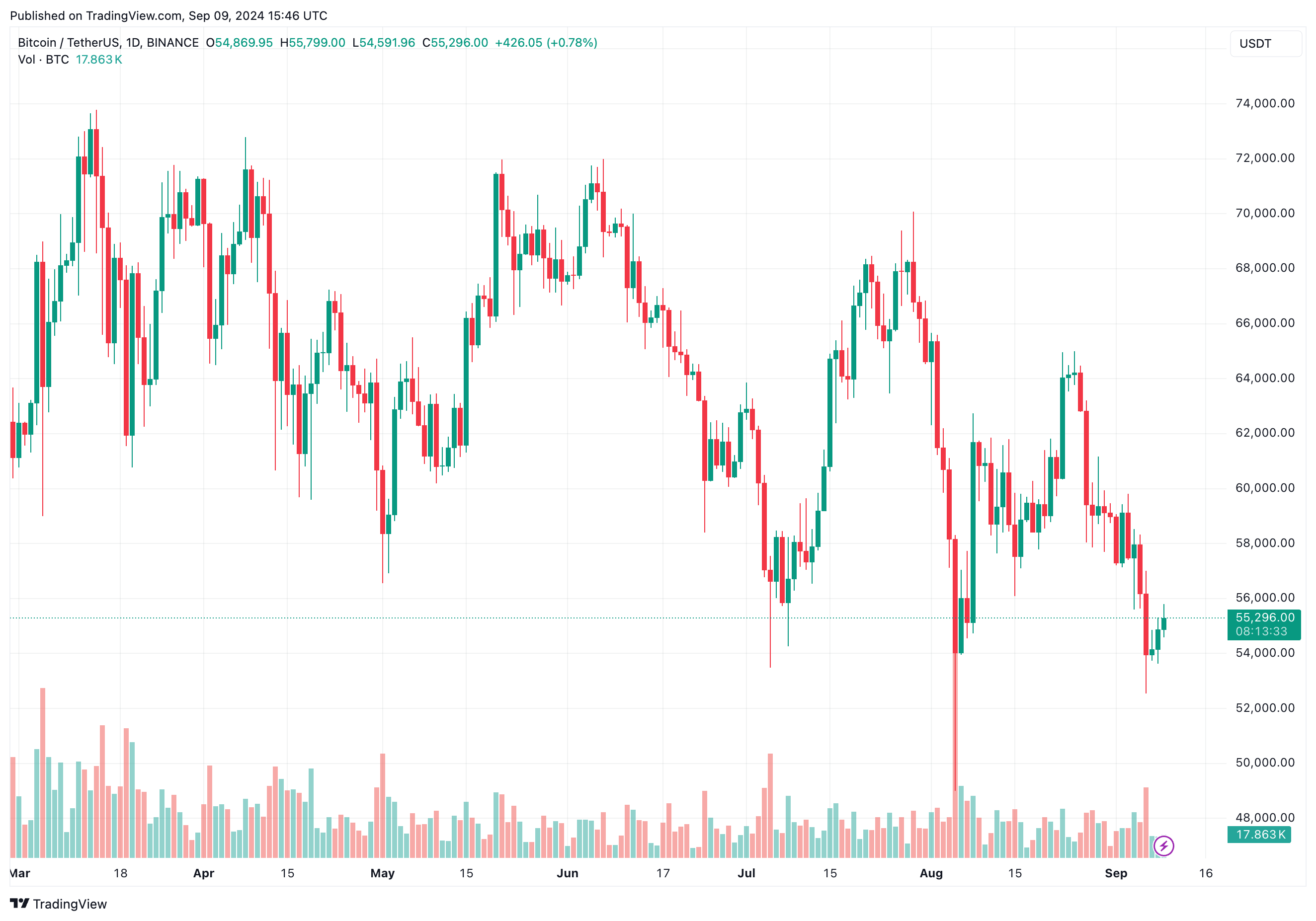

Instead, some analysts predict that Bitcoin could potentially initiate another surge in price around October 2024. Currently, Bitcoin is valued at approximately $55,296, and its total market capitalization surpasses $1.09 trillion, as reported by CoinGecko.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2024-09-10 12:04