As a seasoned analyst with over two decades of experience in global financial markets, I’ve seen my fair share of volatility. However, the crypto world never ceases to surprise me with its unique dynamics and rapid fluctuations.

In the past day, Bitcoin (BTC) experienced significant fluctuations, dipping to as low as $68,830 on the Binance cryptocurrency platform, but then regained some of its lost value.

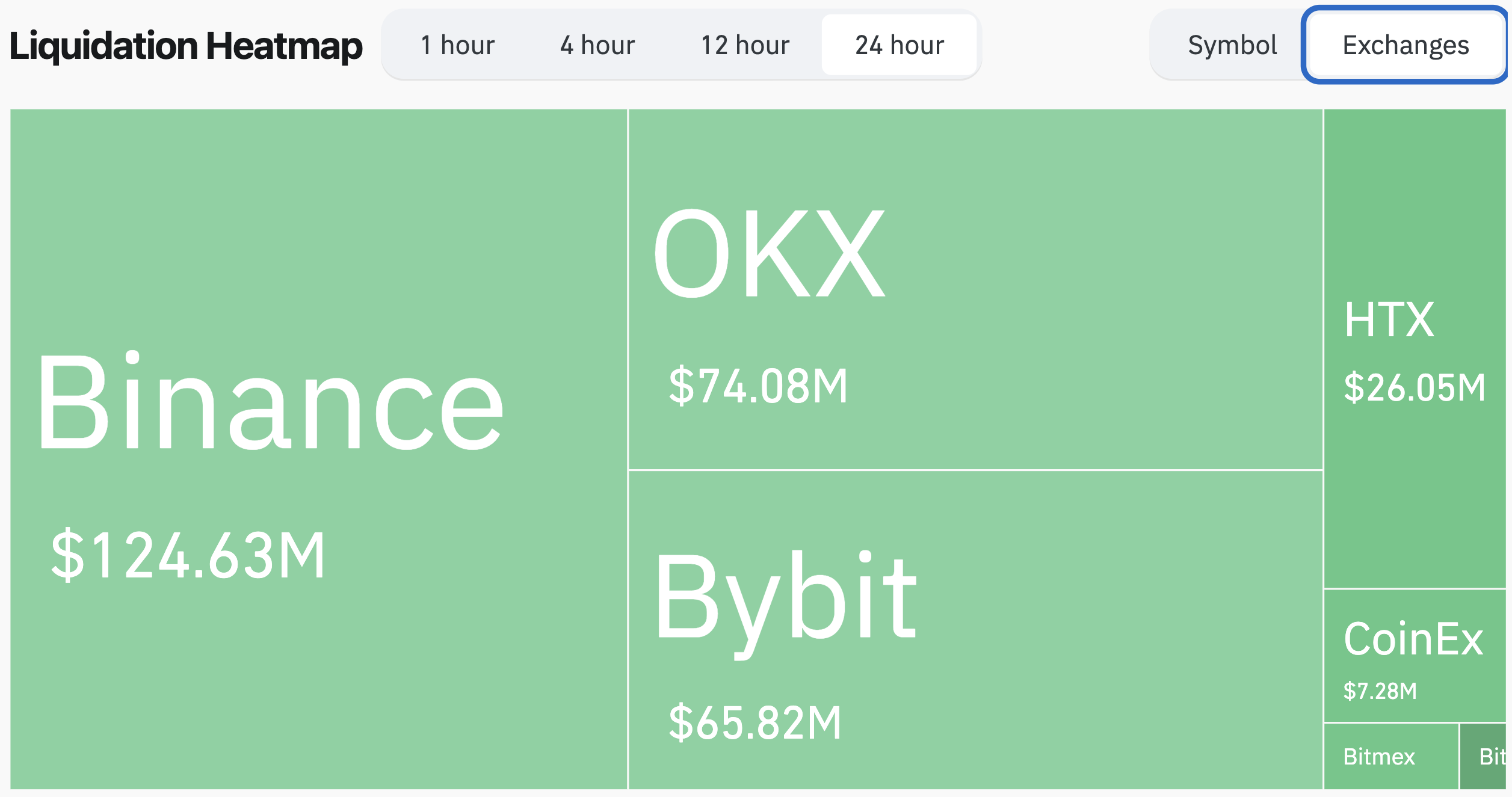

Liquidation Data At A Glance

Despite Bitcoin being almost at its maximum historical price of $73,737, the sudden dip in value yesterday has sparked questions about whether this leading digital currency can establish a fresh all-time high.

Based on information from CoinGlass’s crypto liquidation tracker, a total of about $296 million worth of open positions have been closed within the past day.

Approximately 77% of the trades were ‘buy’ positions, suggesting that traders were predominantly expecting Bitcoin to keep rising. Binance recorded the highest number of liquidations totaling around $124 million, while OKX and Bybit followed closely behind with approximately $74 million and $65 million in liquidations respectively.

Among various digital assets, Bitcoin took the lead with about $97 million in positions being closed, closely trailed by Ethereum (ETH) at approximately $47 million, and Solana came third with close to $17 million in liquidations.

Yesterday’s dip has caused the overall cryptocurrency market value to decrease by approximately 3.5%, now standing at around $2.48 trillion. It’s important to mention that despite Bitcoin being near its all-time high, the total cryptocurrency market cap is still significantly lower than its peak of $2.98 trillion reached in November 2021.

