As a seasoned financial analyst with over a decade of experience in the markets, I have closely followed Bitcoin’s price action and on-chain metrics since its inception. Based on my analysis of the latest developments, I believe that the recent dip in Bitcoin price to around $64,500 levels is merely a temporary setback.

Bitcoin‘s price reached a high of $65,500 early in the week before experiencing some pullback. It currently hovers around $64,500. According to CryptoQuant, an on-chain data analysis platform, Bitcoin has recently touched the short-term holder (STH) realization price.

As a researcher studying Bitcoin’s market dynamics, I’ve found that the activity of Strong Hands (STH) holders is essential during bull markets due to their aggregate cost basis acting as long-term price support. Since the Bitcoin bull run started in early 2023, the BTC/USD pair has only briefly dipped below its short-term realized price, a trend that CryptoQuant has observed. According to J. A. Maartunn’s analysis for CryptoQuant, another such dip is currently nearing its end.

In recent developments, Bitcoin’s value has surpassed its Realized Price once more. This is an optimistic indication since short-term investors typically buy more when the cryptocurrency reaches their initial investment price, thus forming a foundation for potential price stability.

Maartunn noted that starting in 2023, Bitcoin has surpassed its short-term holders’ average purchase price, or realized price, on two separate occasions. Each instance resulted in a minimum 30% price increase. Consequently, if Bitcoin prices surge by an additional 30% from the current value, it may reach a new peak and exceed $80,000 as the new all-time high.

Additionally, according to on-chain analytics provider Glassnode, during the past month, approximately 66% of the cryptocurrency held by short-term investors has shifted from profit to a loss position.

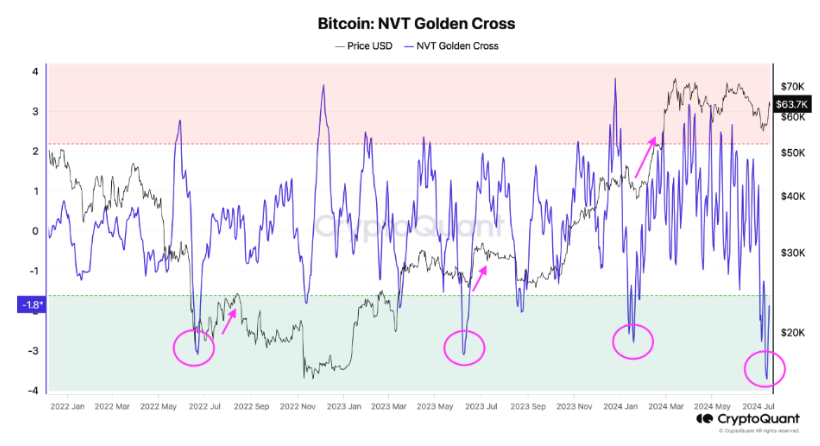

Bitcoin NVT Ratio at 2.5-Year Low

Expert insight: Crypto analyst Michael van de Poppe underscores the significance of the Network Value to Transactions (NVT) ratio for Bitcoin, pointing out that it has recently hit its lowest, negative point in the last 2.5 years. This current slump is more severe than during the Luna collapse, the correction in the previous summer, or even after Bitcoin’s listing on major exchanges. Van de Poppe posits that this corrective phase has come to an end and encourages investors to brace for potential market fluctuations.

Photo: CryptoQuant

Over the past two weeks, Bitcoin’s price has experienced significant growth, bouncing back from its low of $53,500 and surging over 20%. A significant factor contributing to this rise is the survival of pro-crypto US presidential candidate Donald Trump following a major assassination attempt last weekend. This event has boosted optimism within the crypto community regarding his chances of winning the upcoming election.

Over the last fortnight, Bitcoin ETFs have seen substantial investment as a counterbalance to the significant concerns raised by the Mt. Gox creditor reimbursement news.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2024-07-18 15:15