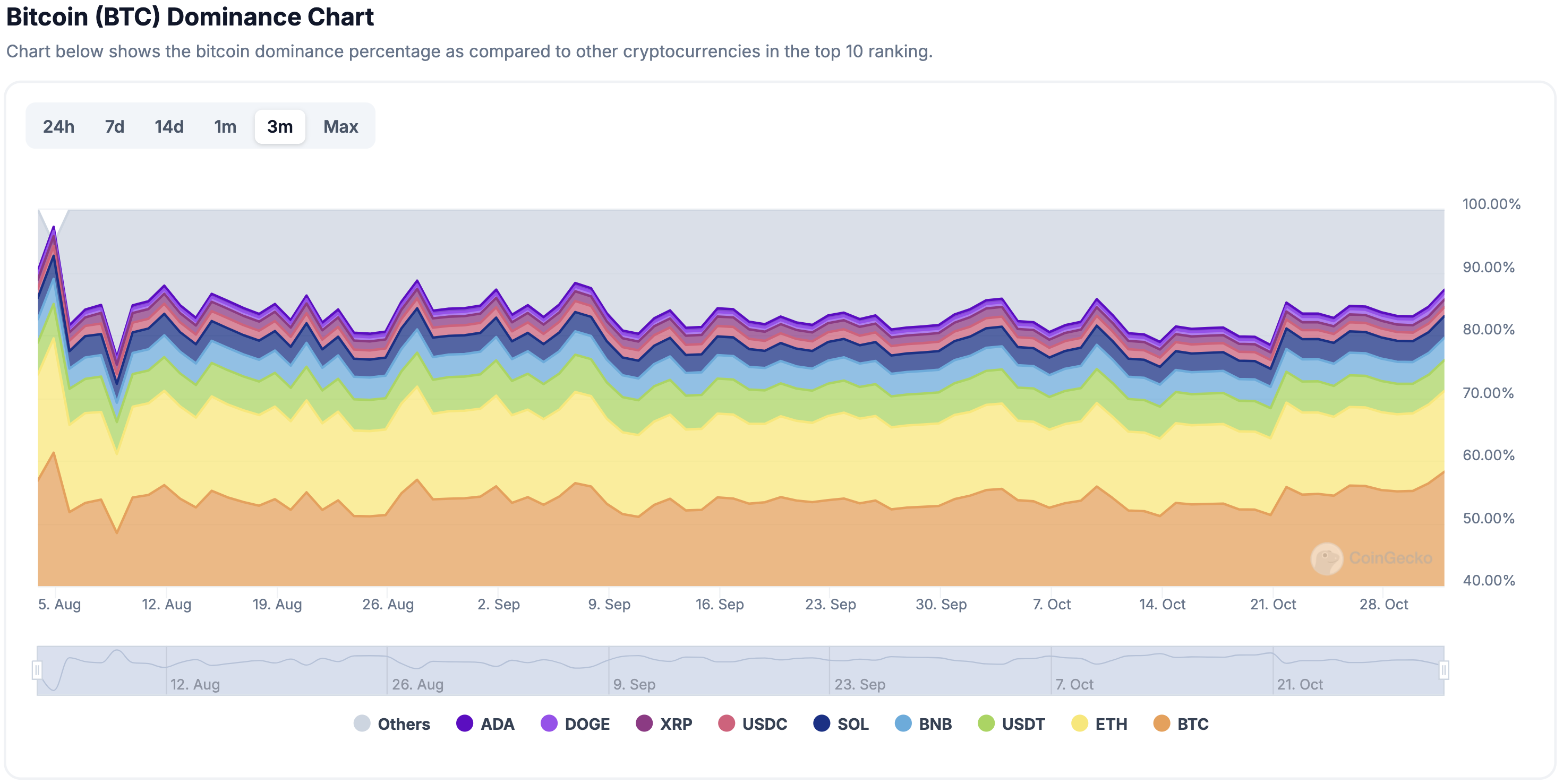

It seems that Bitcoin’s growth hasn’t been matched by altcoins in terms of market value, which explains the significant difference between their performances. This might be a sign that investors are being more conservative, preferring to invest in Bitcoin rather than altcoins during times of uncertainty.

Simultaneously, this implies that there’s plenty of potential for altcoins to expand further, potentially enticing adventurous investors with a higher tolerance for risk to amass altcoins, aiming for substantial returns compared to Bitcoin.

To put it simply, the influence of Bitcoin, measured by its share of the total cryptocurrency market value, is on the rise and is moving closer to 60%. An increased dominance of Bitcoin might mean tough times for alternative coins that are currently lagging behind Bitcoin in terms of price movement.

Can Bitcoin Still Hit ATH?

Among crypto enthusiasts, there’s much discussion over whether Bitcoin (BTC) will reach a fresh all-time high (ATH) during this market surge. However, arriving at a definitive response can be challenging.

Factors supporting a potential new ATH include the increased likelihood of pro-crypto US presidential candidate Donald Trump winning the election, the effects of BTC halving, increased inflows to BTC exchange-traded funds (ETF), and a low interest rate environment.

Instead, the opposite seems to be implied by sentiment measures such as the Fear and Greed Index. This suggests that the market remains in a ‘greed’ stage, potentially indicating further hardships for the market before another upward trend.

No matter what happens next, it’s safe to expect that the cryptocurrency market will continue experiencing fluctuations in the near future. Yet, those who hold Bitcoin long-term don’t seem overly concerned by this possibility, as selling pressure stayed fairly low when Bitcoin reached $71,000.

Currently, Bitcoin is being traded for approximately $71,524 per unit, representing a slight increase of 0.6% over the last day. Its total market capitalization is estimated to be around $1.41 trillion as reported.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-11-02 08:31